An Ethereum-based altcoin that rallied over 11x from this 12 months’s backside is now prone to witness a corrective transfer, in response to a number one analytics agency.

BarnBridge (BOND), a blockchain protocol that goals to tokenize threat, exploded from its 2022 low of $2.18 final month to a excessive of $24.99 on July twenty fourth, marking a rise of 1,046%.

Santiment says a number of on-chain metrics are flashing indicators of serious progress amid BOND’s exponential worth enhance.

“Onchain exercise is rising together with worth. It’s typically good. Extra motion is ready to assist worth pattern up. [Also] It’s quantity of new addresses interacting with BOND each day. Identical right here, new blood maintain flowing into BOND. No divergence with worth. Solely assist.”

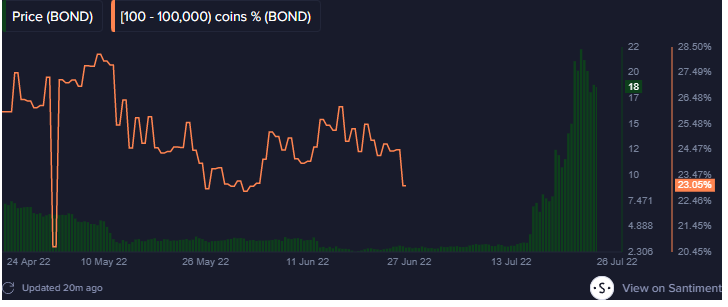

As well as, Santiment notes that holders of 100 to 100,000 BOND have bought their cash all through the rally.

“Homeowners from 100 to 100,000 BOND decreased their holdings on this pump. All of them gave up. And worth can maintain pumping on this denial. To punish many holders that dumped.”

Though a lot of on-chain metrics assist BOND’s explosion from the underside, Santiment highlights that the coin is now flashing sturdy bearish alerts.

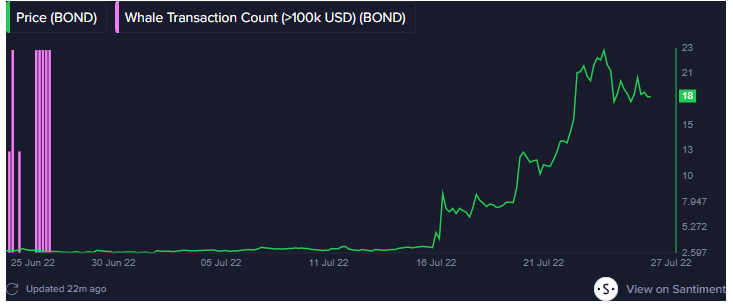

In response to the insights platform, the variety of whale transactions have already topped out, indicating that BOND is at a excessive threat of worth correction.

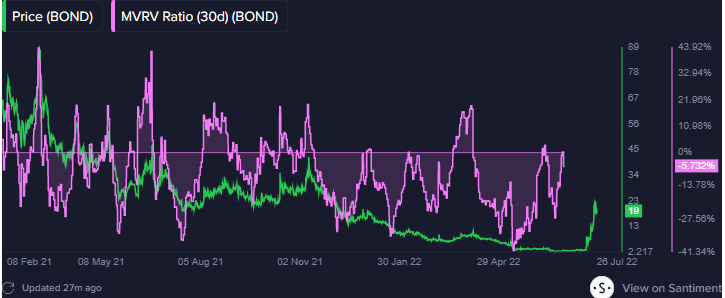

Santiment additionally says that the 30-day market worth to realized worth metric, which reveals the ratio between the present worth and the typical worth of each coin/token acquired, is at present elevated, suggesting that BOND is overvalued.

“It’s too excessive. Mainly, it’s by no means ever been that top for BOND because it matured. Very excessive threat correction and cooling down.”

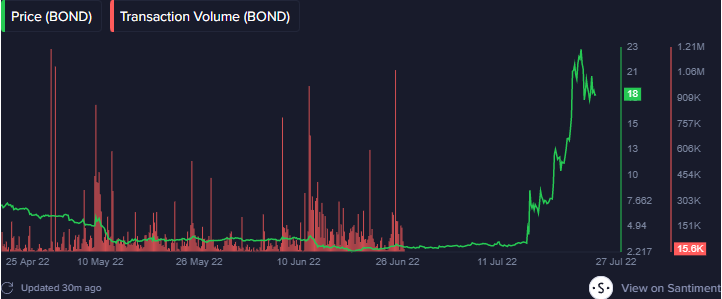

One other metric exhibiting bearishness for BOND is transaction quantity. In response to Santiment, BOND’s transaction quantity has topped out and fading.

“This metric in an onchain different of buying and selling quantity. It reveals what number of BOND has been moved onchain. And it has topped already and fading. Excessive threat.”

Lastly, Santiment notes that BarnBridge whales, or entities that maintain between a million to 10,000 BOND, have begun distributing their cash after closely accumulating in June, across the time the coin bottomed out.

At time of writing, BOND is buying and selling for $19.47, down almost 3% on the day.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/laskoart/WindAwake