The Depository Belief & Clearing Company (DTCC) — the US’s main clearinghouse for securities transactions — has dedicated to selling Ethereum’s ERC-3643 normal for permissioned securities tokens, in line with a March 20 announcement.

DTCC is becoming a member of the ERC3643 Affiliation, a nonprofit devoted to catalyzing the usual’s adoption with the objective of “selling and advancing the ERC3643 token normal,” it stated.

The endorsement highlights how US regulators are embracing tokenization after President Donald Trump vowed to make America the “world’s crypto capital.”

It additionally means that the Ethereum blockchain community could play an necessary function within the US’s permissioned safety token ecosystem.

“DTCC will assist lead the way forward for tokenization and help institutional adoption at scale,” Dennis O’Connell, president of the ERC3643 Affiliation, stated in an announcement.

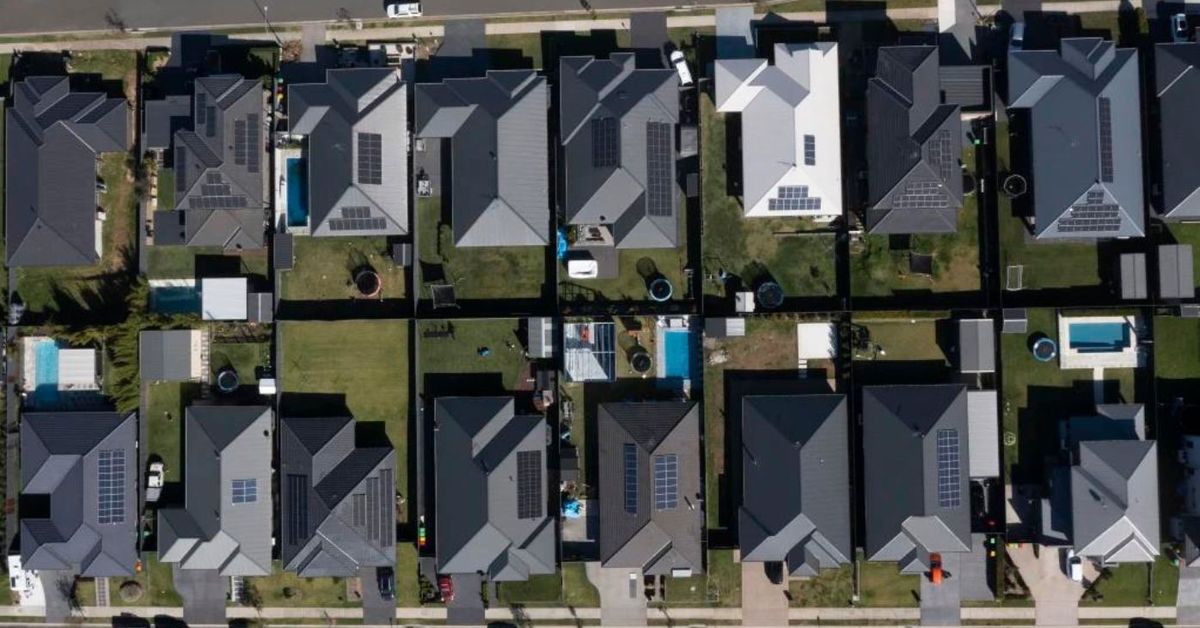

ERC-3643 is a typical for permissioned Ethereum tokens. Supply: ERC3643.org

Associated: Tokenization can remodel US markets if Trump clears the way in which

Early mover

The DTCC is a non-public group intently overseen by the US Securities and Trade Fee (SEC). It settles most US securities transactions.

In 2023, the DTCC processed transactions value an mixture of $3 quadrillion, in line with its annual report.

Also called the T-REX Protocol, ERC-3643 is “an open-source suite of good contracts that allows the issuance, administration, and switch of permissioned tokens […] even on permissionless blockchains,” in line with the ERC3643 Affiliation’s web site.

It depends on a custom-built decentralized id protocol to make sure that solely customers assembly pre-specified situations can turn out to be tokenholders.

The DTCC has been an early mover amongst US monetary overseers in embracing blockchain expertise, piloting a number of initiatives associated to onchain securities transactions. They embrace testing settling tokenized US Treasury Payments on the Canton Community and piloting personal asset tokenization on an Avalanche (AVAX) subnet.

In February, the clearinghouse launched ComposerX, a platform designed to streamline token creation and settlement for regulated US monetary establishments.

In November, the Commodity Future Buying and selling Fee (CFTC) — a prime US monetary regulator — tipped plans to discover related applied sciences for onchain settlement within the derivatives markets.

Journal: Terrorism and Israel-Gaza conflict weaponized to destroy crypto