Wave and FreshBooks are two of probably the most noteworthy accounting software program choices for small companies. Wave Accounting’s utterly free software program plan lets small-business homeowners — particularly self-employed freelancers — monitor their funds, ship invoices and receives a commission for gratis. FreshBooks, which begins at $19 a month, has extra expansive invoicing options and a number of plans that scale as much as assist rising and midsize companies.

Nevertheless, FreshBooks can work properly for some self-employed freelancers, and Wave Accounting’s options may very well be preferrred for some small and midsize companies. In our FreshBooks vs. Wave assessment beneath, we evaluate every software program’s professionals, cons, pricing and options that can assist you hone in on the fitting possibility on your wants.

1

QuickBooks

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Giant (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff), Small (50-249 Staff), Medium (250-999 Staff), Giant (1,000-4,999 Staff)

Micro, Small, Medium, Giant

Options

API, Common Ledger, Stock Administration

2

Acumatica Cloud ERP

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Giant (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff), Small (50-249 Staff), Medium (250-999 Staff), Giant (1,000-4,999 Staff)

Micro, Small, Medium, Giant

Options

Accounts Receivable/Payable, API, Departmental Accounting, and extra

FreshBooks vs. Wave Accounting: Comparability desk

Wave and FreshBooks deal with the identical fundamental bookkeeping duties, from invoicing and billing to expense monitoring and past. Though they have been constructed for several types of enterprise homeowners (Wave for freelancers, FreshBooks for different small companies), each accounting instruments exit of their solution to cater to non-accountant enterprise homeowners.

Nevertheless, the 2 instruments differ by way of how a lot they value, what number of automations they provide and which third-party apps they sync with for essential duties like payroll and time monitoring.

| Function | FreshBooks | Wave Accounting |

|---|---|---|

| Our score | 4.1 out of 5 | 4.0 out of 5 |

| Beginning worth | $19 per 30 days | $0 per 30 days |

| Time and undertaking monitoring | Sure | No |

| Stock monitoring | Restricted | No |

| Person limits | Limitless (additional price) | Limitless (with paid plan solely) |

| Payroll integration | Gusto, SurePayroll by Paychex | Wave Payroll |

| Different third-party integrations | 100+ | Via Zapier solely |

Plan and pricing knowledge verified as of 5/22/2024.

FreshBooks vs. Wave Accounting: Pricing

FreshBooks pricing and plans

Beginning worth: $19/mo.

FreshBooks’ 4 plans have pretty industry-standard pricing. Their options vary from fundamental invoicing and accounting to enterprise-level monetary reporting:

- FreshBooks Lite prices $19 per 30 days and consists of limitless expense, revenue and gross sales tax monitoring.

- FreshBooks Plus prices $33 per 30 days and consists of process automations, extra thorough accounting stories and double-entry bookkeeping.

- FreshBooks Premium prices $60 per 30 days and consists of revenue monitoring, invoice administration and extra bill customizations.

- FreshBooks Choose is a customized plan for enterprises that requires a customized quote.

FreshBooks runs frequent gross sales all year long, providing new customers reductions as deep as 50% off for as much as six months. Companies also can make the most of a ten% low cost in the event that they pay yearly slightly than month to month.

Get extra data on FreshBooks by studying our detailed FreshBooks assessment.

Wave Accounting pricing and plans

Beginning worth: $0/mo.

Till just lately, Wave Accounting supplied free accounting software program solely. As of early 2024, nonetheless, the corporate has launched a (comparatively) reasonably priced paid plan that small companies can scale as much as as they develop. The 2 plans break down as follows:

- Wave Starter is free for all times. It consists of limitless invoices, payments, estimates and bookkeeping data in addition to on-line cost acceptance and money stream monitoring.

- Wave Professional prices $16 per 30 days billed month-to-month or $170 a yr billed yearly. It consists of reductions for transaction charges, limitless receipt scanning, expense monitoring and computerized financial institution reconciliation.

Cell receipt scanning, which permits app-based scanning so you may retailer and categorize receipts, is out there to Wave Starter customers for an extra price of $11 per 30 days (billed month-to-month) or $96 per yr (billed yearly).

In the meantime, Wave Payroll begins at $20/month + $6/worker for self-service payroll or $40/month + $6/worker for full-service payroll.

Be taught extra about how Wave works by studying our complete Wave Accounting assessment.

Function comparability: FreshBooks vs. Wave Accounting

Monetary monitoring

Winner: Wave Accounting

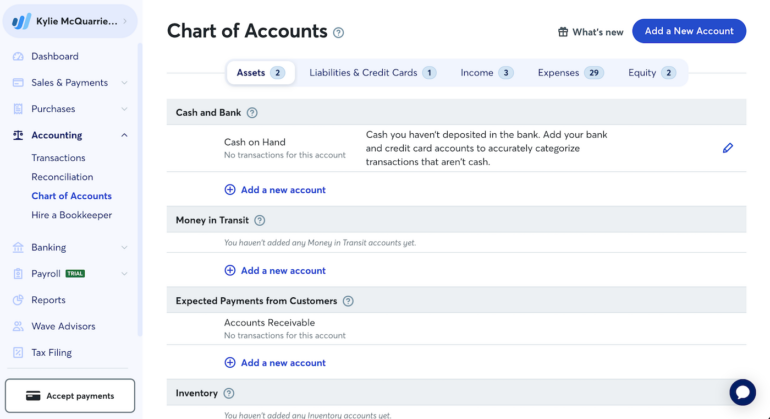

Each Wave and FreshBooks assist you to hold an in depth eye in your funds by way of revenue and expense monitoring. When you join your enterprise financial institution accounts and bank cards together with your most well-liked software program, Wave (with the paid plan) or FreshBooks (with all plans) routinely pull in transaction knowledge to maintain you updated in your funds.

Nevertheless, FreshBooks’ least expensive plan depends on the single-entry accounting system, which is much less correct than the extra extensively accepted double-entry system. And in contrast to practically each different accounting competitor, FreshBooks doesn’t embody free accountant entry with its least expensive plan both.

By means of comparability, Wave Accounting, Xero, QuickBooks On-line and most different accounting software program companies routinely default to double-entry accounting. All of those rivals embody accountant entry with each plan, even plans that in any other case restrict you to at least one consumer solely.

Invoicing

Winner: FreshBooks

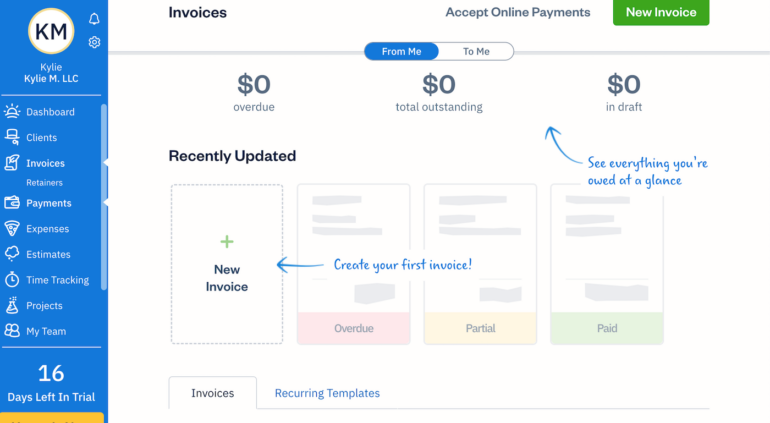

Each Wave and FreshBooks have glorious bill templates which can be straightforward to customise and ship to shoppers. Each accounting merchandise allow you to settle for funds throughout the bill, arrange computerized recurring invoices and ship cost deadline reminders.

Nevertheless, FreshBooks has a number of extra invoicing options than Wave. As an illustration, with FreshBooks, you may connect bills to your invoices for reimbursement, sync time-tracking knowledge to every bill, schedule computerized late cost prices and join together with your prospects by way of FreshBooks’ shopper self-service portal.

Wave Accounting wins huge over FreshBooks in a single key space: Really limitless invoicing. Whereas FreshBooks helps you to ship an infinite quantity of invoices every month, it limits the variety of shoppers you may ship these invoices to.

| Plan identify | FreshBooks Lite | FreshBooks Plus | FreshBooks Premium | FreshBooks Choose |

|---|---|---|---|---|

| Billable shoppers per 30 days | As much as 5 | As much as 50 | Limitless | Limitless |

Plan knowledge correct as of 1/24/2024.

Person limits

Winner: Wave Accounting

Technically, each Wave Accounting and FreshBooks allow you to add limitless customers to your account. Nevertheless, Wave Accounting helps you to accomplish that at no further value whereas FreshBooks prices a per-user price. (Word that further customers are solely accessible with Wave’s paid plan. The free plan limits you to at least one consumer solely.)

Three of FreshBooks’ 4 plans embody entry for only one consumer within the base value. (The enterprise-level accounting plan consists of two customers within the base value.) When you can add as many customers as you need, you’ll pay an additional month-to-month price of $11 per particular person — a price that may add up quick.

In order for you a number of eyes in your accounts with out paying additional, Xero has limitless customers. Zoho Books prices simply $3 per 30 days per additional consumer, and QuickBooks On-line provides entry for as much as 25 customers (relying on which plan you select).

Time monitoring

Winner: FreshBooks

Wave Accounting doesn’t have a built-in time-tracking software, though you need to use Zapier to combine third-party apps like Well timed with Wave. (Word that Wave Payroll doesn’t embody built-in time monitoring both.)

FreshBooks, in distinction, has a superb time-tracking function constructed into each plan. It’s straightforward to trace time (for your self or for any 1099 contractors you’re employed with), then sync that point to your shopper’s bill so that you will be paid precisely on your time.

Payroll integration

Winner: FreshBooks

Wave Accounting’s solely built-in integration is with its payroll product, Wave Payroll. And whereas Wave Payroll is completely serviceable, that’s about all it’s. The software program consists of solely fundamental payroll options like paycheck calculation, direct deposit, entry to at least one payroll report and end-of-year W-2 type era.

Moreover, Wave Payroll’s full-service plan, which calculates and remits payroll taxes in your behalf, is restricted to 14 states. Purchasers in all different states should use Wave Payroll’s self-service plan, which prices much less however requires you to file payroll taxes by yourself.

In distinction, FreshBooks syncs with Gusto and SurePayroll by Paychex, two of probably the most totally featured payroll options for small companies within the U.S. (FreshBooks additionally has built-in payroll integrations for its software program customers in Canada, the U.Ok. and Australia.) Gusto is a full-service payroll supplier solely whereas SurePayroll by Paychex has each a self-service and full-service plan.

Not like Wave Payroll, Gusto and SurePayroll by Paychex may help you discover healthcare and different advantages on your workers (although with Gusto, medical insurance is out there in solely 38 states and D.C.). Each suppliers even have extra HR instruments than Wave, together with new-hire reporting and fundamental onboarding options.

Customer support

Winner: FreshBooks

With Wave’s free plan, buyer assist is restricted to Wave’s chatbot and on-line useful resource middle. Professional plan customers can entry dwell customer support throughout enterprise hours on weekdays, however assist is restricted to e mail and dwell chat solely. Cellphone-based buyer assist isn’t accessible with any Wave Accounting or Wave Payroll plan.

In distinction, FreshBooks has a sturdy on-line useful resource library and a fundamental troubleshooting chatbot. Most significantly, it additionally has e mail and cellphone assist. You’ll be able to request assist straight out of your FreshBooks dashboard, which incorporates fast hyperlinks to the FreshBooks assist middle.

FreshBooks professionals and cons

Execs

- Glorious bill options, customizations and automations.

- Person-friendly interface and cellular app.

- Responsive customer support with a number of strategies of contact.

- 100+ third-party integrations, together with Gusto and SurePayroll by Paychex.

- Constructed-in undertaking administration, time monitoring and expense monitoring.

Cons

- Far fewer third-party integrations than most rivals (particularly Xero and QuickBooks).

- Excessive price for added customers.

- No accountant entry or double-entry accounting with fundamental plan.

- Restricted stock administration options.

- Billable shoppers restricted by plan.

Wave Accounting professionals and cons

Execs

- Fully free accounting software program plan.

- Double-entry accounting with normal ledger and chart of accounts.

- Easy Wave Payroll integration.

- Limitless customers, checking account syncing and enterprise administration (with paid plan).

- Clear, easy setup directions with user-friendly interface.

Cons

- Third-party app integrations via Zapier solely (subscription required).

- Restricted email-only customer support.

- Restricted accounting options.

Ought to your enterprise use FreshBooks or Wave Accounting?

When you ought to at all times take your enterprise’s distinctive wants into consideration when selecting an accounting software program supplier, we suggest following these normal tips.

Select FreshBooks if:

- You run a service-based freelancing enterprise and cost shoppers by time or undertaking.

- You need a simple solution to collaborate with shoppers on undertaking prices.

- You need accounting software program that provides barely greater than the fundamentals with out getting slowed down in overly advanced options.

- Your organization is rising however you don’t plan to turn into a midsize enterprise or giant company.

Select Wave Accounting if:

- You’re a freelancer, solopreneur, self-employed contractor or a small-business proprietor with a handful of workers.

- You need user-friendly software program that permits you to cost prospects and handle your funds for gratis.

- You want fundamental accounting instruments solely, comparable to revenue monitoring, on-line cost acceptance, expense monitoring and invoicing.

- You don’t depend on many third-party apps to handle your enterprise.

In case you don’t assume both Wave or FreshBooks will give you the results you want, there are dozens extra accounting software program choices to select from, beginning with these:

- QuickBooks On-line begins at $30 a month and has extra accounting options than both FreshBooks or Wave.

- Xero begins at $15 a month and consists of limitless customers and stock monitoring with each plan.

- Zoho Books prices nothing for companies with an annual income >$50K USD. Its plans embody at the least as many options as QuickBooks On-line, if no more.

Lastly, even for those who’re fairly certain you’ve discovered the fitting accounting product for your enterprise, we suggest taking it out for a test-drive first. All of the merchandise on this record are free (like Wave Accounting), supply a free plan (Zoho Books) or embody a 30-day free trial (QuickBooks, Xero and FreshBooks).

Organising a free account is the best first step towards discovering accounting software program that can assist you to meet — and even exceed — your monetary targets.

Methodology

To check Wave Accounting vs. FreshBooks, we created free accounts with each companies so we may take a look at every software’s user-friendliness, options, and cellular apps. We considered demos and product specs on each rivals’ websites. We additionally thought-about opinions from verified customers on third-party websites (the BBB, the App Retailer and Google Play, amongst others) to attract conclusions about general buyer satisfaction, customer support responsiveness and extra.

To information our analysis, we centered particularly on how every software program resolution excelled or fell quick within the following areas:

- General accounting and bookkeeping options.

- Pricing and plans.

- General buyer satisfaction and firm repute.

- Person-friendliness and accessibility, together with ease of setup and entry to cellular apps.

- Integration with different software program, particularly third-party payroll suppliers.