The next is a visitor article from Vincent Maliepaard, Advertising Director at IntoTheBlock.

Staking

Staking is a basic yield era technique in DeFi. It entails locking a blockchain’s native tokens to safe the community and validate transactions, incomes rewards in transaction charges and extra token emissions.

The rewards from staking fluctuate with community exercise—the upper the transaction quantity, the better the rewards. Nonetheless, stakers should be conscious of dangers reminiscent of token devaluation and network-specific vulnerabilities. Staking, whereas typically steady, requires an intensive understanding of the underlying blockchain’s dynamics and potential dangers.

For instance, some protocols, like Cosmos, require a selected unlock interval for stakers. Because of this whenever you’re withdrawing your belongings from staking, you received’t be capable to really transfer your belongings for a 21-day interval. Throughout this time, you might be nonetheless topic to cost fluctuations and may’t use your belongings for different yield methods.

Liquidity Offering

Liquidity offering is one other methodology of producing yield in DeFi. Liquidity suppliers (LPs) normally contribute an equal worth of two belongings to a liquidity pool on decentralized exchanges (DEXs). LPs earn charges from every commerce executed throughout the pool. The returns from this technique rely on buying and selling volumes and payment tiers.

Excessive-volume swimming pools can generate substantial charges, however LPs should concentrate on the chance of impermanent loss, which happens when the worth of belongings within the pool diverges. To mitigate this danger, buyers can select steady swimming pools with extremely correlated belongings, guaranteeing extra constant returns.

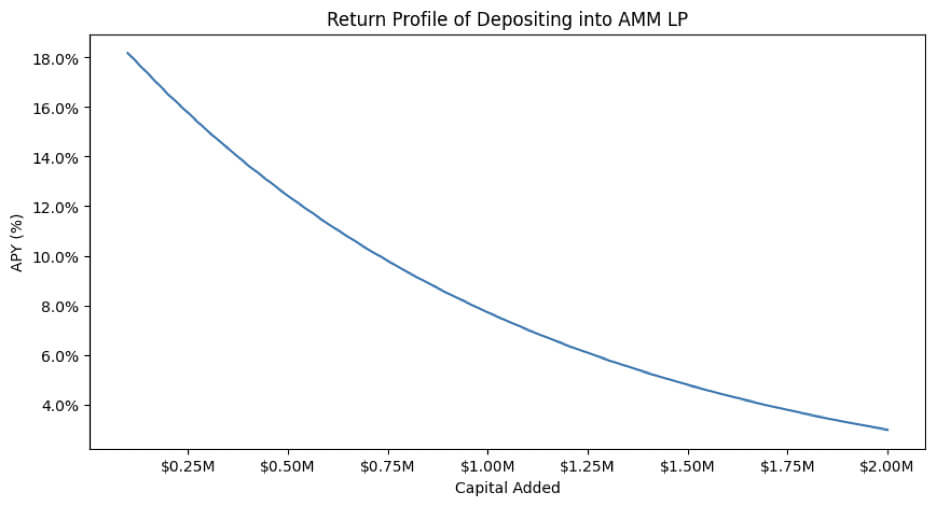

It’s also essential to do not forget that the projected returns from this technique are straight depending on the full liquidity within the pool. In different phrases, as extra liquidity enters the pool, the anticipated reward decreases.

Lending

Lending protocols supply an easy but efficient yield-generation methodology. Customers deposit belongings, which others can borrow in change for paying curiosity. The rates of interest differ based mostly on the availability and demand for the asset.

Excessive borrowing demand will increase yields for lenders, making this a profitable choice throughout bullish market situations. Nonetheless, lenders should think about liquidity dangers and potential defaults. Monitoring market situations and using platforms with robust liquidity buffers can mitigate these dangers.

Airdrops and Factors Techniques

Protocols typically use airdrops to distribute tokens to early customers or those that meet particular standards. Extra not too long ago, factors programs have emerged as a brand new manner to make sure these airdrops go to precise customers and contributors of a selected protocol. The idea is that particular behaviors reward customers with factors, and these factors correlate to a selected allocation within the airdrop.

Making swaps on a DEX, offering liquidity, borrowing capital, and even simply utilizing a dApp are all actions that may typically earn you factors. Factors programs present transparency however are under no circumstances a fool-proof manner of incomes returns. For instance, the latest Eigenlayer airdrop was restricted to customers from particular geographical areas and tokens have been locked upon the token era occasion, sparking debate among the many neighborhood.

Leverage in Yield methods

Leverage can be utilized in yield methods like staking and lending to optimize returns. Whereas this will increase returns, it additionally will increase the complexity of a technique, and thus its dangers. Let’s have a look at how this works in a selected scenario: lending.

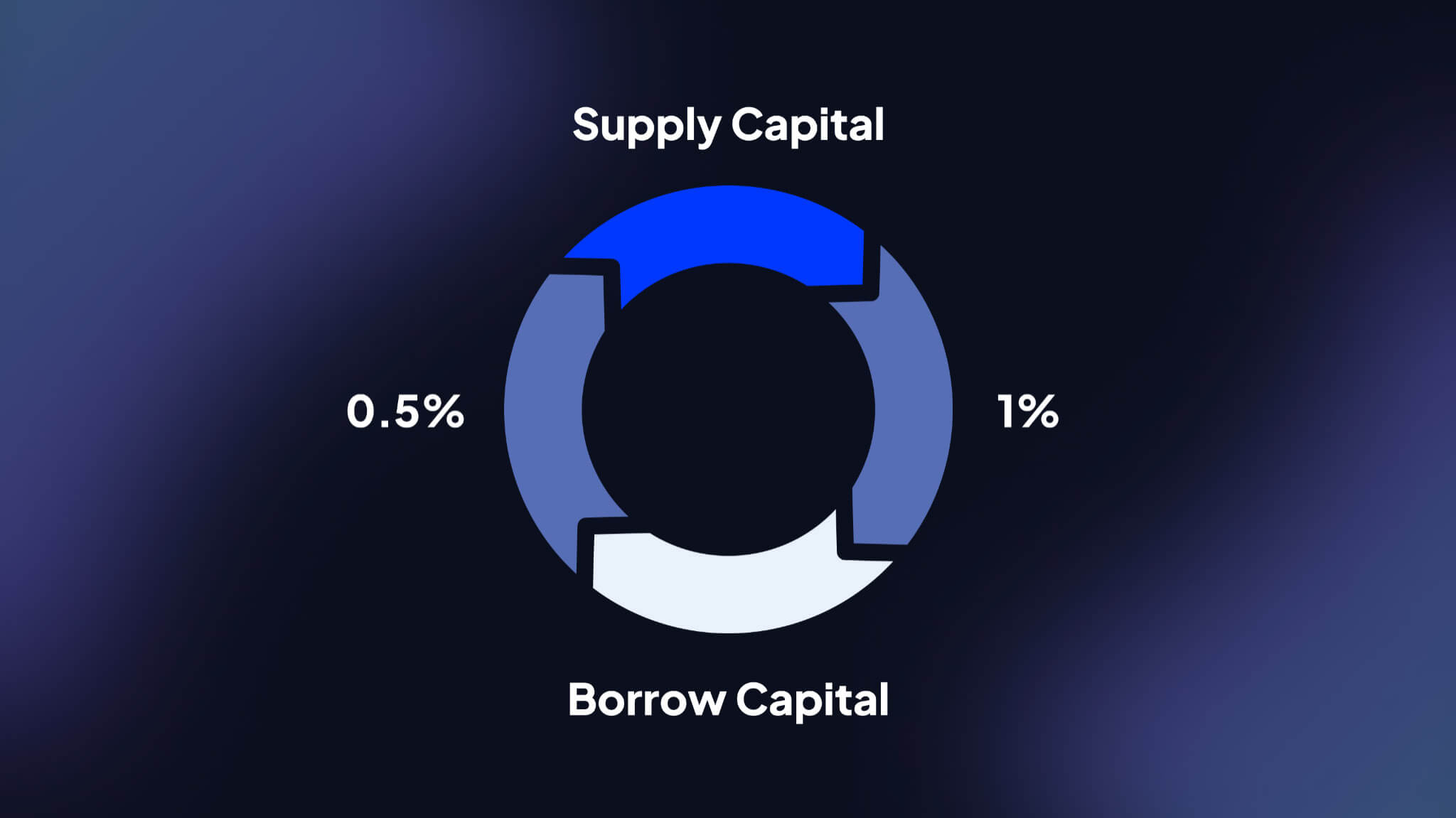

Recursive lending capitalizes on incentive constructions inside DeFi lending protocols. It entails repeated lending and borrowing of the identical asset to accrue rewards supplied by a platform, considerably enhancing the general yield.

Right here’s the way it works:

- Asset Provide: Initially, an asset is equipped to a lending protocol that gives greater rewards for supplying than the prices related to borrowing.

- Borrow and Re-Provide: The identical asset is then borrowed and re-supplied, making a loop that will increase the preliminary stake and the corresponding returns.

- Incentive Seize: As every loop is accomplished, extra governance tokens or different incentives are earned, growing the full APY.

For instance, on platforms like Moonwell, this technique can remodel a provide APY of 1% to an efficient APY of 6.5% as soon as extra rewards are built-in. Nonetheless, the technique entails important dangers, reminiscent of rate of interest fluctuations and liquidation danger, which require steady monitoring and administration. This makes methods like this yet another appropriate for institutional DeFi members.

The way forward for DeFi & Yield Alternatives

Till 2023, DeFi and conventional finance (TradFi) operated as separate silos. Nonetheless, growing treasury charges in 2023 spurred a requirement for integration between DeFi and TradFi, resulting in a wave of protocols getting into the “real-world asset” (RWA) house. Actual-world belongings have primarily supplied treasury yields on-chain, however new use circumstances are rising that leverage blockchain’s distinctive traits.

For instance, on-chain belongings like sDAI make accessing treasury yields simpler. Main monetary establishments like BlackRock are additionally getting into the on-chain financial system. Blackrock’s BUIDL fund, providing treasury yields on-chain, amassed over $450 million in deposits inside just a few months of launching. This means that the way forward for finance is more likely to change into more and more on-chain, with centralized firms deciding whether or not to supply providers on decentralized protocols or by permissioned paths like KYC.

This text is predicated on IntoTheBlock’s most up-to-date analysis paper on institutional DeFi. You may learn the total report right here.