Up to date on February 20, 2023.

The Elliott Wave Principle buying and selling technique is taken into account a complicated technical evaluation strategy that may supply in-depth understanding of worth actions. This principle means that worth adjustments comply with some long-term patterns. If merchants handle to establish them, it might improve their buying and selling technique. At this time we’ll take a look at the fundamentals of this strategy and see the way it could also be utilized in buying and selling.

Elliott Wave Principle Defined

Again within the Nineteen Thirties an American economist Ralph Elliott began analyzing hourly, every day, weekly, month-to-month and yearly worth charts of varied indices. His aim was to establish constant patterns available in the market exercise. He believed that there was a purpose for each worth motion. So he went by charts overlaying 75 years of inventory market knowledge to show his principle.

After years of analysis, Elliott concluded that although market exercise might generally appear random and scattered, in actuality it follows sure guidelines. Which implies that merchants might be able to use them to attain their buying and selling goals.

At present, the Elliott wave principle buying and selling rules are considered as a normal set of market conduct patterns. The Elliott wave buying and selling outcomes might rely upon understanding the ideas of this principle, so let’s go over the principle concepts.

What Are Elliott Waves?

Buying and selling with the Elliott wave principle entails monitoring waves – a collection of repeating worth actions. The idea means that costs comply with 2 predominant wave patterns: impulse (motive) and corrective.

Impulse (Motive) Waves

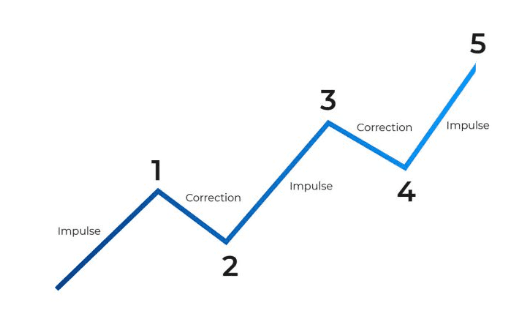

Impulse (motive) wave sequence consists of 5 smaller waves: 3 giant worth actions within the route of the uptrend and a pair of corrections.

These waves are labeled waves 1, 2, 3, 4 and 5 respectively.

To establish these waves accurately, merchants ought to take into accout the next guidelines.

✍️

- The third wave (second impulse wave) is normally the biggest of the sequence. Waves 1 or 5 can’t be longer than wave 3.

- Wave 2 by no means goes past the low of wave 1. It’s sometimes 60% the size of the wave 1.

- The excessive of wave 3 should be greater than the excessive of wave 1 (in any other case it’s needed to start out the wave rely once more). The waves ought to be making progress.

Corrective Waves

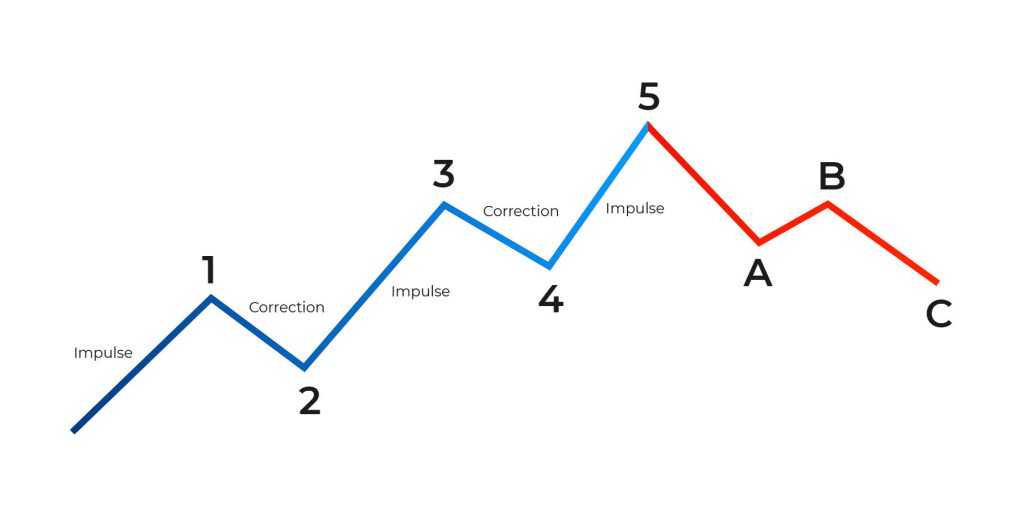

The corrective wave sequence, in response to the Elliott wave principle buying and selling rules, consists of three waves: an impulse down, a correction to the upside and one other impulse down. These waves are labeled A, B and C. As a rule, corrective waves A, B and C normally finish within the space of the prior wave 4 low.

Each motive and corrective waves could be seen within the image above. It is very important take note of the size of the waves in addition to their proportions.

Use Elliott Wave Principle for Buying and selling?

When buying and selling with the Elliott wave principle, it’s necessary to remember the foundations of the waves sequence described above. It will not be straightforward to establish these patterns straight away, as there are various guidelines to remember. Nonetheless, you might learn to use the Elliott waves accurately and get extra correct outcomes over time.

What it is best to keep in mind is that, in response to the Elliott wave buying and selling rules, costs transfer in cycles. Which means you might be able to predict an upcoming worth reversal. After which use this info to open or shut a deal on the optimum second.

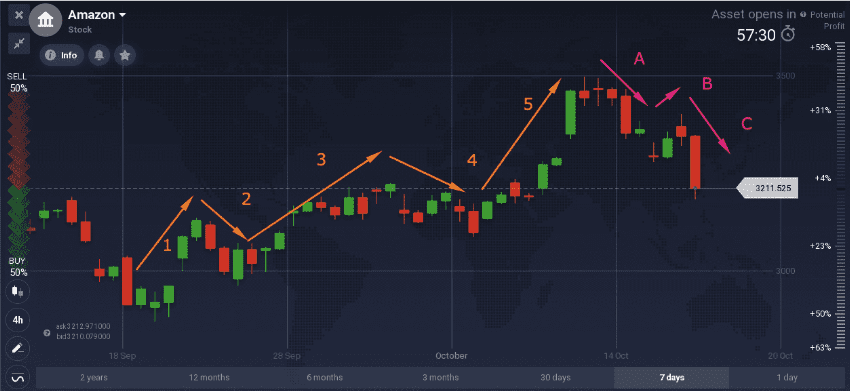

For instance, such a construction could be discovered on a month-to-month chart on the Amazon inventory. It’s clearly seen that the worth first climbed upwards in a cycle of 5 waves, adopted by 3 corrective waves.

Discovering the waves and analyzing the chart on this manner might assist merchants make buying and selling selections. As an illustration, they could select to enter a protracted (BUY) place through the pullbacks (corrective waves) of an uptrend. By doing this, they may be capable to “trip” the next uptrend as the worth rises to the following excessive.

With regards to circumstances the place the Elliott wave downtrend is revealed, it might be potential to open a brief (SELL) commerce throughout corrective waves in a downtrend. This will permit merchants to presumably profit from the market trending down. Nonetheless, it is very important observe that there is no such thing as a assure of 100% right indications.

✍️ FAQ

Does Elliott Wave Principle Work in Foreign exchange?

The Elliott wave principle buying and selling rules are mostly used for inventory buying and selling. Nonetheless, it might even be utilized to technical evaluation of various belongings, together with Foreign exchange.

Can I Use the Elliott Wave for Intraday Buying and selling?

The Elliott wave buying and selling rules might supply priceless insights into long-term worth actions. Nonetheless, if merchants handle to establish recurring patterns in worth adjustments, they could learn to use the Elliott wave principle of their intraday buying and selling as effectively.

Is the Elliott Wave Principle Correct?

When utilizing any technical evaluation device, needless to say they don’t present any type of certainty about future worth motion. However they could be useful in predicting potential worth actions. Contemplate combining buying and selling with the Elliott wave principle with different types of technical evaluation, together with technical indicators, to establish particular alternatives.

Publish Views: 1,321