Fast Take

Quick-term holders (STHs) are buyers who’ve acquired Bitcoin throughout the final 155 days, whereas long-term holders (LTHs) are those that have held Bitcoin for longer.

Notably, the launch of the Bitcoin ETF within the US on Jan. 11, roughly 172 days in the past, implies that buyers who purchased Bitcoin at the moment are actually categorised as LTHs.

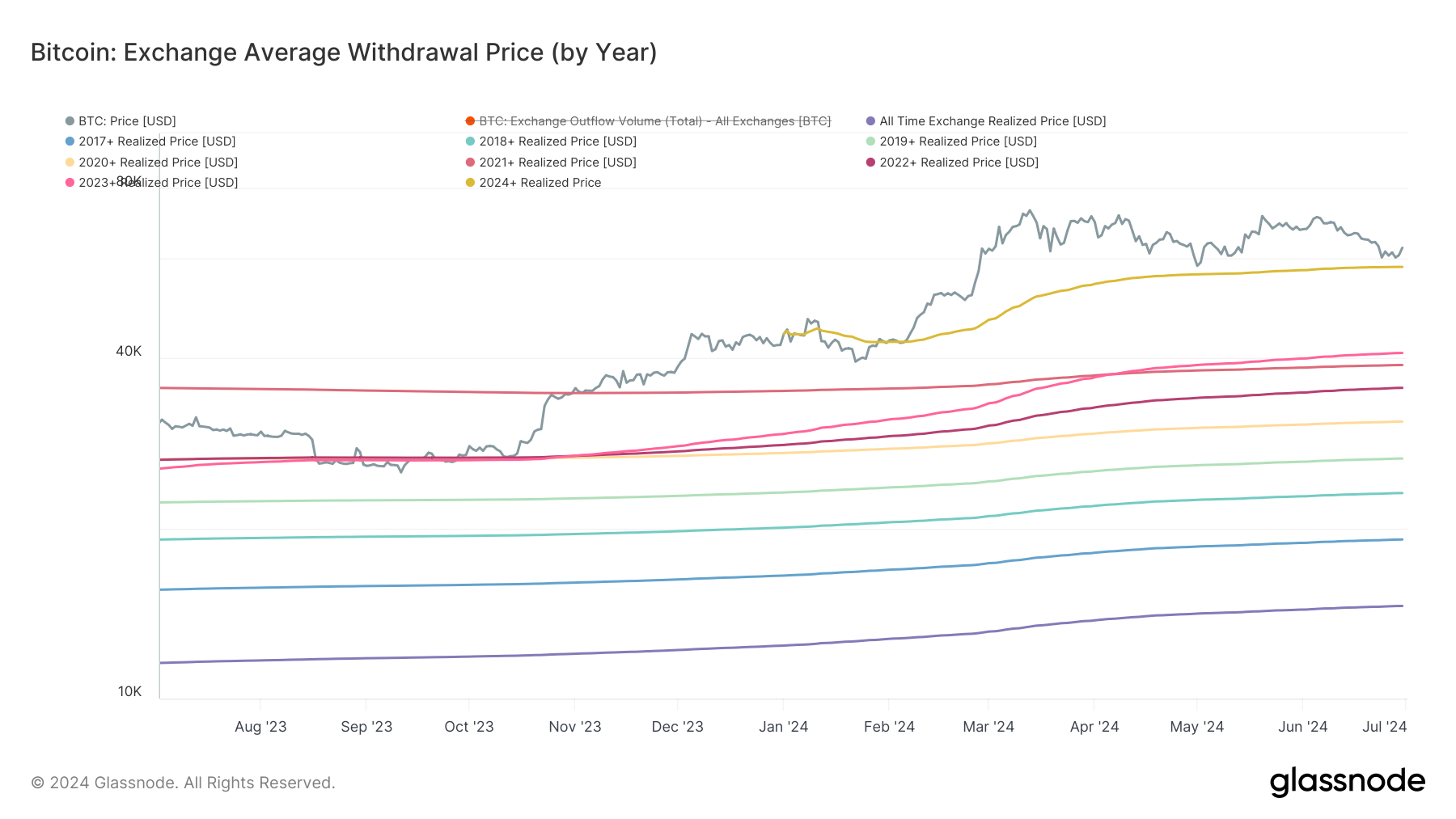

The typical price foundation for this group of LTHs is $58,049. With Bitcoin buying and selling above $62,000, these buyers are seeing a return of about 7%. STHs are recognized for his or her sensitivity to short-term value fluctuations, whereas LTHs are usually much less reactive to market volatility over time.

Curiously, Bitcoin skilled a 20% correction beginning on June 7, throughout which the fee foundation for these LTHs was $57,600. Regardless of the correction, these buyers have continued to purchase, indicating a method of buying the dip.

Equally, when Bitcoin dropped to $56,500 on Could 1, the typical price foundation was $56,300, suggesting that these LTHs supplied help throughout that drawdown as nicely. This habits highlights the resilience and strategic shopping for patterns of LTHs throughout market corrections.

The put up Early US ETF buyers now acknowledged as long-term holders appeared first on CryptoSlate.