Actual Imaginative and prescient CEO Raoul Pal says that Solana (SOL) is prone to maintain its uptrend in opposition to its sensible contract rival Ethereum (ETH).

In a brand new weblog publish, the previous Goldman Sachs govt says that he’s retaining an in depth watch on the Solana versus Ethereum (SOL/ETH) pair.

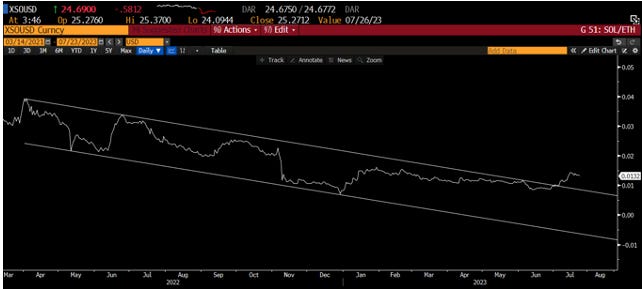

In line with Pal, he sees Solana outperforming Ethereum after the pair broke out from a descending channel.

“Lastly, SOL is up over 30% on the month (+150% year-to-date!) and has damaged the downtrend versus ETH. That is one thing that we’ve been anticipating for some time now and we predict this pattern will proceed increased.”

Solana is buying and selling for $23.25 at time of writing, down over 5% over the last 24 hours.

In a brand new technique session, the macro guru says that he believes the broader crypto markets are prone to outperform different asset courses within the present cycle, citing wider world adoption and continued fiat foreign money debasement.

Pal additionally says that the approval of a spot-based Bitcoin (BTC) exchange-traded fund (ETF) will possible push the crypto markets to better heights.

“[Crypto] outperforms every little thing in this sort of cycle. Like, expertise, it’s pushed by the debasement of central banks, of the fiat foreign money market, notably the world’s reserve foreign money of the greenback, however all of them collectively actually.

And as well as, it’s pushed by the secular pattern. The adoption pattern of crypto is big. It’s now 421 million wallets. It retains going up each single 12 months. Even final 12 months in a bear market, it grew 40%. So within the coming years, we are going to most likely get that quantity as much as a billion fairly quick.

So we’ve acquired an enormous change to come back. The continuing adoption. We’ve acquired central financial institution digital currencies to come back which is, whether or not you prefer it or not, nonetheless an adoption of blockchain applied sciences.

We even have funds rails and all of that form of factor happening. Plus persons are taking a look at tokenizing asset costs like bonds and stuff like that. So the monetary world is shifting onto blockchain, which is a core thesis of mine.

Along with that, we’ve now the onramps for the typical punter which is the ETF. I feel ARK (Make investments) will get the primary one throughout on August thirteenth, 18th or no matter it’s. That can open the floodgates. I feel costs might be rising into that anyway, my forecast forwards to a lot increased costs anyway.”

I

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses chances are you’ll incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney