Ethereum dangers dropping additional after breaking beneath the $1K worth level in a 2018-like bearish cycle so let’s learn extra at the moment in our newest Ethereum information.

Ethereum dangers dropping additional after the newest crash beneath $1,000 with the continued sell-off available on the market bringing much more ache for cryptocurrencies. Ether reached $975 which is the bottom level since 2021 and misplaced 80% of its worth from the excessive of November 2021. The decline appeared amid the issues in regards to the FED 75 foundation factors price hike which is a transfer that pushed most cryptos and shares right into a bear market. Analyst at knowledge useful resource Econometrics warned there can be much more downsides coming:

“The Federal Reserve has barely began elevating charges, and for the file, they haven’t offered something on their stability sheet both.”

The traders and merchants have been watching Ether’s worth prior to now few days and feared a breakdown beneath $1000 which can set off extra liqudations of leveraged bets and in flip, it will put extra strain on Ethereum. The fears seem as a result of Babel Finance and Celsius community as part of lending platforms which stopped withdrawals because of citing market volatility. They intensified, much more, when Three Arrows Capital did not shore up collateral to cowl bets. This got here lower than a month after Terra’s algorithmic stablecoin collapsed.

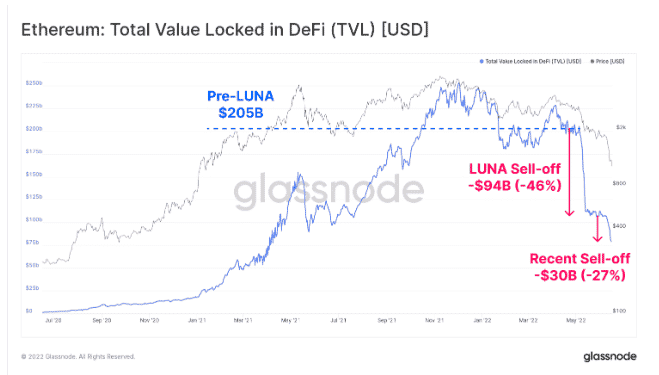

The occasions coincided with the large capital withdrawal from Ethereum’s blockchain ecosystem with the entire TVL unwind taking place in two elements. Ethereum’s TVL throughout the DEFI initiatives dropped by $94 billion after the Terra crash again in Might after which by one other $30 billion by mid-June. CheckMate and CryptoVizArt analysts added:

“The deleveraging occasion that’s underway is observably painful, and is akin to a type of mini-financial disaster. Nonetheless, with this ache comes the chance to flush extreme out leverage, and permit for a more healthy rebuild on the opposite aspect.”

FED’s hawkish insurance policies and the DEFI market implosion recommended extending a bearish transfer on the Ether market. From a technical perspective, ETH’s worth has to regain $1000 as its psychological help which if it will get damaged to the draw back, it may have the token eye the $830 as a brand new goal. The identical degree served as resistance again in 2018 which preceded a 90% drop to round $80 in 2018. within the meantime, the ETH/USD pair can drop to as little as $420 if Ether’s correction seems just like the 2018 bear cycle when the drawdown reached 90%.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the very best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be happy to contact us at [email protected]