Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

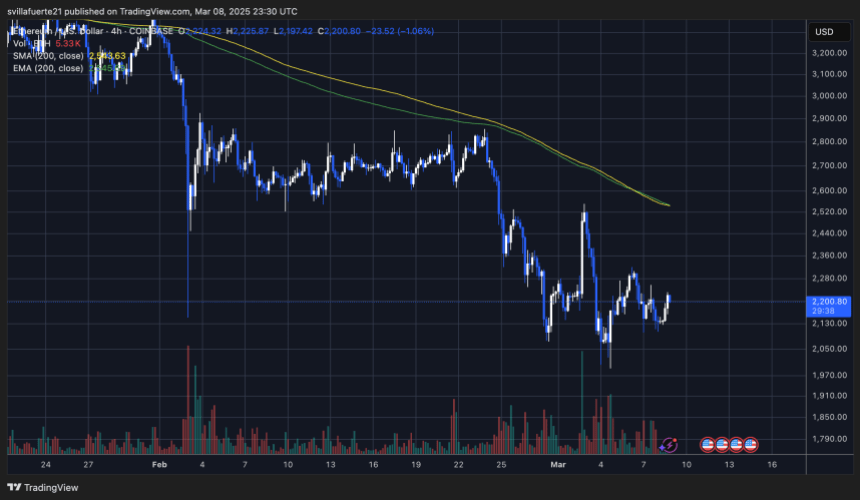

Ethereum (ETH) has been struggling across the $2,200 degree, with bulls unable to reclaim larger costs regardless of a number of makes an attempt. The market sentiment stays bearish, as ETH continues to face promoting stress even after Thursday’s announcement of the US Strategic Bitcoin Reserve, which many had anticipated to spice up general confidence within the crypto sector.

Associated Studying

As ETH hovers close to essential demand ranges, analysts consider that the subsequent week can be essential in figuring out its short-term course. If bulls can defend key help zones, Ethereum might have an opportunity to regain momentum. Nonetheless, failure to carry these ranges may result in additional draw back stress.

High analyst Carl Runefelt shared a technical evaluation on X, highlighting that Ethereum is breaking out of a sample that usually alerts a possible breakout. If ETH follows this setup, it may push into larger resistance zones and reclaim key worth ranges above $2,500. Nonetheless, affirmation of this breakout is required, as market volatility stays excessive.

Ethereum Bulls Hope For A Restoration

Ethereum has suffered a steep decline, shedding over 50% of its worth since late December, triggering worry and panic promoting throughout the market. As soon as a frontrunner in earlier bull cycles, ETH is now struggling to regain momentum, main many analysts to query whether or not the long-awaited altseason will occur this yr. With Ethereum and most altcoins unable to reclaim bullish constructions, the market stays beneath bearish management, protecting traders cautious.

Regardless of the unfavorable sentiment, there may be nonetheless hope for a restoration as Ethereum approaches key technical ranges that might decide its subsequent transfer. Runefelt’s remarks reveal that ETH is breaking above a descending triangle sample, a setup that usually alerts a development reversal. Nonetheless, affirmation is essential, as many previous breakouts have was fakeouts, trapping merchants in additional draw back strikes.

For Ethereum to solidify a bullish breakout, it should push above and shut above $2,300. This degree is a key resistance zone, and flipping it into help would point out renewed shopping for power, doubtlessly opening the door for a push towards $2,500 and better worth targets.

Associated Studying

Till this affirmation occurs, Ethereum stays vulnerable to additional declines if sellers regain management. Merchants and traders are intently watching whether or not ETH can keep its breakout try or if it can face one other rejection, extending its bearish development into the approaching weeks.

ETH Key Ranges To Watch

Ethereum is at the moment buying and selling above the $2,000 help degree, an important final line of protection for bulls hoping to see robust efficiency this yr. Holding this degree is crucial, as a breakdown under $2,000 may set off additional draw back, reinforcing bearish sentiment out there.

Regardless of this, bulls have struggled to reclaim larger costs, leaving traders pissed off with ETH’s lack of momentum. Current worth motion has been uneven and indecisive, with every try at a breakout rapidly met with promoting stress. This has stored ETH caught in a good vary, stopping a transparent shift in market sentiment.

Associated Studying

Nonetheless, a decisive reclaim of $2,300 may mark a turning level. If ETH pushes above and holds this degree, it will seemingly open the door for a transfer towards $2,500, strengthening the case for a restoration rally. Till then, merchants stay cautious, as Ethereum’s battle to realize traction continues to weigh on the broader altcoin market.

Featured picture from Dall-E, chart from TradingView