Ethereum worth has been buying and selling sideways for the previous few weeks after going through a powerful rejection from the necessary degree of $1,900. On the time of writing, Ethereum was buying and selling barely greater at $1,850.88. The asset’s complete market cap has slipped to $222 billion, whereas the entire quantity of ETH traded over the past day jumped by greater than 77%.

Elementary Evaluation

Ethereum worth has been underneath intense stress for the previous few days towards the backdrop of world uncertainty and a decline in market sentiment. In line with Coinmarketcap, the worldwide crypto market has crashed over the previous few weeks to $1.17 trillion, whereas the entire crypto market quantity surged by practically 50% over the previous 24 hours.

Bitcoin, the most important cryptocurrency by market capitalization, has failed to start out a recent upward trajectory above the essential degree of $30,000, weakening the worldwide crypto market sentiment. A take a look at the Crypto Concern and Greed Index, the important thing measure of the feelings driving the crypto market, exhibits that buyers are in conservation mode. The present studying on the index is impartial at 50, down from a Greed degree of 64 seen just a few weeks in the past.

The US greenback jumped to a five-week excessive on Monday after excessive inflation readings printed final week. Knowledge printed by the Bureau of Labor Statistics on Thursday confirmed that the US headline inflation in July rose barely from June. The month-on-month Shopper Value Index (CPI) rose by 0.2% in July, matching June’s improve, whereas the annual inflation rose by 3.2%, up from 3% in June. The US Producer Value Index additionally grew greater than anticipated in July.

Larger inflation charges give the US Federal Reserve extra incentive to additional hike rates of interest, bettering the outlook of the buck. A stronger US greenback tends to be bearish to the costs of belongings, together with shares, commodities, and significantly cryptocurrencies. Even so, the CPI improve in July was smaller than anticipated, supporting the case for the US central financial institution to carry regular its rates of interest until its subsequent assembly in September. The Federal Open Market Committee (FOMC) is slated to launch its assembly minutes later this week on Wednesday.

Ethereum Value Prediction

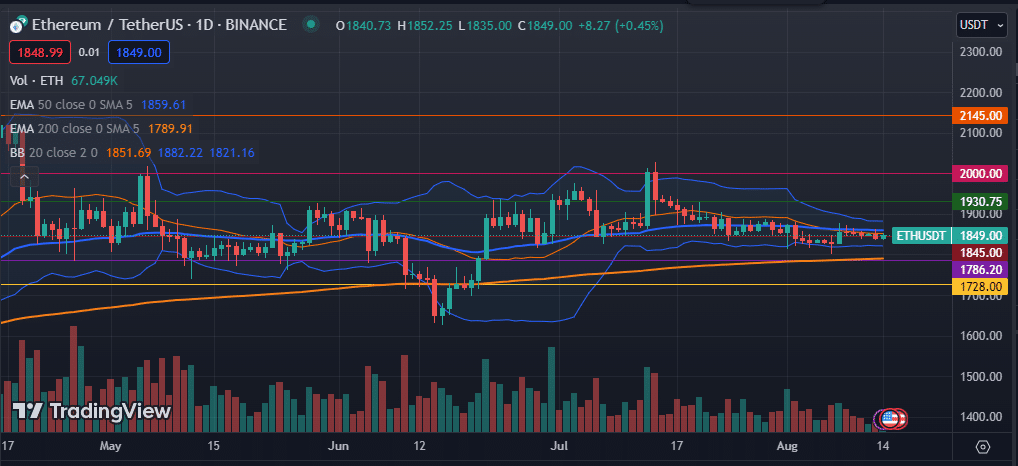

The day by day chart exhibits that the Ethereum worth has been in consolidation mode for the previous few weeks, buying and selling between the tight vary of $1,885 and $1,830. The asset stays barely under and above the 50-day and 200-day exponential transferring averages, respectively. Its Relative Energy Index (RSI) has improved barely, transferring above the sign line. The Bollinger Bands have narrowed, indicating a decline in market volatility.

As such, the Ethereum worth is more likely to proceed buying and selling sideways within the ensuing classes, struggling to search out path. A flip above the higher band at $1,888, might pave the best way for additional good points to the subsequent resistance ranges at $1,930.75 and $2,000. Nonetheless, a transfer under the essential help degree of $1,845 will invalidate the bullish thesis.

ETH Value Chart