ETH drops beneath $1000 on Uniswap because the whale market tries to repay the money owed and the Ethereum whale unleashed an enormous place to repay money owed which triggered the WETH value to crash so let’s learn extra right this moment in our newest Ethereum information.

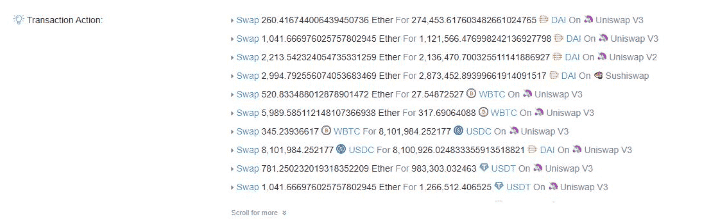

Prior to now few days, the crypto market noticed some excessive turbulence and large volatility so, throughout the turmoil, one whale liquidated an enormous quantity of ETH and pushed the worth on Uniswap to 941 USDC earlier than recovering. The ETH whale liquidated an enormous quantity of wrapped ETH on Uniswap which boosted the worth all the way down to 941 USDC. The transaction will be tracked on the ETH explorer and in addition seen within the transaction is that the whale used a number of the funds to repay some loans.

On the time of writing, the worth returned to the place the remainder of the market trades beneath $1300. ETH Drops beneath $1000 and it’s down by 11.2% ont eh day and 30% on the week. Information reveals that there have been over $170 million in liquidated ETH positions previously day and within the meantime, the broader market is about $50 billion away from dropping beneath $1 trillion. The final day noticed greater than $500 in complete liquidations whereas BTC had a subject day and pushed the worth beneath $26,000.

As just lately reported, The ETH core builders delay the Issue bomb after assembly on Friday and probably delay the Merge which is able to migrate the community from a PoW consensus to a PoS. The problem bomb was planted within the ETH code in 2015 as a measure to pressure validators and settle for the merge. The implementation of the merge dubbed went stay on the Ropsten testnet a number of weeks in the past and after the testnet merge and the dialogue of quite a lot of bugs revealed by the check merge, the builders proposed EIP-5133 to delay the bomb to August 2022 and have been already delayed 5 occasions earlier than.

The previous 24 hours introduced extra ache to the crypto market with BTC dumping to a low of over $27,000 however the different cash suffered much more. ETH, for instance, crashed beneath $1500 to a 2018 ATH stage. After a number of makes an attempt to beat $32,000 final week, the primary crypto began dropping worth steadily and the final rejection introduced it all the way down to $30,000 the place the asset remained for a number of days. The panorama modified when the US inflation numbers went to eight.6%.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be at liberty to contact us at [email protected]