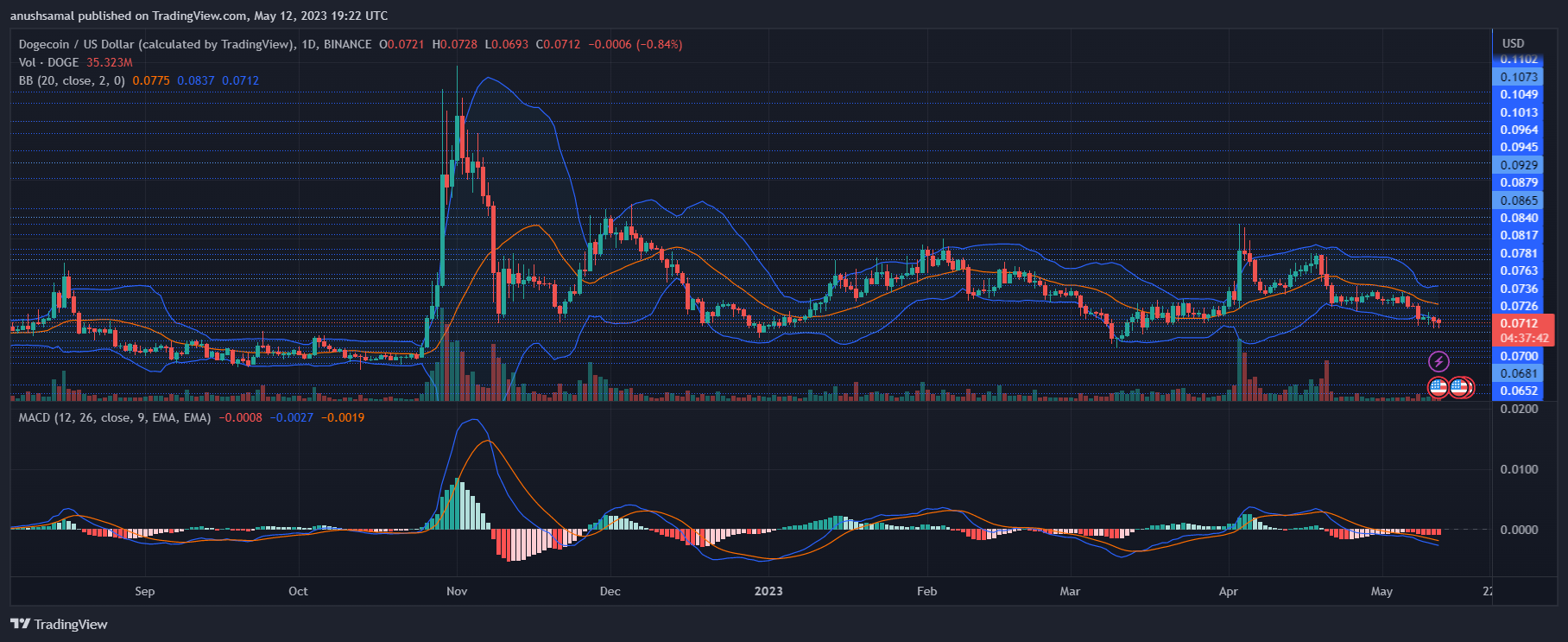

As of the time of writing, Dogecoin (DOGE) was buying and selling at $0.070. The meme-coin has been struggling to recuperate after dealing with rejection at $0.076, with the bulls unable to achieve momentum. The present overhead resistance for DOGE is $0.073. If this stage is breached, it might propel the meme-coin to $0.078.

Nevertheless, if the worth falls from its present stage, it is going to probably attain $0.068 and probably drop additional to $0.066, leading to an almost 6% decline in worth. The buying and selling quantity of DOGE within the final session indicated a pink sign, indicating mounting promoting stress.

Technical Evaluation

All through the vast majority of the month, the demand for the meme-coin remained low. This was evident from the Relative Power Index (RSI) staying beneath the 40-mark and practically reaching the 30-mark, indicating oversold situations.

Moreover, the asset’s worth constantly traded beneath the 20-Easy Shifting Common line, suggesting that sellers had been the driving power behind the market’s worth momentum.

All through this month, DOGE has lacked optimistic demand, and its chart shows promote alerts. The Shifting Common Convergence Divergence (MACD), which signifies worth momentum and reversals, fashioned pink histograms beneath the half-line.

This means a sign to promote, indicating a possible decline in worth within the upcoming buying and selling classes. The Bollinger Bands indicator has widened relating to worth volatility and fluctuation, indicating that DOGE could expertise worth fluctuations within the subsequent buying and selling session. For Dogecoin to recuperate shortly, it closely depends on broader market power.

Featured Picture From UnSplash, Charts From TradingView.com