FTX CEO John Ray III Dec. 13 testimony to the U.S. Congress revealed that the bankrupt change commingled property and saved wallets’ non-public keys with out encryption.

In keeping with Ray, FTX’s collapse was brought on by the failure of company controls — the worst he has seen in his over 40 years of dealing with chapter instances. He famous that FTX’s operation was concentrated within the arms of a “very small group of grossly inexperienced and unsophisticated people” who did not implement the type of management mandatory for a corporation holding different folks’s cash.

SBF arrested

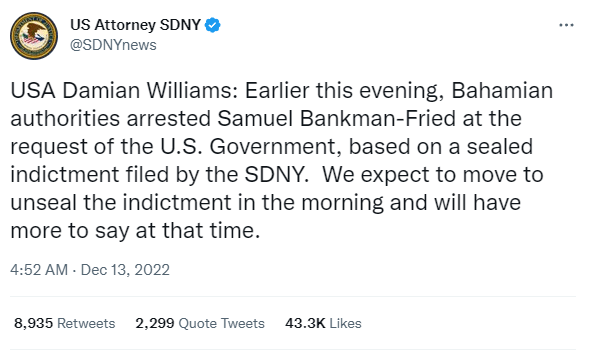

Earlier within the day, FTX co-founder Sam Bankman-Fried was arrested within the Bahamas on the orders of the U.S. authorities. A Dec. 12 press assertion by the Bahamas Lawyer Basic revealed that the U.S. authorities had filed felony expenses towards SBF and is prone to request extradition.

The U.S. Lawyer for the Southern District of New York, Damian Williams, confirmed the event. Williams stated SBF “was arrested on the request of the U.S. Authorities, primarily based on a sealed indictment filed by the SDNY.”

The unacceptable administration practices at FTX

Ray’s testimony listed eight unacceptable administration practices at FTX group. These included the commingling of property, absence of audited monetary statements, absence of unbiased governance, and lack of personnel to deal with monetary and danger administration.

Moreover, the bankrupt change’s senior administration had entry to shopper funds, they didn’t correctly doc FTX investments, and Alameda had entry to borrowing with out restrict.

Alameda’s position in FTX collapse

Ray additionally highlighted Alameda’s position within the collapse of the bankrupt change. In keeping with the CEO, FTX commingled customers’ property with Alameda’s buying and selling platform.

Aside from that, Alameda borrowed clients’ property held at FTX with out limits -these funds had been used for margin buying and selling and resulted in big losses.

Additionally, Alameda deployed “funds to varied third celebration exchanges which had been inherently unsafe, and additional exacerbated by the restricted protections provided in sure international jurisdictions.”

FTX went on a $5B “spending binge”

The testimony additional revealed that FTX went on a $5 billion spending binge between late 2021 and 2022. Throughout this era, Ray stated the corporate purchased and invested in a number of firms that ” could also be price solely a fraction of what was paid for them.”

In the meantime, insiders additionally loved particular therapy, getting over $1 billion in private loans.

Ray famous that efforts are ongoing to get better a number of the lacking funds, maximize worth for patrons and collectors, and restore FTX relationships with regulators worldwide.