Regardless of a number of macro challenges, Ethereum (ETH) has been displaying steady upward momentum and a possible of reaching the $2K mark. Nonetheless, latest market developments have seen Ethereum face a robust rejection above the $1.9K mark, inflicting ripples amongst long-term holders and merchants. The rejection at $1.9K was not completely surprising. The crypto market has been in a state of flux, with Bitcoin, the market chief, additionally experiencing comparable worth resistance.

Whales’ Revenue Taking Sentiment Causes Promoting Strain

One vital ingredient contributing to the promoting stress on Ethereum is the profit-taking sentiment amongst Ethereum whales.

A outstanding Ethereum holder transferred a considerable sum of 23,080 ETH, equal to roughly $44 million following the cryptocurrency’s worth escalation above $1,904. This transfer signifies that vital stakeholders are starting to capitalize on their positive factors in gentle of Ethereum’s latest worth surge.

The typical worth at which the whale withdrew Ethereum hovers round $1,820. This determine is significantly decrease than the latest peak worth, implying a cautious technique in the direction of threat administration and an inclination to safe earnings throughout instances of worth appreciation.

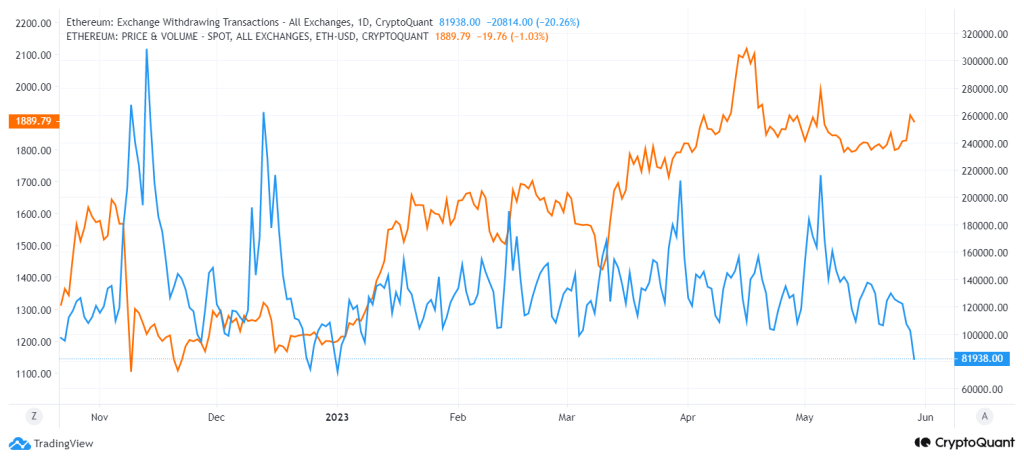

Furthermore, analyzing on-chain knowledge, Ethereum’s withdrawing transaction metric has been declining following ETH’s latest massive purple candle. The metric is presently at 81K stage which was final seen in January.

Withdrawal transactions are the switch of Ethereum from exchanges to non-public wallets. Excessive withdrawals counsel traders are holding ETH privately, probably anticipating a worth rise. Low withdrawals suggest extra ETH is saved on exchanges, usually indicating upcoming gross sales.

A decline in Ethereum withdrawal transactions can due to this fact exert downward stress on the ETH worth. It is because when giant quantities of ETH are stored on exchanges, it will increase the availability of Ethereum accessible for buying and selling. If the demand doesn’t match this elevated provide, it could result in a surplus of ETH available on the market, which may subsequently trigger the worth to drop.

What’s Subsequent For ETH Worth?

Ether has been in a declining wedge sample for a number of days. On Could 25, regardless of bears’ efforts to decrease the worth to the wedge’s assist line, bulls purchased the dip aggressively, evident from the lengthy candlestick tail. As of writing, ETH worth trades at $1,892, gaining over 2% within the final 24 hours.

Nonetheless, ETH worth at present witnessed a large promoting stress, plunging its worth from a excessive of $1,927. Bulls at the moment are trying to take care of the worth above the 20-day EMA at $1,842. If profitable, the ETH worth may climb to the resistance line at $1,930. It is a essential stage to watch as a break above it may set off a rally to $2,000.

Nonetheless, if the worth drops from the present stage or drops under the 38.6% Fib channel, it would point out that bears are nonetheless dominant at larger ranges. This might consequence within the ETH worth remaining inside a bearish area for a number of extra days.