Onchain Highlights

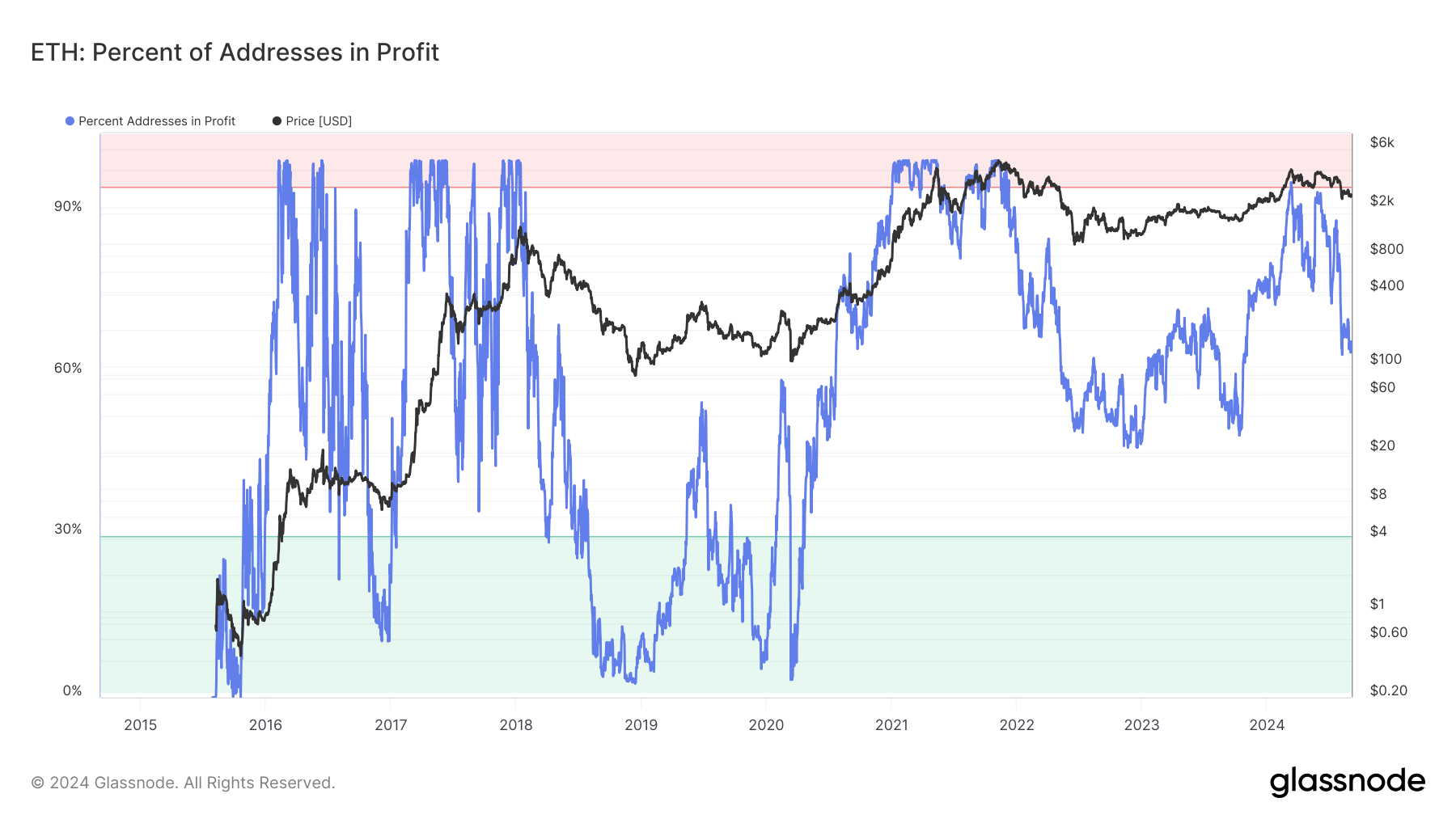

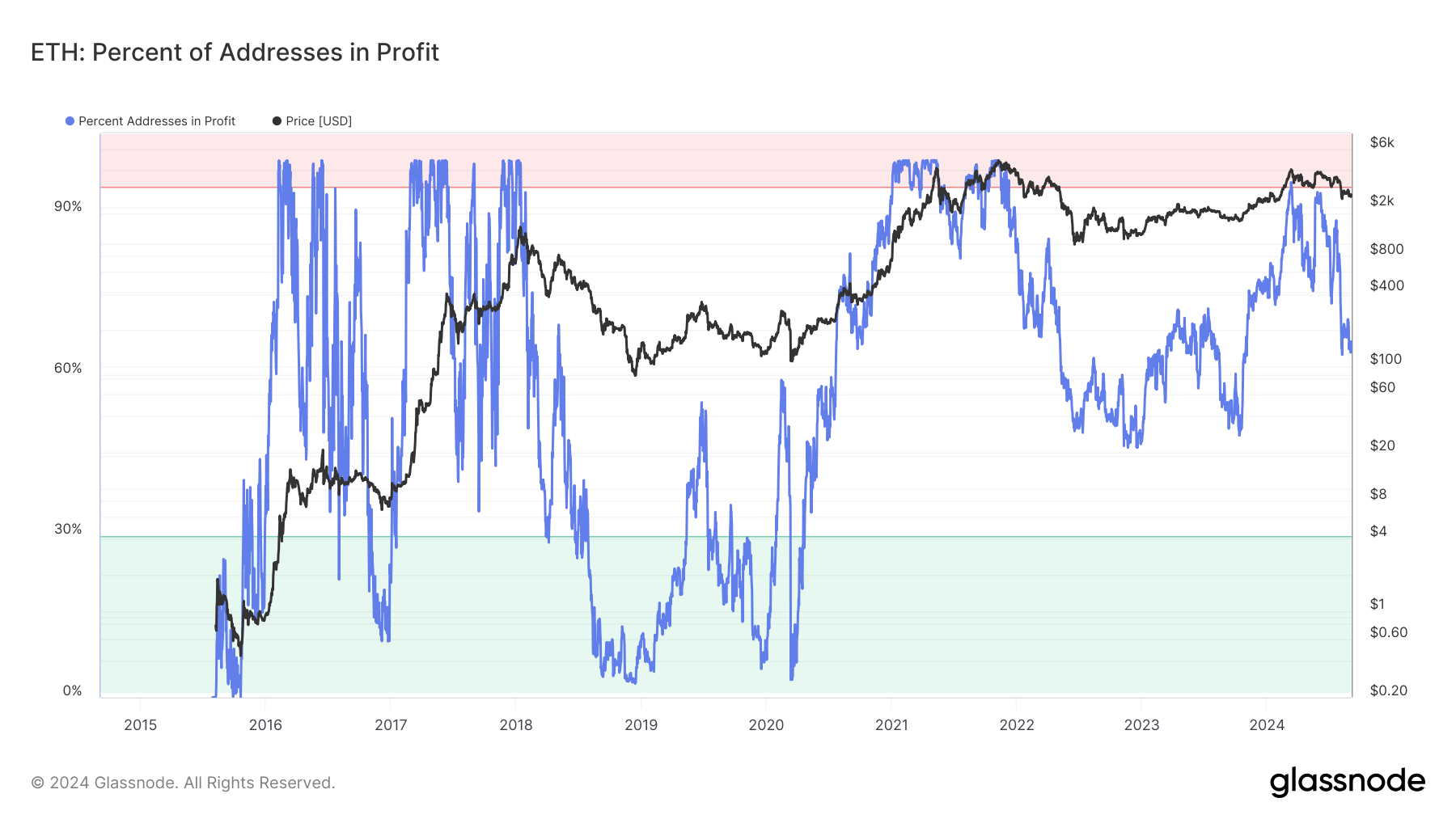

DEFINITION:The share of distinctive addresses whose funds have a median purchase worth that’s decrease than the present worth. “Purchase worth” is right here outlined as the value on the time cash had been transferred into an deal with.

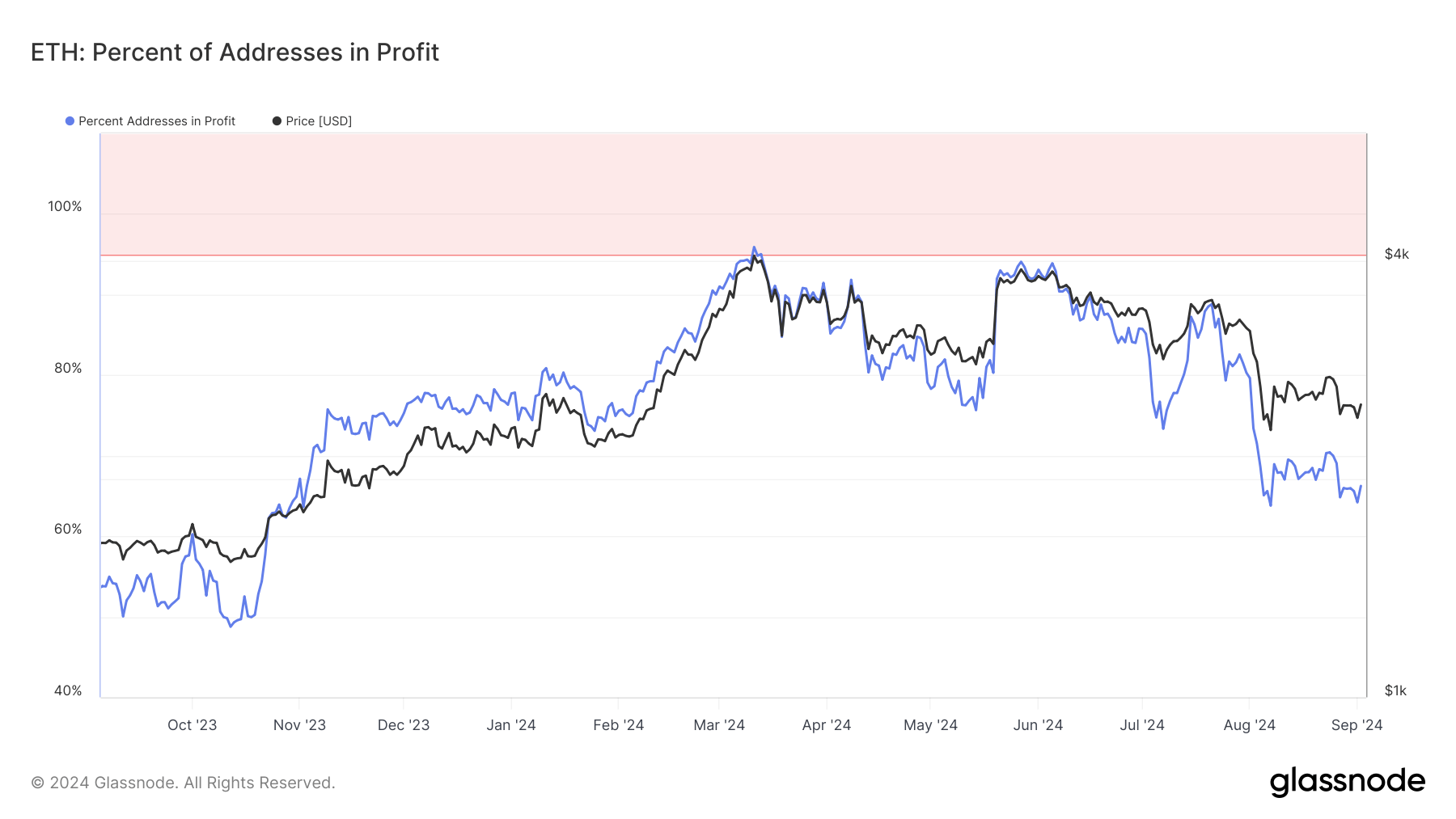

Ethereum addresses in revenue have seen a notable decline in 2024. The share of addresses in revenue has fallen to 65% as of Sept. 3 after reaching a peak close to 90% in March. This decline is clear from the broader context of Ethereum’s worth, which has additionally retraced from its earlier highs this 12 months.

Historic knowledge displays an identical sample throughout market downturns. In late 2018, Ethereum’s proportion of worthwhile addresses plunged beneath 10% because the asset’s worth fell sharply, marking one among its most vital drops. The same development occurred in early 2020 when profitability dipped to almost 0% through the broader market correction.

The present development suggests Ethereum’s profitability is mirroring previous bear markets, the place a lower in worthwhile addresses preceded prolonged intervals of decrease costs. As Ethereum’s worth stays underneath stress, the proportion of addresses in revenue might proceed to say no, doubtlessly revisiting ranges seen in earlier market cycles, indicating cautious market sentiment.