Este artículo también está disponible en español.

Ethereum (ETH) demand is essentially pushed by the token’s use in on-chain functions and token transfers, in accordance with a report by CoinShares.

Ethereum’s Use-Circumstances Have Elevated, However Lengthy-Time period Worth Is Lacking

In a lately printed detailed report, CoinShares’ Matthew Kimmell famous that regardless of Ethereum’s potential to host common functions sooner or later, buyers are struggling to see a major worth proposition in its native ETH token.

Associated Studying

Since its inception in July 2015, Ethereum has made massive strides because it has regularly witnessed the emergence of latest use-cases, ranging from easy token transfers, to make use of in on-chain functions, decentralized finance (DeFi) protocols, and, most lately, non-fungible tokens (NFTs).

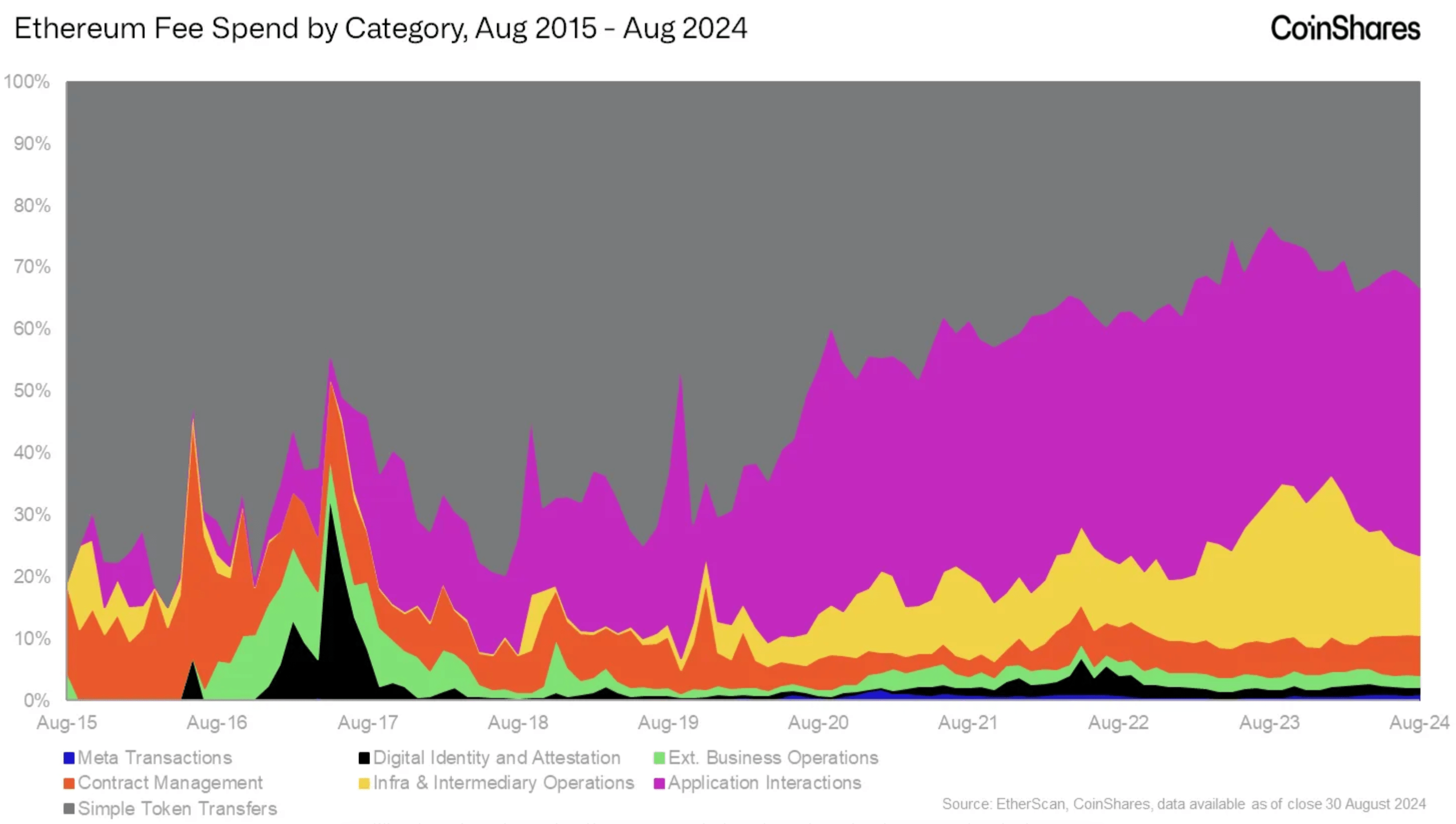

In line with the report, Ethereum started to see broader utility from 2018 onwards, when its main use shifted from token transfers to easy on-chain functions, digital identification techniques, and on-chain withdrawals.

From 2020 onwards, Ethereum has facilitated extra advanced use-cases comparable to protocol staking, liquidity mining, MEV (most extractable worth), bridges, oracles, and second-layer applied sciences. Though the growing use-cases would possibly sound favorable for Ethereum on the floor stage, the problem lies in ETH utilization being concentrated amongst a restricted vary of providers.

The report reads:

Nevertheless, the laborious reality is {that a} very small set of providers persistently makes up nearly all of Ethereum utilization, and these units largely revolve round hypothesis or easy worth switch, not essentially the kind of advanced “real-world utility” use circumstances initially envisioned by the builders of the Ethereum Basis.

The chart beneath confirms this remark, displaying that straightforward token transfers and utility interactions comprise the majority of ETH utilization, adopted by infrastructure, middleman operations, and contract administration.

Marketplaces Dominate Software Utilization, Stablecoins Lead Token Transfers

The report highlights that on-chain marketplaces – particularly decentralized exchanges (DEXes) like Uniswap – dominate utility interactions. Notably, over 90% of transaction charges originate from market exercise.

Within the first half of 2024, Uniswap alone captured about 15% of Ethereum transaction charges. This isn’t shocking, because the main DEX lately achieved the milestone of producing $50 million in income. Quite the opposite, NFT buying and selling platforms have suffered a dramatic decline in consumer transactions since their peak in 2021.

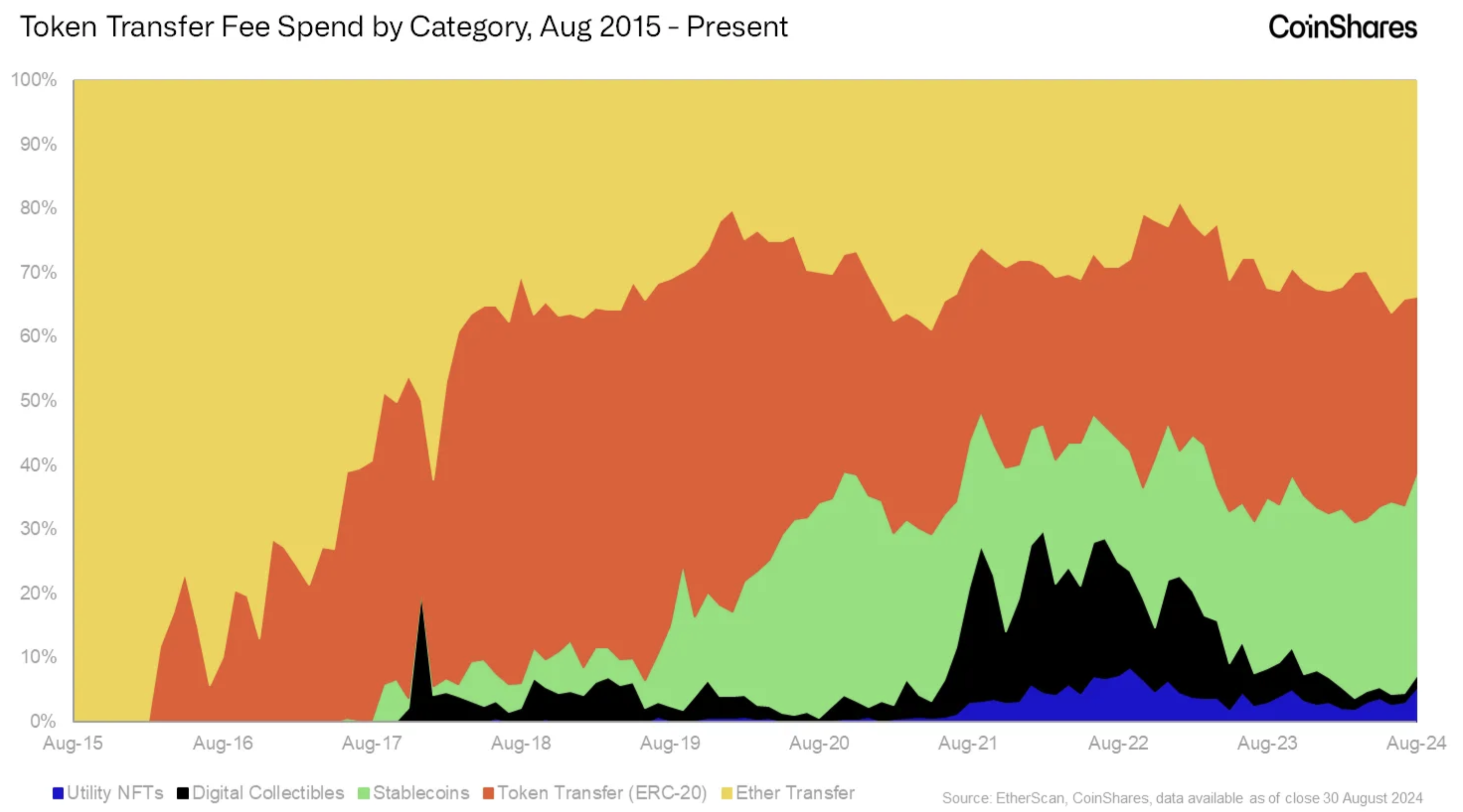

Token transfers proceed to play a key function within the Ethereum community exercise. With the continuously increasing ecosystem, the kind of tokens being transferred has diversified. Nevertheless, ETH, and stablecoins comparable to USDT and USDC have emerged because the dominant tokens by way of transaction charges.

The chart beneath illustrates the rise of stablecoins from mid-2017, when USDT started to see excessive adoption as a buying and selling pair for nearly all listed ERC-20 tokens on crypto exchanges. Circle’s entry into the market in late 2020 with its USDC stablecoin additional boosted stablecoin utilization inside the wider Ethereum ecosystem.

An fascinating remark made within the report is relating to the elevated use of Ethereum layer-2 options. Whereas their adoption has tackled a few of Ethereum’s scalability points, they’ve additionally, unintentionally diminished demand for Ethereum’s base layer. Kimmel notes:

In our view, the newest main change, EIP-4844, which strongly incentivized Layer 2s, has labored immediately towards the financial design advantages of EIP-1559, which tied the worth of ether to its Layer 1 platform demand.

Associated Studying

ETH trades at $2,613 at press time, up 0.2% within the final 24-hour interval. Stablecoins comparable to USDT and USDC command a market cap of $119 billion and $36 billion, respectively.

Featured picture from Unsplash, Charts from CoinShares.com and Tradingview.com