newbie

Because the cryptocurrency panorama continues to evolve, one occasion — the Litecoin halving — has constantly piqued crypto fans’ curiosity globally. Also referred to as the “block reward halving occasion,” this pivotal incidence takes place roughly each 4 years and possesses the potential to set off important worth actions in Litecoin. With eyes set on the upcoming Litecoin halving slated for 2023, the query on everybody’s thoughts is, “Will this occasion spark the following Litecoin rally, or will it dampen the market sentiment?” Amidst the anticipations and speculations, a cautious evaluation of LTC market situations, the general state of the crypto market, and the funding conduct of whale addresses might be paramount.

Whats up, my identify is Zifa, and I’ll be your information by the intricacies of Litecoin halvings. I’m right here to light up why the thrill across the forthcoming Litecoin halving in 2023 isn’t just excessive however justified. With my experience and fervour for cryptocurrencies, we’ll discover and untangle the advanced but intriguing world of Litecoin halving occasions collectively.

What Is a Block Halving Occasion?

A block halving occasion is a time period used to explain the cyclical lower within the block reward given to Litecoin miners inside the framework of the Litecoin community. This occasion, which happens at predetermined intervals, serves as a vital mechanism within the operation of quite a few cryptocurrencies, together with Litecoin.

This course of, typically acknowledged as a major occasion on the Litecoin blockchain, sees a brand new block being mined roughly each 2.5 minutes. Earlier than every halving occasion, miners obtain a sure variety of Litecoins as a reward for efficiently mining a brand new block. Nevertheless, after the halving occasion, this reward will get decreased by half.

One important operate of the block halving occasion is to regulate the financial provide of the cryptocurrency, thereby aiming to control its inflation price. As per this mannequin, the general provide of Litecoins steadily decreases, which in keeping with easy financial concept, might stimulate a rise in demand. This doubtlessly results in an increase within the worth and general market worth of Litecoin.

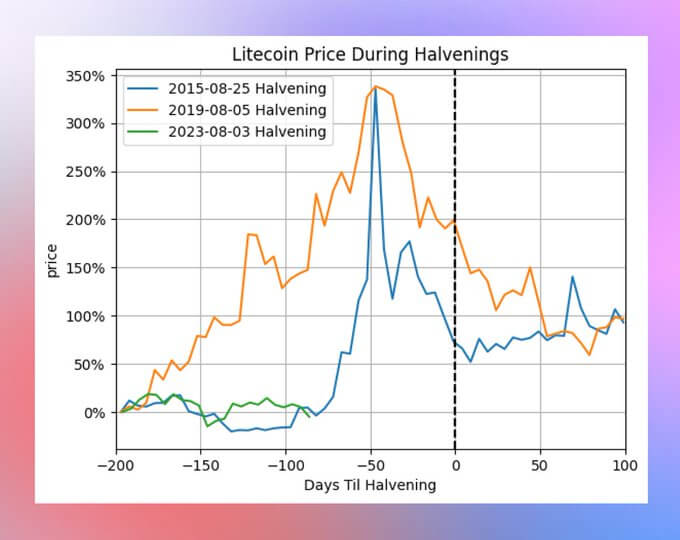

Traditionally, Litecoin halving occasions have performed a considerable position in influencing the cryptocurrency market. For instance, throughout earlier halving occasions in 2015 and 2019, the typical worth of Litecoin skilled notable surges. These intriguing worth performances have caught crypto analysts’ consideration as a result of they typically base their worth predictions on the block-halving schedule and the corresponding fluctuations within the financial provide.

Although we are able to’t precisely predict the precise worth actions and impacts of future Litecoin halving occasions, understanding the idea of a block halving occasion is important for buyers and people within the Litecoin community and the broader cryptocurrency market.

How Does Halving Work?

In relation to Litecoin’s coin issuance and block reward, the idea of halving works by reducing the variety of Litecoins obtained by miners for efficiently mining a block.

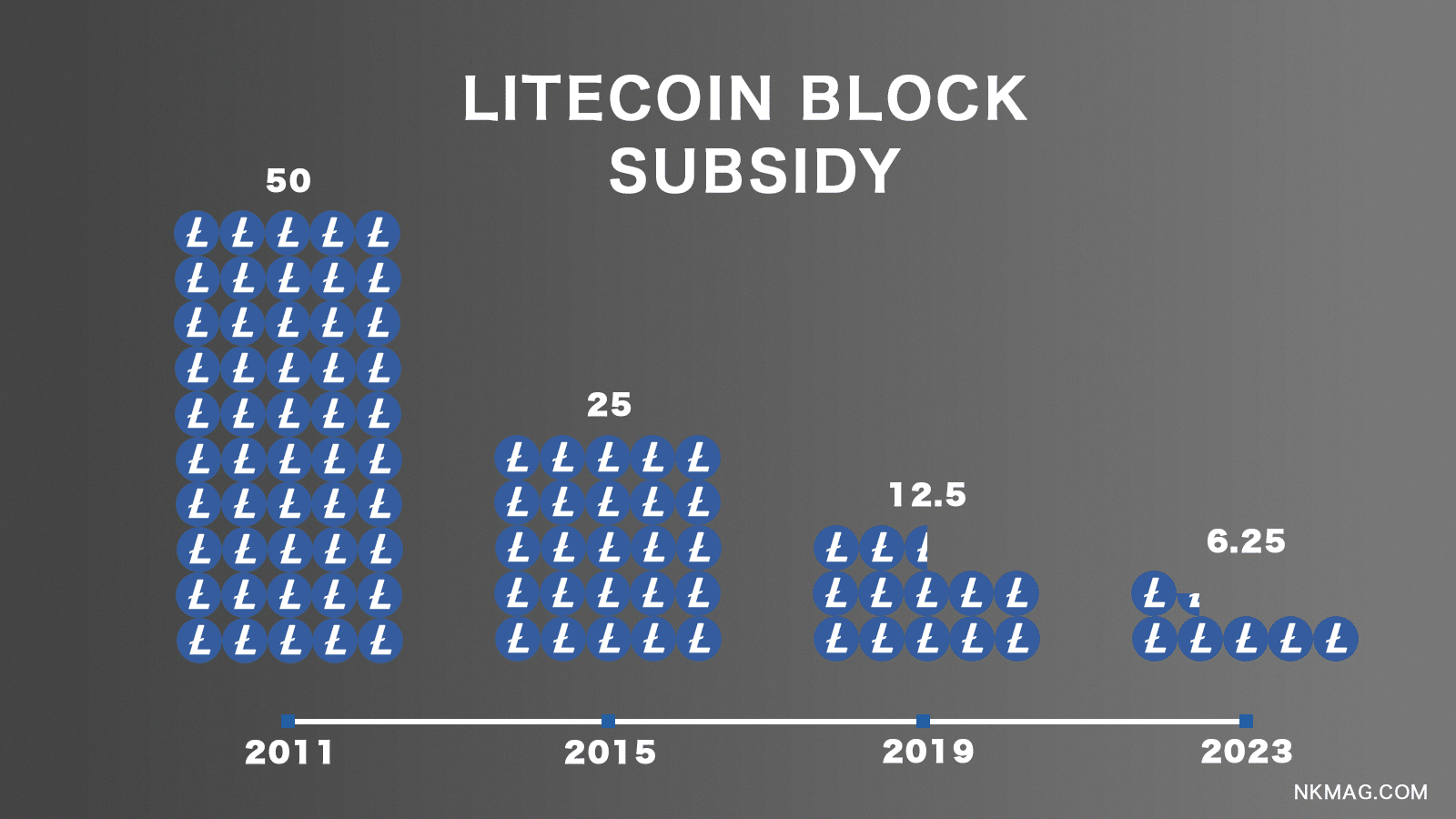

The halving occasion is about to occur roughly each 4 years or after each 840,000 blocks have been mined. This course of helps regulate the inflation price of Litecoin, making certain a finite provide of the cryptocurrency. By diminishing the block reward, the provision of Litecoins stays restricted, which is predicted to spike demand and doubtlessly enhance the worth and market worth of the cryptocurrency.

In 2023, the anticipated Litecoin halving occasion will happen. As of now, the block reward per block is 12.5 Litecoins, however post-halving, it’s going to shrink to six.25 Litecoins per block. This discount within the block reward has traditionally influenced the worth efficiency of Litecoin, typically resulting in appreciable rallies within the common worth of the cryptocurrency.

What Is the Significance of Litecoin Halving?

A Litecoin halving is a crucial occasion within the provide and worth dynamics of the cryptocurrency. By trimming the block reward, Litecoin halvings successfully govern the speed at which new cash are created, preserving shortage and influencing the supply-demand stability.

The halving occasion, recurring each 4 years, lessens the block reward per block. This mechanism ensures a managed provide and limits the inflation price of Litecoin. With a finite provide, Litecoin’s shortage will increase, enhancing its desirability and doubtlessly creating upward worth stress.

Historic information reveals that previous Litecoin halvings have considerably influenced worth efficiency. The block reward discount typically results in rallies within the common worth of the cryptocurrency. Traders and crypto analysts maintain an in depth eye on these occasions, viewing them as potential catalysts of worth motion.

Litecoin halvings underscore the significance of shortage and managed provide within the cryptocurrency market. By sustaining a restricted variety of Litecoins accessible, this occasion can create alternatives for potential worth surges, making Litecoin an interesting funding choice for merchants and fans alike.

Litecoin Halving Dates

The dates of Litecoin halvings are decided by a set variety of blocks mined on the Litecoin blockchain. Programmed into the cryptocurrency’s code, halving occasions are triggered after each 840,000 blocks, which roughly corresponds to a four-year interval. Nevertheless, these dates aren’t actual. They’ll shift barely as a result of dynamic nature of the Litecoin community’s complete computational energy, or hash price. This hash price influences the velocity at which blocks are found, which means the precise date of halving might be considerably earlier or later than predicted. Thus, whereas the Litecoin halving mechanism is about in stone, the precise dates of those occasions stay approximate, their estimations primarily based on common block technology occasions and the predetermined block heights at which halvings happen.

When Was the Final Litecoin Halving?

The final Litecoin halving came about on August 5, 2019. Throughout this occasion, the block reward for miners was decreased from 25 LTC to 12.5 LTC.

Integral to Litecoin’s protocol, halving occasions are designed to regulate the issuance price of latest cash. Crypto analysts and the broader crypto group monitor Litecoin halvings carefully to guage potential worth impacts. Historic information exhibits that important worth rallies typically happen within the months main as much as and following halvings. That is primarily as a result of anticipation of decreased provide and elevated shortage.

This text gives data and discussions associated to the earlier two halving occasions of Litecoin and anticipates the following one. The main points are for informational functions solely and shouldn’t be interpreted as funding recommendation. Whereas we try to supply correct and up-to-date data, we strongly suggest conducting your personal analysis and consulting with a monetary advisor earlier than making any funding choices. The dynamic nature of the cryptocurrency market, together with Litecoin, implies that costs and developments can shift quickly. Consequently, previous efficiency or developments shouldn’t be taken as a assure of future outcomes. All the time make knowledgeable choices and think about your private monetary scenario and threat tolerance.

When Is the Subsequent Litecoin Halving?

Litecoin halvings are programmed to happen roughly each 4 years or after each 840,000 blocks have been mined. The following Litecoin halving is a much-anticipated occasion scheduled for August 2, 2023, at block 2,520,000. It’s important to do not forget that the precise date might shift barely attributable to potential and unforeseeable adjustments within the community’s hash price.

Every halving occasion reduces the block reward, resulting in a gradual lower within the provide of latest Litecoins coming into the market. This scarcity-driven mechanism has the potential to affect the worth of Litecoin, with earlier halvings typically leading to worth rallies. Nonetheless, varied elements comparable to market situations and investor sentiment additionally play a major position in influencing the cryptocurrency’s worth actions across the upcoming halving occasion.

The halving schedule for Litecoin is about in stone, and instantly following the 2023 occasion, buying new Litecoins will grow to be more difficult. On the time of writing, roughly 73.33 million Litecoins out of the overall 84 million have already been mined. This represents about 85% of the overall provide, with the remaining 15% to be distributed at a steadily slower price over the next many years.

Each crypto analysts and the broader crypto group keenly monitor the impacts of halving occasions on worth actions. Traditionally, Litecoin halvings have been adopted by important worth rallies. Whereas previous efficiency isn’t essentially indicative of future outcomes, many speculate that the discount in block rewards might have related results on LTC’s worth throughout this cycle.

Traders striving to make knowledgeable choices consider varied elements, together with market situations, sentiment, and the impact of the halving on provide and demand, to foretell potential worth penalties. Nevertheless, it’s value noting that predicting exact worth actions might be difficult as a result of myriad elements influencing such actions.

In conclusion, the upcoming LTC block reward halving is a key milestone for Litecoin. It can reshape its provide dynamics and doubtlessly affect its worth. Nevertheless, as with all funding choice, conducting thorough analysis and looking for skilled recommendation earlier than making any funding choices is at all times really helpful.

Will Litecoin Halving Enhance Worth?

The upcoming discount in block rewards — a necessary occasion referred to as Litecoin halving — has captured the eye of buyers and crypto analysts. With the discount, the provision of Litecoins will lower, doubtlessly main to cost development. The value of LTC has already surged over 27% because the one-month countdown to the Litecoin halving commenced.

Earlier Litecoin halvings have proven important worth rallies, however it’s vital to do not forget that previous efficiency doesn’t assure future outcomes. Traders trying to make knowledgeable choices ought to think about market situations, sentiment, and different elements, though predicting actual worth actions might be difficult.

Previous Halving Worth Efficiency

Traditionally, Litecoin’s halving occasions have been accompanied by important worth surges and volatility within the cryptocurrency market. The final Litecoin halving occasion occurred in 2019, culminating in a considerable worth enhance of virtually 300%. Through the 2021 bull run, Litecoin reached its peak worth, delivering spectacular returns to buyers who had positioned themselves forward of the halving.

On the time, LTC had discovered resistance at $100. On the day of the halving, LTC peaked at over $105. Nevertheless, after a number of days of volatility, the worth fell beneath $90 inside per week.

Timing trades throughout these worth rallies is essential, as worth actions earlier than and after the halving might be swift and unpredictable.

Over time, Litecoin has proven constant development in worth, making it a pretty funding choice for these trying to diversify their portfolios. Whereas previous efficiency isn’t indicative of future outcomes, understanding the historic sample of worth spikes and volatility surrounding Litecoin’s halving occasions can present invaluable insights for buyers and merchants.

You will discover our Litecoin worth prediction right here.

Litecoin Worth Prediction After Halving

The potential worth motion of Litecoin following a halving occasion has traditionally proven combined developments. Whereas some halvings have resulted in important worth rallies, others have seen extra reasonable and even minimal worth will increase.

Quite a few elements can affect the crypto’s worth motion after the following Litecoin halving occasion, together with market situations, demand, and general cryptocurrency sentiment. It’s prudent to method worth predictions with warning as a result of extremely unstable nature of the cryptocurrency market.

In some instances, market contributors and crypto analysts could anticipate a worth enhance main as much as the halving as a result of the decreased mining rewards create a shortage of latest cash coming into the market. Nevertheless, forecasting actual worth actions isn’t possible as a result of unpredictable nature of the crypto market.

Traders also needs to think about that historic developments could not essentially repeat sooner or later, as market situations and dynamics can change. Thorough analysis and evaluation of market situations, in addition to steering from respected sources, ought to be sought earlier than making any funding choices primarily based on worth predictions.

To sum up, whereas the Litecoin halving could have potential implications for the asset’s worth motion, one ought to carry out due diligence and perceive the dangers concerned in investing in cryptocurrencies.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.