Market specialists and technical indicators indicate that XRP may get away in a optimistic means. After a brief rise and retracement, the cryptocurrency has been buying and selling at ranges that point out a break in consolidation.

Associated Studying

On the time of writing, XRP was buying and selling at $0.5149, up 1.1% within the final 24 hours, however sustained a 19.7% drop within the final seven days, knowledge from Coingecko exhibits.

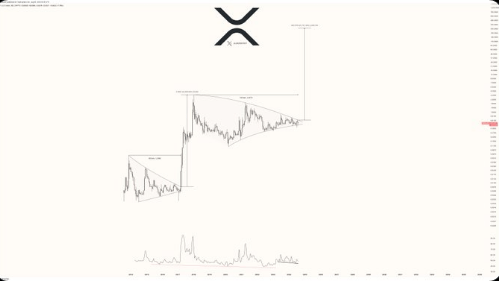

Javon Marks, a crypto analyst, has recognized quite a few vital technical indicators that assist the optimistic outlook for the coin, regardless of it shedding a variety of worth within the weekly body. A symmetrical triangle construction is regularly noticed in his chart evaluation, which is regularly linked to substantial worth will increase.

$XRP just lately broke out briefly which appears to be like to have been solely an tried breakout however, between Value Motion and the RSI, there are patterns nonetheless current by way of bull divergences that may counsel a profitable bullish breakout to be on the horizon!

On a conservative notice,… https://t.co/BCrp9CwT6i pic.twitter.com/XGGiv0nBDp

— JAVON

MARKS (@JavonTM1) August 6, 2024

The MACD and RSI indicators each have ranges that point out a bullish divergence. The resiliency and upward trajectory of XRP are on show in these numbers.

Count on Brief-Time period Positive factors

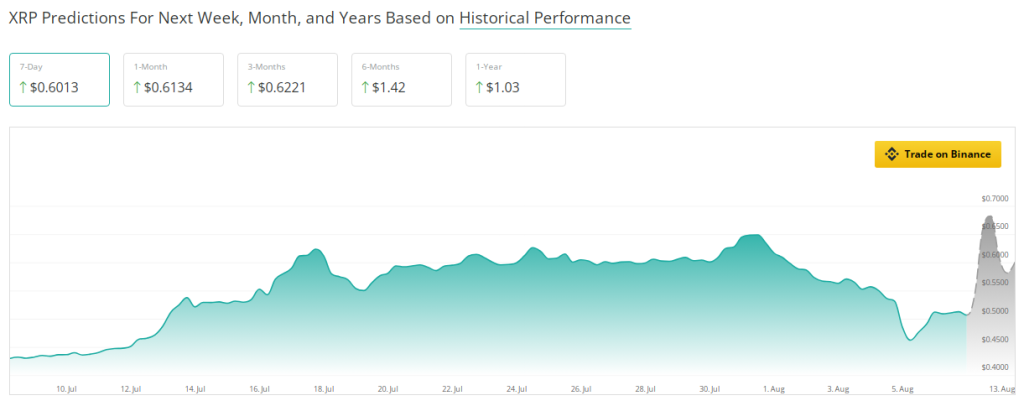

Over the following seven days, XRP is predicted to point out an uptick, indicating a optimistic quick time period perspective. Based mostly on info from the crypto prediction software CoinCheckup, XRP is buying and selling 20.98% under the anticipated worth for the following month proper now. Technical indicators, nonetheless, present a bullish change simply forward.

Rising buying stress and the current worth ranges level to the coin possibly being set to surpass its current resistance ranges. The RSI and MACD each present indications of optimistic momentum, subsequently supporting the likelihood for upward motion. Analysts suppose this may end in a profitable breakout effort, driving XRP to contemporary highs within the not too distant future.

Projected Medium-Time period Development

Trying additional into the close to future, XRP has equally vivid medium-term potential. Reflecting nice market confidence and investor curiosity, CoinCheckup’s research tasks a 22.68% worth rise over the following three months. This predicted enlargement matches rising acceptance of cryptocurrencies and extra normal market patterns.

Based mostly on an intensive investigation, Marks’ symmetrical triangle formation exhibits that XRP possibly getting ready for a notable worth motion. This sample, together with optimistic divergent RSI readings, means that XRP has the flexibility to interrupt out from its current interval of consolidation and go very considerably greater.

XRP: Excessive Value Targets

With a one-year progress estimate of 103.77%, long-term XRP estimates stay fairly optimistic. This steady rise factors to XRP as a helpful altcoin for these in search of each fast earnings and long-term growth. Development projections climb sharply to 180.60% over a six-month interval, subsequently indicating the prospect for vital will increase.

Extra bold projections, together with these from Marks, point out that XRP may even see its worth rise to between $15 and $18, subsequently reflecting an enormous achieve of over 2,101%. Such forecasts depend on technical evaluation patterns and previous market habits which have these days proven massive worth swings.

Associated Studying

Additional driving these will increase are the rising acceptance and integration of the broader cryptocurrency business into standard monetary establishments.

The liquidity and buying and selling quantity for XRP are projected to extend as institutional traders and large-scale merchants turn into extra engaged, thereby possibly driving much more notable worth swings.

These metrics emphasizes XRP’s transformative energy within the altering digital asset scene in addition to its attraction as a high-reward funding chance.

Featured picture from Pexels, chart from TradingView