The current flash crash of Bitcoin from over $45,500 to as little as $41,100 has despatched shockwaves all through the crypto neighborhood, sparking debate over the underlying causes. Whereas some have attributed the crash to unconfirmed rumors that the US Securities and Alternate Fee (SEC) may, in any case, not approve Bitcoin ETFs in January, The Wolf Of All Streets on X suggests a special rationalization.

Blame The Excessive Funding Fee For The BTC Crash

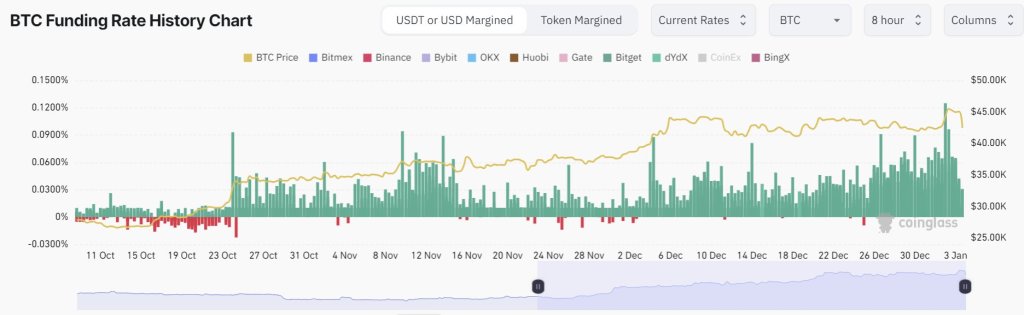

The analyst factors to the ultra-high optimistic funding fee on perpetual futures contracts as the first offender. In crypto perpetual buying and selling, the funding fee is a mechanism that adjusts the worth of futures contracts to mirror the distinction within the spot value of the underlying asset, on this case, Bitcoin.

In current months, the funding fee, in response to Coinglass, had surged to multi-month highs, reaching an annualized fee of 66% on January 2, as The Wolf Of All Streets famous, earlier than at this time’s crash.

With Bitcoin trending larger, a big inflow of lengthy positions on Bitcoin’s perpetual futures contracts drove the funding fee to month-to-month highs. Increasing Bitcoin costs created an imbalance out there, with extra folks paying to be lengthy than brief. Consequently, when the worth of Bitcoin started to say no quickly, exchanges needed to unwind lengthy positions, triggering a wave of liquidation.

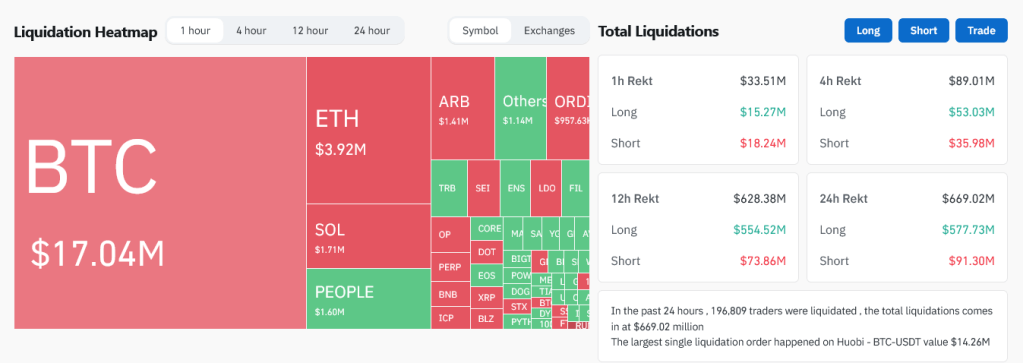

As of January 3, information from Coinglass present that over $669 million had been liquidated. Most of those positions had been lengthy, at round $577 million, with solely roughly $91 million being shorts. Total, OKX closed essentially the most positions with $292 million longs closed. Binance, Huobi, and Bybit additionally closed many lengthy positions.

Will Bitcoin Degens Arrest The Promote-Off?

In keeping with The Wolf Of All Streets, the current flash crash was not a pure market occasion however an intentional transfer orchestrated by “degens.” Based mostly on the analyst, the unusually excessive funding fee as of early January 3 created a scenario the place lengthy positions, amplified by leverage, needed to be liquidated for equilibrium to be reinstated within the Bitcoin market.

The analyst’s feedback echo these of different market observers who’ve warned of the potential for blow-ups within the perpetual futures market because of the excessive leverage and funding charges concerned. These warnings have turn into extra vital in gentle of the current flash crash.

How costs will react going ahead is unclear. Nevertheless, what’s clear is that bears look like in management within the brief time period. The current sell-off is behind excessive buying and selling quantity that will see the coin monitor decrease, in the direction of $38,000 or decrease, within the coming classes.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal danger.