The latest approval of the primary Bitcoin spot exchange-traded fund (ETF) in america by the Securities and Alternate Fee (SEC) has reverberated throughout the cryptocurrency panorama, triggering a major surge in varied altcoins, with Ethereum Basic (ETC) taking the highlight.

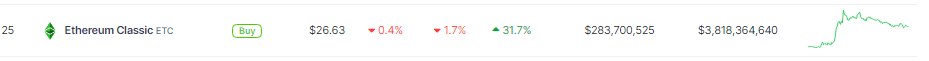

Usually overshadowed by its extra well-known sibling, Ethereum, ETC has emerged because the clear winner within the aftermath of the groundbreaking information, experiencing a powerful surge of over 31% prior to now seven days.

Ethereum Basic Buying and selling Quantity Up

For the reason that SEC’s approval of the Grayscale Bitcoin ETF on January tenth, Ethereum Basic has skyrocketed by a staggering 30%, at the moment sustaining a buying and selling worth round $26. This meteoric rise has been accompanied by a exceptional 270% improve in buying and selling quantity, hovering to a considerable $1.8 billion.

Such strong figures underscore a palpable surge in investor confidence, suggesting the potential for additional positive factors within the close to future.

Whereas Bitcoin itself witnessed a modest value improve, briefly touching $47,000, Ethereum stole the limelight by breaking a 20-month barrier and surpassing $2,600.

Ethereum Basic at the moment buying and selling at $26.36 on the day by day chart: TradingView.com

This exceptional 10% surge inside a mere 24 hours has positioned Ethereum at its highest worth since Might 2022. Analysts attribute this spectacular efficiency to Ethereum’s strong underlying know-how and up to date community upgrades, cementing its standing as a good choice for traders after Bitcoin.

The approval of the Bitcoin spot ETF will not be the only real catalyst for this altcoin rally; the much-anticipated Bitcoin halving occasion, scheduled for later within the yr, can be enjoying a pivotal function in bolstering bullish sentiment.

ETC value motion within the weekly timeframe. Supply: Coingecko

This occasion, occurring roughly each 4 years, entails a discount within the variety of newly minted Bitcoins and has traditionally coincided with value appreciation within the cryptocurrency market.

The confluence of those elements has created an ideal storm for Ethereum Basic, propelling it in direction of the coveted $30 mark.

ETC Sturdy Efficiency

Trade consultants anticipate that this milestone could also be achieved quickly, fueled by Ethereum Basic’s spectacular buying and selling quantity and market capitalization, which has surged by 34% to cross the $4 billion mark for the reason that ETF information broke.

Nonetheless, amidst the euphoria surrounding this surge, it stays essential to acknowledge the inherent volatility of the cryptocurrency market. Whereas the approval of the Bitcoin spot ETF and the approaching halving occasion supply promising prospects, unexpected elements can swiftly alter market dynamics.

The latest ascent of Ethereum Basic serves as a compelling testomony to the interconnectedness of the cryptocurrency market and the substantial impression of main regulatory choices.

Because the trade continues to evolve, it will likely be intriguing to watch how different altcoins reply to those developments and whether or not Ethereum Basic can maintain its lead on this post-ETF period.

Featured picture from Shutterstock

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual threat.