The ETH liquidations reached $157 million after the Merge improve check, following the Beacon Chain block reorganization which led ETH to drop over 7% as we reported earlier in our Ethereum information.

With the bears circling crypto and conventional markets, ETH confronted the brunt of it. Ethereum is buying and selling fingers at $1,770 down by 3.4% previously day and the bearish development is the most recent in what was seen as a reasonably pink week for the second largest crypto by market cap. Previously week, Ethereum shed about 16% of its worth and crashed from $2,077 to as little as $1,731 throughout the early hours on Friday. It recovered some however now stands at round $1,770 down by 3.5% on the day. The massive value shift led to ETH Liquidations attain $175M as per the information pulled from Coinglass. About 75% of them had been lengthy positions from the bullish crypto merchants.

The Ethereum beacon chain skilled a 7-block deep reorg ~2.5h in the past. This exhibits that the present attestation technique of nodes must be reconsidered to hopefully end in a extra steady chain! (proposals exist already) pic.twitter.com/BkQrKuUlw1

— Martin Köppelmann 🇺🇦 (@koeppelmann) May 25, 2022

Most notable was the current hang-up associated to the ETH incoming merge that’s set for August. The merge will see the present PoW model of ETH merge with the PoS counterpart. The counterpart known as the Beacon Chain and was in operation since December 2020. The PoW-based model will finish and can make Ethereum a PoS community and also will deliver a bunch of latest advantages. The Beacon Chain is a form of ghost model of ETH operating in parallel to the present community which skilled a block reorganization occasion so such an occasion implies that for a brief second, the Beacon Chain was forked and all blocks had been processed on one other parallel model of the Beacon Chain. The community began producing quickly.

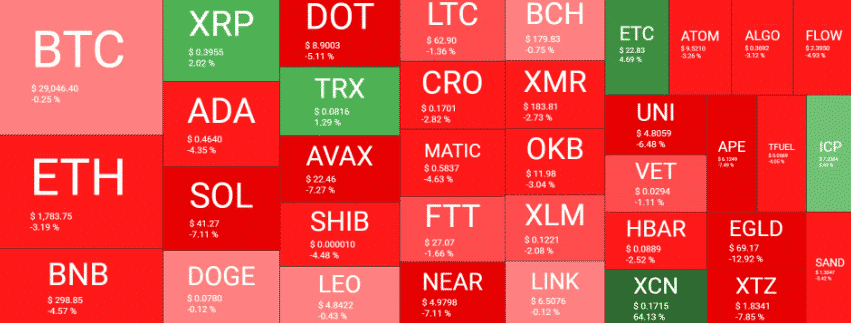

As earlier reported, The altcoins are bleeding out as a lot of the market took a leg down previously day and this induced bitcoin’s dominance to surge to new highs that weren’t seen since final 12 months. Ethereum’s value relative to Bitcoin dropped to the bottom level since final 12 months and on the time of writing, ETH traded at 0.0629 BTC which lastly was recorded in October 2021. within the meantime, right this moment’s pullback noticed the ETH greenback worth drop by 7% and left some $86 million in liquidated positions. As a matter of truth, previously day, probably the most liqudations had been of ETH contracts and the most important single liquidation order came about on OKEX and was an ETH/USDT swap with a face worth of $2.24 million.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the very best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be happy to contact us at [email protected]