Fast Take

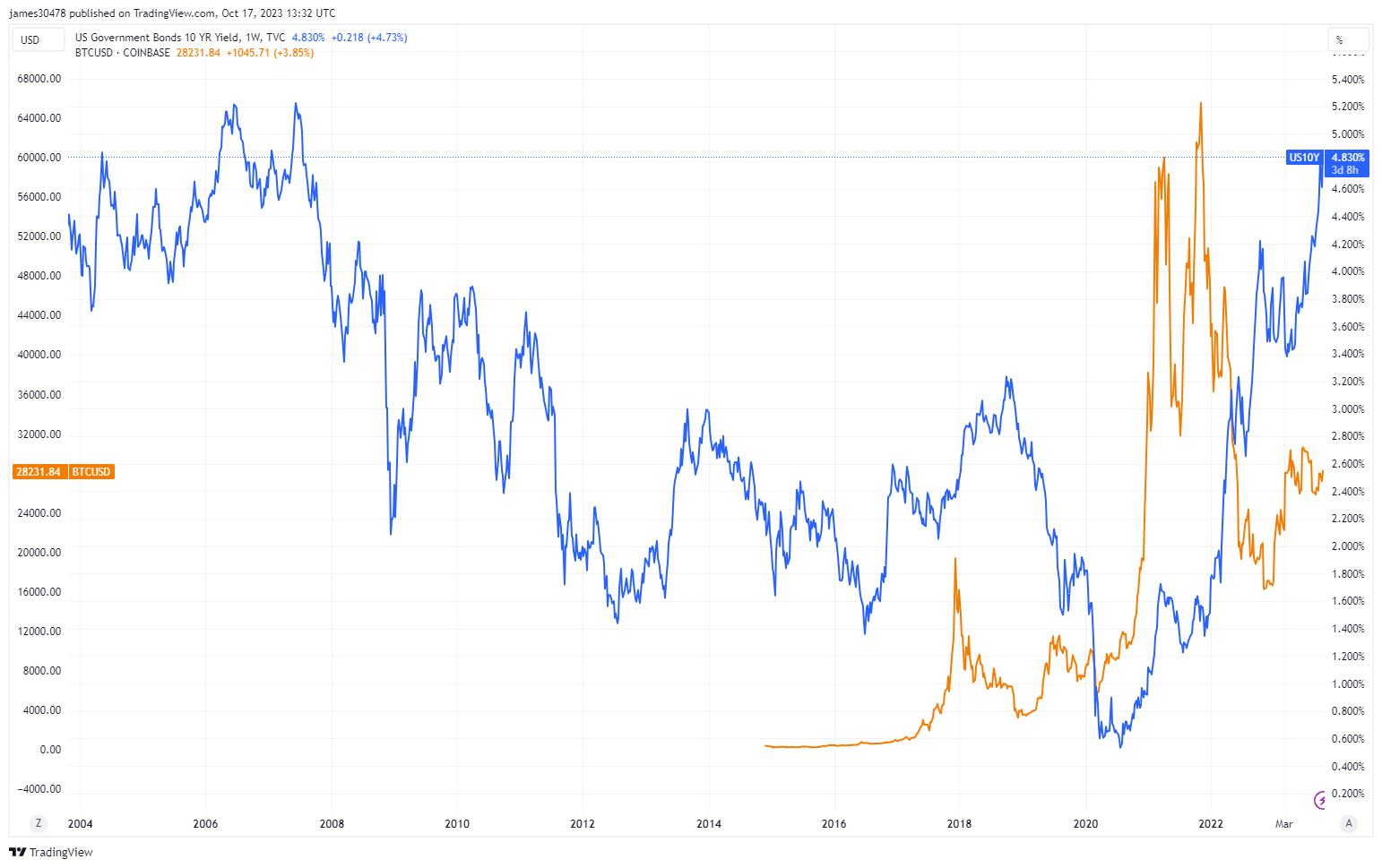

The bond market is exhibiting vital destruction, as mirrored by the present state of the U.S. 10Y notice. Not too long ago, the yield on the notice surged above 4.843%, a excessive unseen since 2007 and simply 17bps from the 5% mark. This high-yield interval precedes the creation of Bitcoin by a number of years, illustrating simply how way back it was.

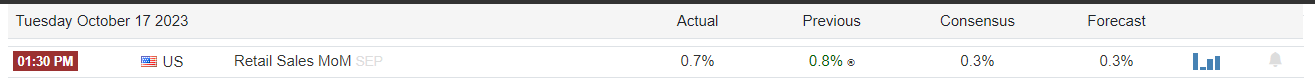

The rise in U.S. yields follows a substantial sudden surge in U.S. retail gross sales, the place the month-over-month enhance reached 0.7%, greater than double the preliminary projection of 0.3%.

This surge signifies a powerful sell-off within the bond market, evident within the efficiency of long-duration bonds such because the TLT, a 20-year+ treasury bond. The TLT opened at a notably low stage of 84.89, a mark solely replicated a scant few occasions in 2004 and 2006.

This paints a stark image of the upheaval bonds have endured because of the most speedy tightening of rates of interest witnessed in 4 many years. The bond market is in a precarious place because of the intricate inverse relationship between bonds and yields, a dynamic that turns into much more essential within the present local weather of swiftly rising rates of interest.

The put up Echoes of ’07: 10-year U.S. Treasury notice yield rises to pre-crisis ranges appeared first on CryptoSlate.