Digital belongings supervisor CoinShares says establishments poured $1.1 billion into crypto funding merchandise one month after the U.S. Securities and Trade Fee (SEC) authorised spot BTC exchange-traded funds (ETFs).

In its newest Digital Asset Fund Flows report, CoinShares finds that crypto funding merchandise noticed over a billion {dollars} in inflows final week and present no indicators of slowing.

“Digital asset funding merchandise noticed massive inflows totaling $1.1 billion, bringing year-to-date inflows to $2.7 billion. Coupled with latest worth rises, whole belongings underneath administration (AuM) is on the highest degree since early 2022 at $59 billion.”

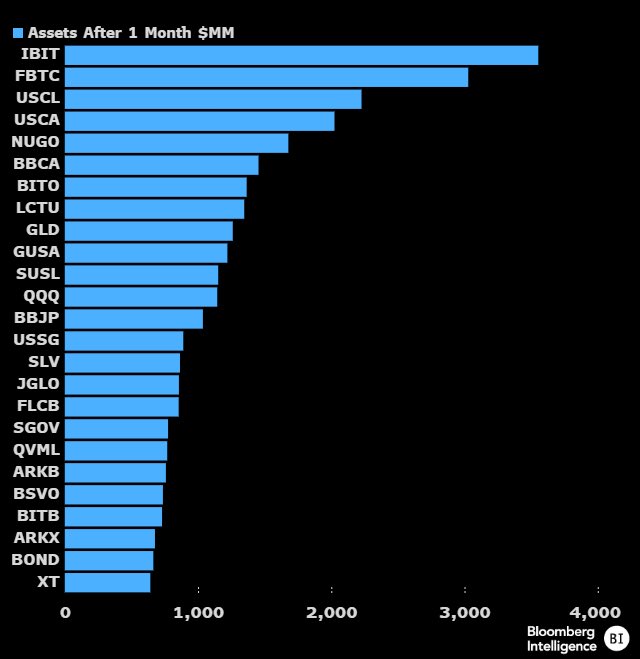

In accordance with CoinShares, many of the inflows had been targeted on BTC ETFs, which have reached nearly $3 billion within the final month. The agency says Bitcoin’s worth appreciation “buoyed sentiment” for Ethereum (ETH) and Cardano (ADA), which each noticed extra inflows than the remainder of the altcoin market.

“Regionally, the main target remained on the newly issued spot-based Bitcoin ETFs within the US, which noticed a web $1.1 billion inflows final week, bringing inflows for the reason that January eleventh launch to $2.8 billion. The outflows from incumbents have slowed considerably, however the potential sale of the Genesis holdings of $1.6 billion may immediate additional outflows within the coming months…

Bitcoin noticed nearly 98% of the inflows, whereas the worth appreciation additionally buoyed sentiment for Ethereum and Cardano.”

BTC, per common, noticed the lion’s share of inflows, taking in 98% of final week’s inflows at $1.09 billion. Ethereum (ETH), Cardano (ADA), Avalanche (AVAX), Polygon (MATIC), and Tron (TRX) every noticed inflows of $16 million, $6 million, $0.5 million, $0.4 million, and $0.4 million, respectively.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/Naeblys/INelson