newbie

Cryptocurrency buying and selling is an thrilling and dynamic world. Merchants search to grasp and predict market actions, and one efficient approach to do that is by using technical evaluation, which incorporates finding out varied candlestick patterns. The night star candlestick is one such sample, identified for its capability to sign a possible bearish reversal.

On this article, I’ll check out the important thing traits of the night star candlestick, strategies of buying and selling with it, and the dangers and advantages of utilizing it in crypto buying and selling.

Traits of the Night Star Candlestick

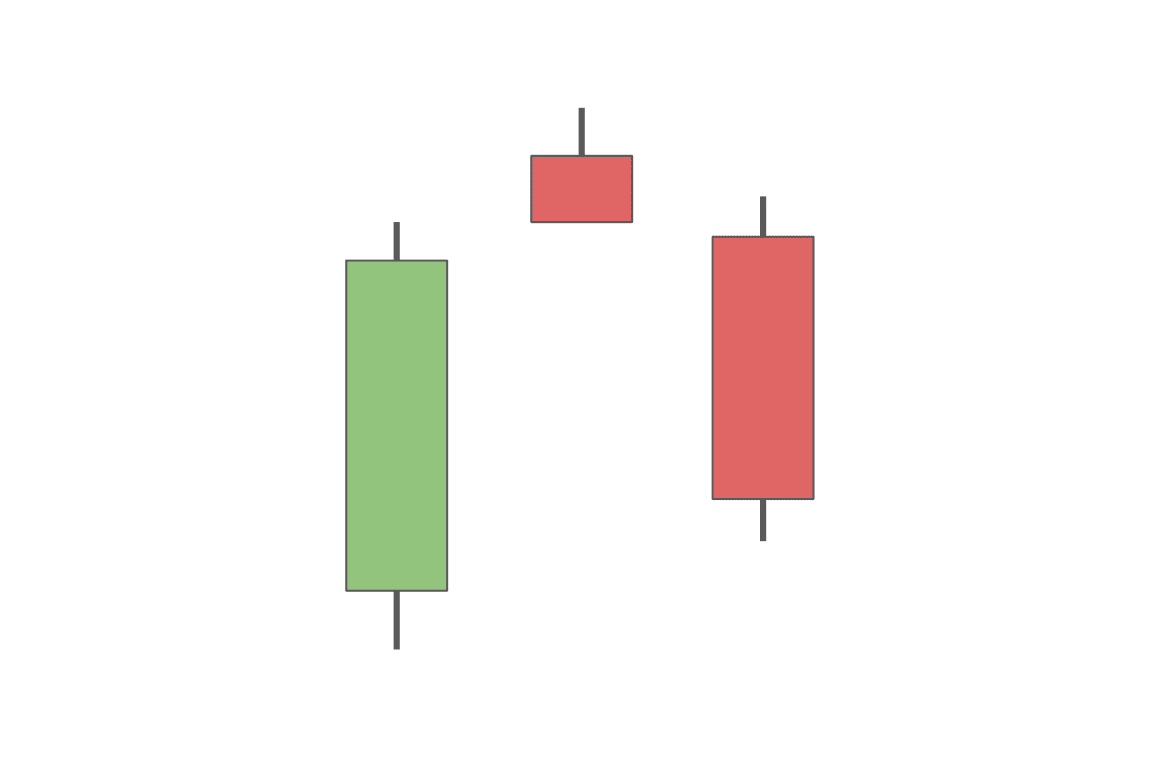

The night star candlestick is a bearish reversal sample, which generally emerges after a bullish development. It consists of three Japanese candlesticks:

- A bullish candle. This inexperienced candle represents a robust upward value motion, indicating that patrons are in management.

- A small-bodied candle. This can be a doji candle or a small inexperienced or purple candle, which varieties when the opening and shutting costs are shut collectively, suggesting indecision available in the market.

- A bearish candle. This purple candle signifies a downward value motion, exhibiting that sellers at the moment are dominating the market.

The sample varieties when a small-bodied candle gaps above the earlier bullish candle, adopted by a bearish candle that closes beneath the midpoint of the primary candle. This sample is taken into account extra dependable if the bearish candle engulfs the bullish candle.

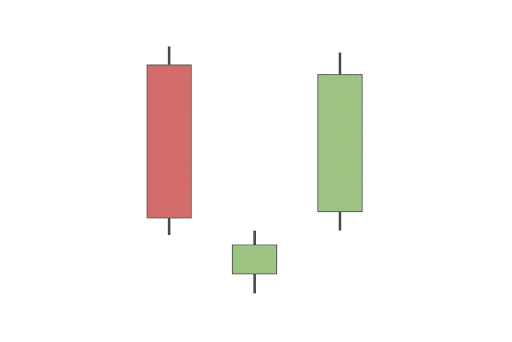

The alternative of the night star candlestick is the morning star sample. The morning star is a bullish reversal sample that indicators a possible development reversal from a downtrend to an uptrend. It consists of three candlesticks: a bearish candle, a small-bodied candle, and a bullish candle.

The morning star sample varieties when a small-bodied candle gaps beneath the earlier bearish candle, adopted by a bullish candle that closes above the midpoint of the primary candle. Just like the night star sample, the morning star sample is taken into account extra dependable if the bullish candle engulfs the bearish candle.

An Instance of an Night Star Candlestick Sample

Night star patterns are kind of frequent in each the inventory market and the crypto market. As a substitute of taking a look at any particular instance, let’s think about a hypothetical situation of a dealer eager to promote their Bitcoin or alternate their BTC for one more cryptocurrency.

Let’s say the worth of Bitcoin has been experiencing a robust uptrend over the previous few days. As the worth continues to rise, a big bullish candle varieties, representing a day of great positive factors for Bitcoin. This bullish candle signifies that patrons are in management and driving the worth larger, so our dealer decides to maintain holding their funds.

On the next day, a small-bodied candle (a doji or a small inexperienced or purple candle) seems. This candle signifies that the market individuals are indecisive, and the worth motion is restricted. The small-bodied candle gaps above the day gone by’s bullish candle, suggesting that the upward momentum could also be slowing down.

Lastly, on the third day, a big bearish candle varieties, closing beneath the midpoint of the primary day’s bullish candle. This means that sellers have taken management, pushing the worth downwards. Our dealer sees this as a chance to exit their BTC place.

This formation of a bullish candle, adopted by a small-bodied candle, after which a bearish candle is the night star candlestick sample. On this hypothetical instance, the looks of this sample within the Bitcoin market means that the uptrend could also be reversing, and the downtrend could possibly be on the horizon. Merchants who acknowledge this sample may determine to take revenue or enter brief positions, anticipating bearish market motion.

Tips on how to Commerce with the Night Star Candlestick

To successfully commerce with the night star candlestick, observe these steps:

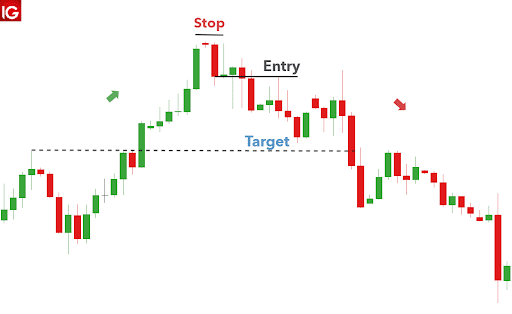

- Establish the sample. Search for a bullish development adopted by the formation of the night star sample, which ought to sign a possible development reversal.

- Affirm the sample. To extend the reliability of the sign, wait for added bearish candlestick patterns or different technical indicators that counsel a bearish reversal, resembling resistance ranges or trendlines.

- Set a cease loss. Place a stop-loss order above the very best level of the sample to attenuate potential losses if the development reversal fails to materialize.

- Enter a brief place. As soon as the sample is confirmed and the cease loss is in place, enter a brief place, anticipating that the worth will drop.

- Monitor the commerce. Control the worth motion and alter the stop-loss and take-profit ranges as wanted.

The Dangers and Advantages of Utilizing the Night Star Candlestick in Crypto Buying and selling

Identical to some other methodology of analyzing charts and optimizing your buying and selling, the night star candlestick sample has its dangers and advantages. Be cautious and attempt to apply multiple strategy of market evaluation when making selections.

Advantages:

- Early warning signal. The night star sample provides an early indication of a possible development reversal, permitting merchants to react accordingly and capitalize on the bearish motion.

- Elevated likelihood of success. Combining the night star sample with different technical evaluation instruments can enhance the chance of a profitable commerce.

Dangers:

- False indicators. Like all technical evaluation software, the night star sample can often produce false indicators, resulting in potential losses.

- Excessive volatility. Crypto markets are identified for his or her excessive volatility, which might typically end result within the sample failing to foretell a development reversal precisely.

Conclusion

The night star candlestick is a robust bearish reversal sample that may assist merchants determine potential development reversals within the crypto market. By understanding its traits, utilizing it along with different technical evaluation instruments, and being conscious of the dangers and advantages, merchants can enhance their probabilities of success. As with all buying and selling technique, it’s important to handle threat and keep self-discipline to realize constant outcomes.

FAQ

What’s a night star candlestick?

The night star candlestick is a bearish reversal sample that usually indicators a possible reversal from an uptrend to a downtrend. It consists of three candles: an extended bullish candle, a small-bodied indecision candle, and a bearish candle.

This bearish candlestick sample signifies that bullish momentum is dropping energy, and bearish sentiment is taking up, doubtlessly resulting in a downtrend within the asset value.

What are one of the best bearish reversal patterns?

Among the greatest bearish reversal patterns in monetary markets embody the night star candles, bearish harami, capturing star, and bearish engulfing. These patterns assist merchants determine potential reversals in value uptrends, permitting them to reap the benefits of bearish market actions. Every sample has its distinctive traits, however all of them sign a weakening of bullish momentum and a shift in the direction of bearish sentiment.

Is the night star candlestick dependable?

The night star candlestick is taken into account a comparatively dependable bearish reversal sign, notably when it seems after a robust uptrend and different technical indicators, resembling resistance ranges or value oscillators, affirm it. Nonetheless, like all technical evaluation instruments, the night star sample might often produce false indicators. To mitigate this threat, merchants ought to mix this sample with different indicators and keep strict threat administration practices.

What’s the morning star sample?

The morning star sample, being the other of the night star candlestick, is a bullish reversal sample. It indicators a possible reversal from a downtrend to an uptrend within the monetary markets. The sample consists of three candles: a bearish (purple or black) candle, a small-bodied indecision candle, and a bullish (inexperienced or white) candle. The morning star sample signifies that bearish momentum is subsiding and bullish sentiment is taking up, doubtlessly resulting in an uptrend within the asset value.

Disclaimer: Please word that the contents of this text usually are not monetary or investing recommendation. The knowledge supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.