Ethereum’s topside bias stays weak after the 7% drop over the previous day whereas it did achieve some bearish momentum after breaking the $1920 help line so it might probably now prolong losses if it breaks the $1760 help so let’s learn extra as we speak in our newest Ethereum information.

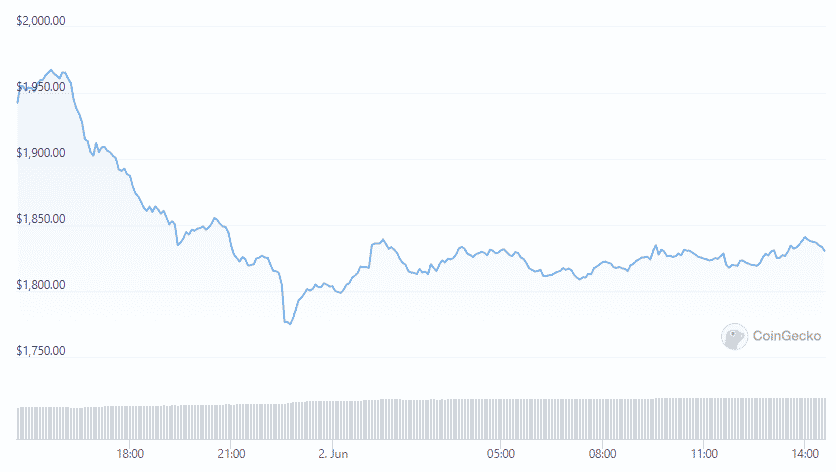

Ethereum began a contemporary decline after breaking the $1920 help and now the value is buying and selling beneath $1900 and there was a break beneath the most important contracting triangle with help near $1900 on the hourly chart for the ETH/USD pair. The pair examined the $1760 help and remained at a threat of extra losses as ETH did not clear the $2000 resistance with a pointy bearish response beneath the $1950 and the $1920 help ranges.

The bears managed to push the value beneath the 61.8% fib retracement degree from the upwards transfer of $1705 swing low to the $2015 excessive. Ether’s value dropped beneath the $1840 help and dropped beneath however then examined the $1760 help. The pair is now correcting good points and buying and selling above the $1800 degree. The value is buying and selling close to the 23.6% fib retracement degree from the decline of $2015 swing excessive to $1762 low. The preliminary resistance is near the $1835 degree with the subsequent main resistance nearing the $1888 degree and the 100 hourly easy shifting common and close to the 50% fib retracement degree from the drop of $2015 excessive to the $1762 low.

A transfer above the $1888 degree might push the value to the principle resistance at $1920 and extra good points might ship it in direction of the $2000 resistance zone. If ETH fails to get better above the $1888 resistance, it might probably prolong the drop and the preliminary help is close to the $1758 zone. Ethereum’s topside bias stays weak with the most important help nearing the $1760 degree and the draw back break beneath this degree might ship the value to $1720. Extra losses might provoke a transfer to $1650 the place the bulls would possibly emerge. The MACD for the pair is dropping momentum within the bearish zone and the ETH/USD is beneath the 40 ranges.

As not too long ago reported, The ETH/USD buying and selling pair pulled the most important variety of merchants from January to March 2022 and within the studies from Capital.com, the most important variety of merchants was held by DOGE in 2021 to the USD pair. Nevertheless, the ETH/USD pair took the spot for many merchants on the buying and selling platform for the primary time. The report famous that the crypto turnover went up by 93% within the quarter and regardless of the optimistic statistic, the report admitted that the rise in income doesn’t present the broader market developments as a result of the quantity was reached by a couple of single-day spikes in quantity.

DC Forecasts is a pacesetter in lots of crypto information classes, striving for the very best journalistic requirements and abiding by a strict set of editorial insurance policies. In case you are to supply your experience or contribute to our information web site, be at liberty to contact us at [email protected]