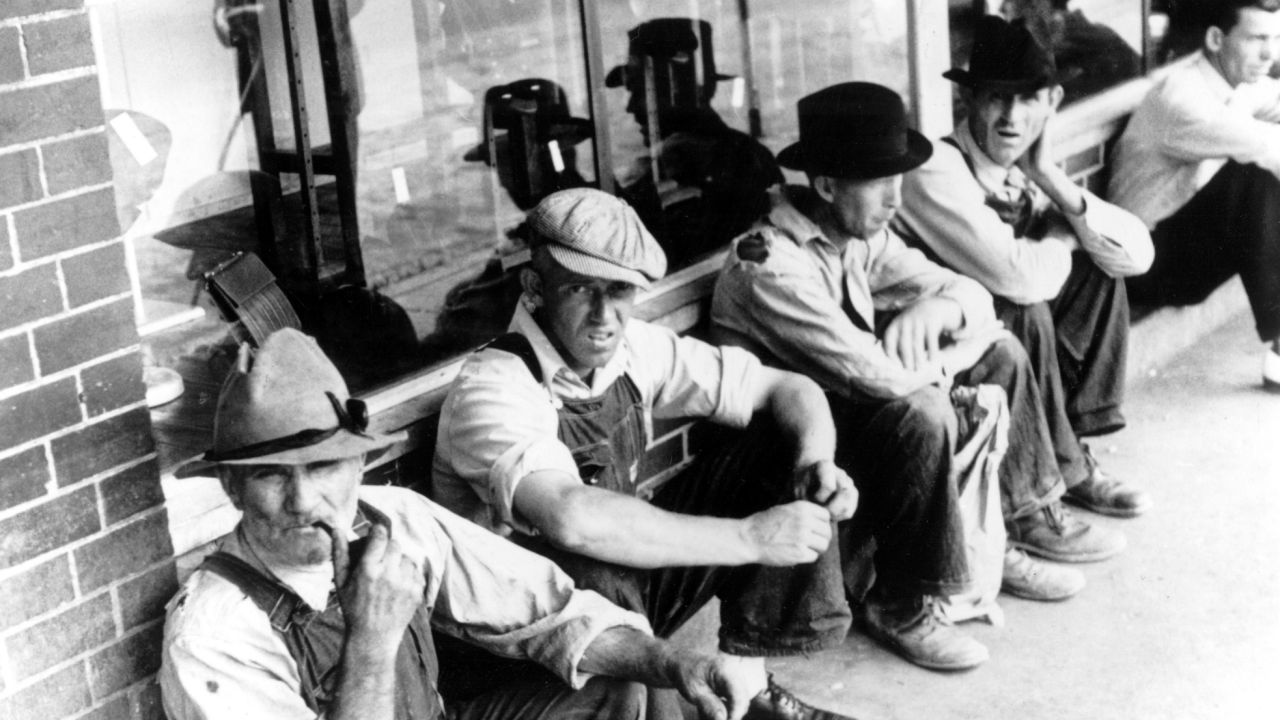

Peter Schiff, best-selling creator and chief economist of Europac, has warned concerning the coming of a brand new nice despair interval in America. In an interview, Schiff said that official Client Value Index (CPI) numbers had been designed to mislead the general public and that the nation was going to face a despair worse than the one it confronted again within the Nineteen Thirties.

Peter Schiff Warns of Nice Despair With Costs Rising

Peter Schiff, economist and best-selling creator, has warned about an upcoming financial disaster that can unleash a brand new Nice Despair far worse than the one the U.S. confronted again through the 30s. In an interview, Schiff commented that this disaster might be partly originated by the excessive inflation ranges that the federal government is fueling by rising public spending, which can have an effect on the qualification of the U.S. public debt.

Schiff said:

We’re going to have a disaster as a result of we do elevate the debt ceiling. As a result of we’ve continued to boost that debt ceiling as an alternative of coping with the actual downside, which isn’t the ceiling, however the debt. The ceiling could be the answer to the issue in the event that they solely stopped elevating it.

The economist defined that this upcoming new Nice Despair might be totally different because of the continued rise of costs and the lack of buying energy of Individuals. Schiff declared:

It’s in all probability going to be worse. It’s a despair, however not like the despair of the Nineteen Thirties, the place the folks not less than obtained the advantage of falling costs that offered some aid. This time, even the individuals who don’t lose their jobs are going to endure as a result of they’re going to lose the worth of their paychecks.

How Inflation Numbers Can Be Deceptive

Schiff additionally criticized the best way the Client Value Index (CPI), knowledge used to find out inflation, is calculated, stating that it’s designed to provide a low end result. He stated that “you principally need to double the official numbers to get a greater thought of what’s really taking place with costs,” indicating that the actual inflation quantity must be at the moment nearer to 10%.

Even so, Schiff believes that prime rates of interest won’t be able to manage inflation and that the U.S. must cope with each. “Rates of interest are costs. It’s the worth you pay whenever you borrow cash. The value goes up, similar to the worth of every part else,” he defined. Lastly, he remarked that “as curiosity goes up, properly, that’s simply one other price that it’s essential to go on to your clients by way of greater costs.”

What do you concentrate on Peter Schiff and his warning about an upcoming nice despair? Inform us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.