Ethereum (ETH), the world’s second-largest cryptocurrency, is demonstrating strong momentum as its worth levels a resurgence, reclaiming ranges above $2,000.

This bullish pattern beneficial properties traction concurrently with vital developments within the US Securities and Trade Fee (SEC). The regulatory authority is partaking in discussions concerning the potential approval of a spot Ethereum Trade-Traded Fund (ETF).

This pivotal improvement has injected optimism into the Ethereum market, because the prospect of an ETF introduces new potentialities for mainstream adoption and funding, additional fueling the present upward trajectory of Ether’s worth.

Ethereum’s Ascending Triangle: Bullish Breakout Potential

Over the course of a number of months, the worth of Ethereum has been in a consolidation pattern that has resulted within the formation of an ascending triangle. Though the technical formation is bullish by nature, that is solely true following a worthwhile breakout.

Development strains join the equal highs and better lows of the ascending triangle configuration. This association signifies that traders are rising extra assured and shopping for the dips at a quicker tempo.

ETHUSD at the moment buying and selling at $2,066 on the each day chart: TradingView.com

Apparently, at this time’s charts present there are not any “dips” to purchase, as Ethereum broke previous the vaunted $2,000 degree to welcome December on a excessive be aware.

Ethereum shouldn’t be solely maintaining, but in addition rising to unprecedented heights. The worth of ETH is at the moment up 3% at $2,100, and traders and lovers are enthusiastic about the opportunity of a rally to $3,000 and even greater.

Ether’s spectacular success towards Bitcoin, outperforming the alpha cryptocurrency by nearly 5%, is a significant indicator of this. Essential on-chain indicators suggest that ETH could proceed to outperform BTC this month.

Constancy Submitting Fuels Ethereum Optimism

The primary indication of a bullish transfer was a breakout over the psychological $2,000 barrier, though there was a number of see-saw movement round this degree. Extra particularly, ETH is buying and selling between the weekly help degree at $1,930 and the excessive for the second quarter at $2,140. That is the fourth week in a row that this has been taking place.

#Ethereum Spot ETF submitting by Constancy!

Confirms my thesis that after #Bitcoin will get its shine, we’ll see Ethereum working to $3,500 in Q1 2024.

— Michaël van de Poppe (@CryptoMichNL) November 30, 2023

Crypto analyst Michael van de Poppe has voiced his optimism for Ethereum in gentle of the Constancy submitting. Given this submission, he affirms his conviction that after Bitcoin’s speedy enhance, Ethereum is positioned to achieve $3,500 all through the preliminary quarter of 2024.

Supply: Santiment

In a associated improvement, analysis exhibits there was a major enhance in Ethereum whale accumulation. On-chain information signifies that the most important Ethereum wallets, in keeping with Santiment, are exhibiting a constructive sample that implies an enormous change.

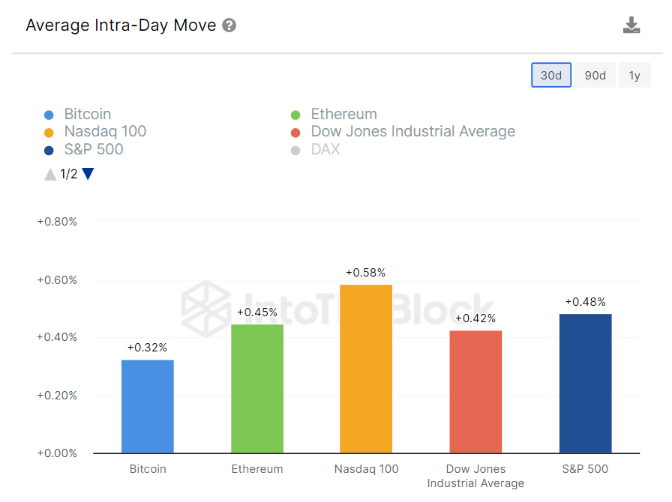

ETH Value Volatility Developments vs. Bitcoin. Supply: IntoTheBlock

In the meantime, Ethereum has a tremendous 30-day Common Intra-Day Volatility rating of 0.45%, surpassing Bitcoin’s 0.32%, a latest analysis by IntoTheBlock exhibits.

Funding methods might have to vary because of this variation in volatility dynamics, which might spotlight the Ethereum market’s dynamic prospects.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from Freepik