Please see this week’s market overview from eToro’s world analyst group, which incorporates the newest market information and the home funding view.

Dangerous belongings up globally for a robust end of Q3

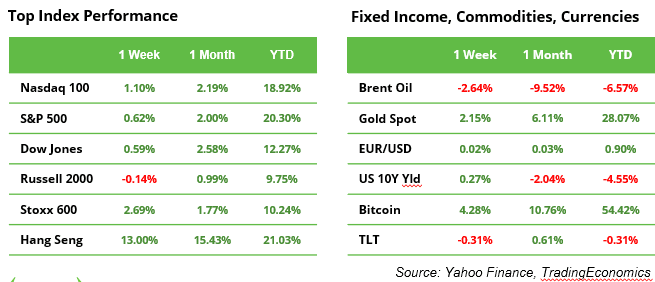

US GDP progress for Q3 was confirmed at 3.0%, and softer Private Consumption Expenditure (PCE) inflation information for August, at 2.2%, supported the Federal Reserve’s outlook for a “Goldilocks” state of affairs. This optimism helped the S&P 500 and Dow Jones shut the week up by 0.6%, whereas the Nasdaq rose by 1.1%. The European STOXX gained 2.7%, and Japan’s Nikkei added 5.6%. Nonetheless, probably the most exceptional efficiency got here from Hong Kong’s Dangle Seng, which surged by 13%, its finest week in 16 years, highlighting a rotation in direction of areas beforehand lagging the US.

As of the top of Q3, the S&P 500 is up 20% for the 12 months, Nasdaq +19%, Dangle Seng +21%, gold +28%, and Bitcoin +54%, providing robust returns throughout varied funding methods. With This autumn historically performing effectively, optimism stays excessive for the rest of 2024.

China’s $284 billion stimulus package deal

Reduction for Chinese language equities arrived when the Chinese language authorities unveiled a big financial stimulus package deal to handle the slowing economic system and stabilise the property market. The PBoC lowered rates of interest, decreased reserve necessities for banks, and launched measures to decrease mortgage prices, benefiting 50 million households. Moreover, the package deal included new insurance policies geared toward bolstering the inventory market and issuing 2 trillion yuan in bonds to assist native governments and stimulate shopper spending.

Outlook October

October will shift the main target again from macro to micro, with JP Morgan unofficially kicking off the brand new earnings season on October 11, working by means of to NVIDIA’s report in mid-November. Analyst expectations for realised income and earnings progress in Q3 stay modest however are considerably larger for the next intervals. As time goes on, investor consideration will more and more flip to the result of the tense US presidential election on November 5, in addition to the high-profile BRICS Summit in Russia, starting on October 22. For extra steering, watch our This autumn Funding Outlook video because of be launched on October 7.

The US labour market should not cool a lot additional

The US labour market information for September, due for launch on Friday, is of paramount significance to buyers. The Federal Reserve has made it clear that its precedence is to keep away from additional cooling of the labour market, as attaining a “smooth touchdown” stays its prime aim. Any indicators of weak point within the labour market might enhance the probabilities of the Fed contemplating a further 50 foundation level price reduce in November. Nonetheless, such indicators may additionally set off heightened volatility within the markets. A reasonable enhance of 145,000 new jobs is anticipated, whereas the unemployment price is anticipated to stay regular at 4.2%.

Rate of interest cuts not but adequate for property increase

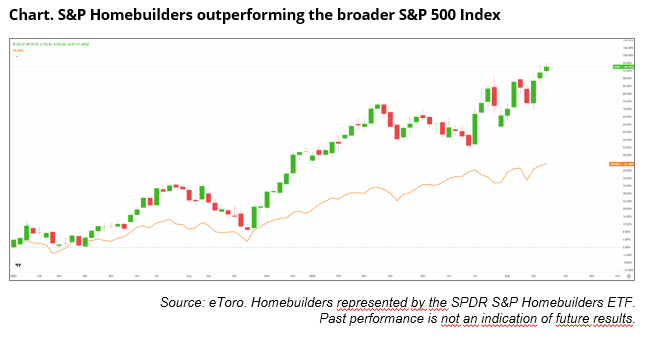

The US homebuilder sector has considerably diverged from the S&P 500 since late 2023 (see chart under), as buyers anticipate the optimistic affect of forthcoming price cuts on the housing market. The SPDR S&P Homebuilders ETF has delivered greater than double the return of the broader market because the begin of 2023. Regardless of this optimism, a full restoration in the actual property sector has but to materialise, as weak constructing allow and housing begin figures recommend. Though there have been occasional robust months, a sustained upward pattern stays elusive. The 30-year mounted mortgage price has dropped to six.1%, making homebuilding extra reasonably priced, however for a real increase, charges would want to fall additional. The normalisation of financial coverage is on the horizon.

Earnings and occasions

Earnings are due for Nike (the place Elliot Hill will substitute John Donahue as CEO), Carnival Cruise Traces, Levi Strauss and Constellation Manufacturers. Traders will likely be watching not solely Chinese language shares similar to Alibaba, Tencent, JD.com, PDD, BYD and NIO after the historic rally following the financial stimulus announcement final week, but additionally luxurious items makers similar to LVMH, Tesla and Apple with a robust deal with the Chinese language shopper.

Wanting forward on the agenda, subsequent week we are going to see Amazon Prime Large Deal Days (Oct.8-9), TSMC month-to-month gross sales (Oct.9), Tesla robotaxi unveil (Oct.10), and JP Morgans Q3 earnings (Oct.11), marking the unofficial begin of the brand new earnings season.