Fast Take

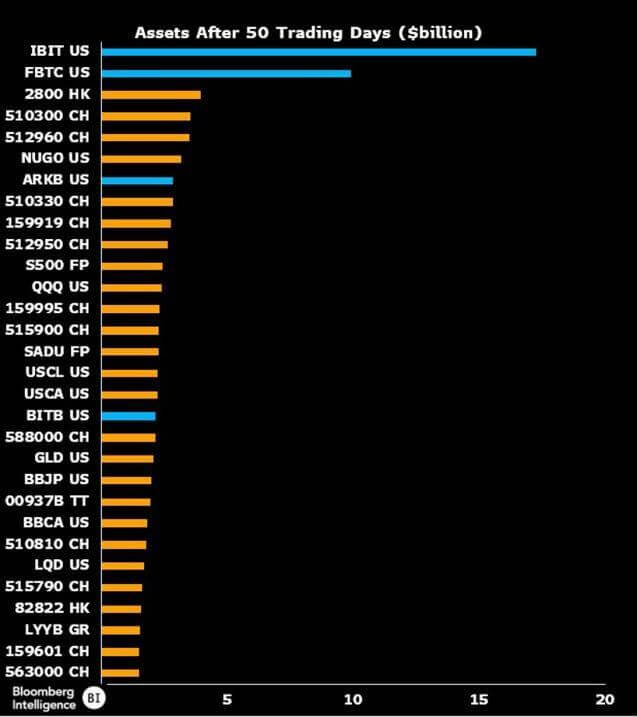

Eric Balchunas, a Senior ETF Analyst at Bloomberg, has compiled a chart showcasing the High 30 ETFs by property gathered of their preliminary 50 days of buying and selling.

This spectacular lineup is chosen from an enormous pool of 11,338 ETFs worldwide and consists of 4 Bitcoin ETFs among the many frontrunners. Notably, the BlackRock IBIT and Constancy FBTC ETFs have distinguished themselves by way of their asset gathering, in keeping with Balchunas.

Furthermore, the Bitwise BITB ETF has achieved a milestone by outperforming the established GLD gold ETF, whereas ARKB has secured the seventh spot within the rankings.

Balchunas has famous that even adjusting for inflation, the efficiency of Bitcoin ETFs, and IBIT particularly, has been distinctive, describing it as a “blowout.”

The chart additionally consists of different comparatively new ETFs like NUGO, which began in September 2021 and has claimed the sixth spot, in addition to BBJP and USCL. The Invesco QQQ ETF, mirroring the Nasdaq-100 index, has secured the twelfth place, highlighting the sturdy entrance of those Bitcoin ETFs right into a dynamic funding sphere.

The submit 4 Bitcoin ETFs safe high spots in Bloomberg’s international ETF asset race appeared first on CryptoSlate.