Amid ongoing market reversal, Floki (FLOKI) the favored meme coin is poised for a big upside rally probably on account of its current breakout and bullish on-chain metrics. On September 24, 2024, the meme coin skilled a powerful worth surge ensuing within the breakout of a vital resistance degree of $0.000137.

Present Worth Momentum

At press time, FLOKI is buying and selling close to $0.000141 and has skilled a worth surge of over 6.4% previously 24 hours. Throughout the identical interval, traders and merchants have proven robust curiosity. In response to CoinMarketCap information, FLOKI’s buying and selling quantity has skyrocketed by 35%, indicating larger participation from merchants and traders following its current breakout.

FLOKI Technical Evaluation and Upcoming Ranges

In response to CoinPedia’s technical evaluation, FLOKI seems bullish regardless of buying and selling beneath the 200 Exponential Transferring Common (EMA) on a each day timeframe, seemingly as a result of breakout from each the consolidation zone and the resistance degree of $0.000137.

The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an uptrend or downtrend. To substantiate this breakout, FLOKI wants to shut its each day candle above the $0.000142 degree.

Based mostly on the historic worth momentum, with the current breakout, there’s a robust chance that the FLOKI worth might soar by 45% to achieve the $0.00021 degree within the coming days. Nonetheless, the meme coin could face a hurdle on the $0.00016 degree throughout its upcoming rally.

Bullish On-chain Metrics

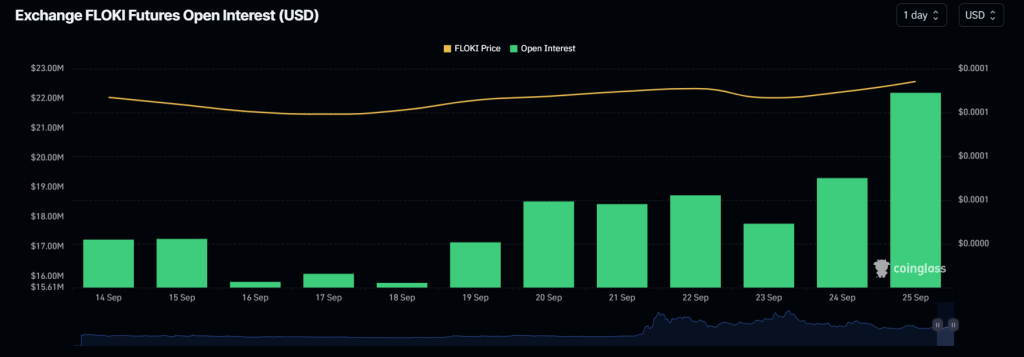

This bullish outlook is additional supported by on-chain metrics. In response to the on-chain analytics agency Coinglass, FLOKI’s lengthy/quick ratio presently stands at 1.238, indicating robust bullish market sentiment amongst merchants. Moreover, its future open curiosity has skyrocketed by 17% over the previous 24 hours and 4.9% over the previous 4 hours.

This rising open curiosity signifies that merchants and traders are probably making massive bets on lengthy positions. At the moment, 55.33% of high merchants maintain lengthy positions, whereas 44.67% maintain quick positions.