In his newest market evaluation titled “Sugar Excessive”, BitMEX founder Arthur Hayes lists 4 causes to be bullish on Bitcoin and the broader crypto market within the remaining quarter of 2024.

Hayes opens his evaluation with a metaphorical comparability of his snowboarding food plan to the fiscal approaches of main central banks. He likens fast power snacks to short-term financial coverage changes, significantly the rate of interest cuts by the US Federal Reserve, the Financial institution of England, and the European Central Financial institution. These cuts, he argues, are like “sugar highs”—they increase asset costs quickly however should be balanced with extra sustainable monetary insurance policies, akin to “actual meals” in his analogy.

This pivotal financial coverage shift after Federal Reserve Chairman Jerome Powell’s announcement on the Jackson Gap symposium, triggered a constructive response out there, aligning with Hayes’s prediction. He means that the anticipation of decrease charges makes belongings priced in fiat currencies with fastened provides, similar to Bitcoin, extra enticing, therefore boosting their worth. He explains, “Traders imagine that if cash is cheaper, belongings priced in fiat {dollars} of fastened provide ought to rise. I agree.”

Nevertheless, Hayes cautions concerning the potential dangers of a yen carry commerce unwind, which may disrupt the markets. He explains that the anticipated future charge cuts by the Fed, BOE, and ECB may cut back the rate of interest differential between these currencies and the yen, posing a threat of destabilizing monetary markets.

Hayes argues that until actual financial measures, akin to his “actual meals” throughout ski touring, are taken by central banks—particularly increasing their stability sheets and fascinating in quantitative easing—there could possibly be unfavorable repercussions for the market. “If the dollar-yen smashes via 140 on the draw back in brief order, I don’t imagine they may hesitate to offer the “actual meals” that the filthy fiat monetary markets require to exist,” he provides.

Associated Studying

To additional solidify his argument, Hayes references the US economic system’s resilience. He notes that the US has solely skilled two quarters of unfavorable actual GDP progress for the reason that onset of the COVID-19 pandemic, which he argues just isn’t indicative of an economic system that requires additional charge cuts. “Even the newest estimation of 3Q2024 actual GDP is a strong +2.0%. Once more, this isn’t an economic system affected by overly restrictive rates of interest,” Hayes argues.

4 Causes To Be Bullish On Bitcoin In This autumn

This assertion challenges the Fed’s present trajectory in the direction of decreasing charges, suggesting that it is perhaps extra politically motivated somewhat than based mostly on financial necessity. In mild of this, Hayes presents 4 key causes to bullish on Bitcoin and the broader crypto market in This autumn.

1. World Central Financial institution Insurance policies: Hayes highlights the present pattern of main central banks, that are chopping charges to stimulate their economies regardless of ongoing inflation and progress. “Central banks globally, now led by the Fed, are lowering the value of cash. The Fed is chopping charges whereas inflation is above their goal, and the US economic system continues to develop. The BOE and ECB will probably proceed chopping charges at their upcoming conferences,” Hayes writes.

Associated Studying

2. Elevated Greenback Liquidity: The US Treasury, underneath Secretary Janet Yellen, is ready to inject important liquidity into the monetary markets via the issuance of $271 billion in Treasury payments and an extra $30 billion in buybacks. This improve in greenback liquidity, totaling round $301 billion by year-end, is anticipated to maintain monetary markets buoyant and will result in elevated flows into Bitcoin and crypto as traders search increased returns.

3. Strategic Treasury Basic Account Utilization: Roughly $740 billion stays within the US Treasury Basic Account (TGA), which Hayes suggests will probably be strategically deployed to help market circumstances favorable for the present administration. This substantial monetary maneuvering functionality may additional improve market liquidity, not directly benefiting belongings like Bitcoin that thrive in environments of excessive liquidity.

4. Financial institution Of Japan’s Cautious Method To Curiosity Charges: The BOJ’s latest apprehensive stance in the direction of elevating rates of interest, significantly after observing the influence of a minor charge hike on July 31, 2024, indicators a cautious method that may contemplate market reactions intently. This cautiousness, supposed to keep away from destabilizing markets, suggests a world atmosphere the place central banks would possibly prioritize market stability over tightening, which once more bodes nicely for Bitcoin and crypto.

Hayes concludes that the mixture of those elements creates a fertile floor for Bitcoin’s progress. As central banks globally lean in the direction of insurance policies that improve liquidity and cut back the attractiveness of holding fiat currencies, Bitcoin stands out as a finite provide asset that would probably skyrocket in worth.

“Some worry that the Fed chopping charges is a number one indicator of a US and, by extension, developed market recession. That is perhaps true, however […] they may ramp up the cash printer and dramatically improve the cash provide. That results in inflation, which could possibly be unhealthy for sure varieties of companies. However for belongings in finite provide like Bitcoin, it is going to present a visit at lightspeed 2 Da Moon! Hayes states.

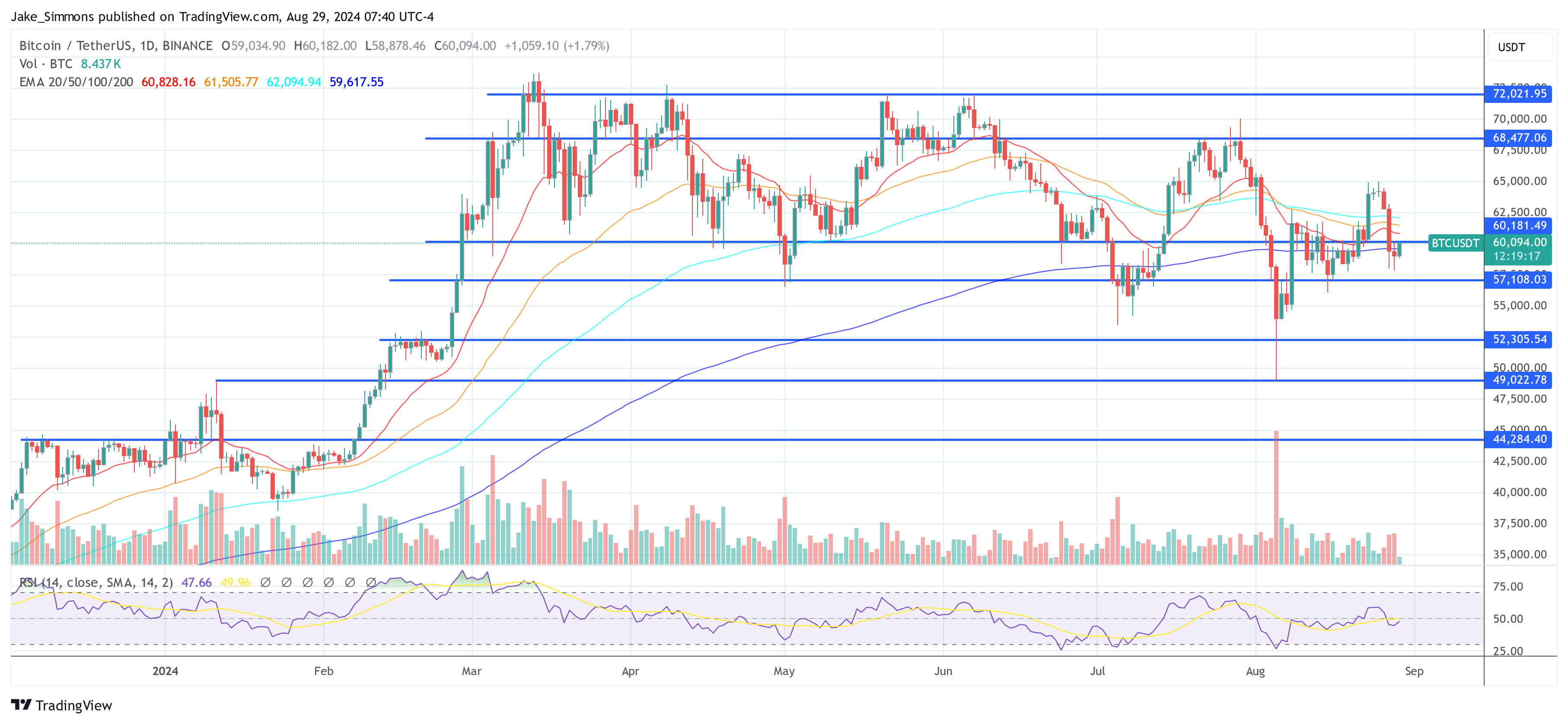

At press time, BTC traded at $60,094.

Featured picture created with DALL.E, chart from TradingView.com