The urge to promote within the cryptocurrency market has dwindled based mostly on the surge of main cash, according to on-chain perception supplier Santiment.

Santiment acknowledged:

“Crypto merchants’ enthusiasm to promote has shortly subsided, particularly as Bitcoin jumped again over $25k and Ethereum over $2k this weekend. Ideally, bulls will truly need FUD to remain excessive, as costs traditionally flourish when there’s doubt.”

Supply: Santiment

It is a bullish signal as a result of as soon as promoting strain shrinks, the demand to purchase kicks in and this triggers an upward thrust.

Regardless of retracing to the $24K and $1,880 ranges, Bitcoin and Ethereum have been up by 0.74% and 5.88%, respectively, throughout intraday buying and selling, in keeping with CoinMarketCap.

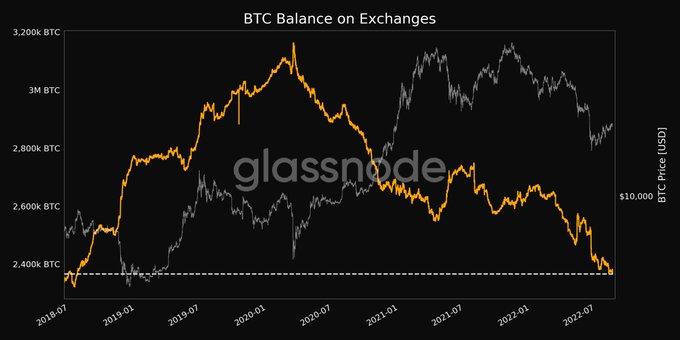

In the meantime, a hodling tradition continues to play out within the BTC market, on condition that the stability on crypto exchanges hit a 4-year low. Market perception supplier Glassnode acknowledged:

“Bitcoin stability on exchanges simply reached a 4-year low of two,366,543.394 BTC Earlier 4-year low of two,368,067.658 BTC was noticed on 15 August 2022.”

Supply: Glassnode

This correlates with the truth that the quantity of BTC hodled or misplaced hit a 21-month excessive, Glassnode added.

Supply: Glassnode

Cash leaving exchanges illustrate a hodling development as a result of cash are transferred to chilly storage and digital wallets for future functions apart from speculating and promoting. Due to this fact, it’s one other bullish sign.

In the meantime, the main cryptocurrency has held the 200-week shifting common (WMA) as help for 3 consecutive weeks. Crypto analyst Rekt Capital explained:

“Discover how the BTC $23400 stage (blue) is roughly confluent help with the orange 200-week MA A dip into ~$23400 would represent one other retest of the 200-week MA. The 200-week MA has been held as help for 3 consecutive weeks to date.”

Supply:TradingView/RektCapital

The 200 WMA is a long-term indicator that exhibits whether or not a market is bullish or bearish.

Then again, Bitcoin’s open curiosity has been experiencing an uptick, Blockchain.Information reported.

Picture supply: Shutterstock