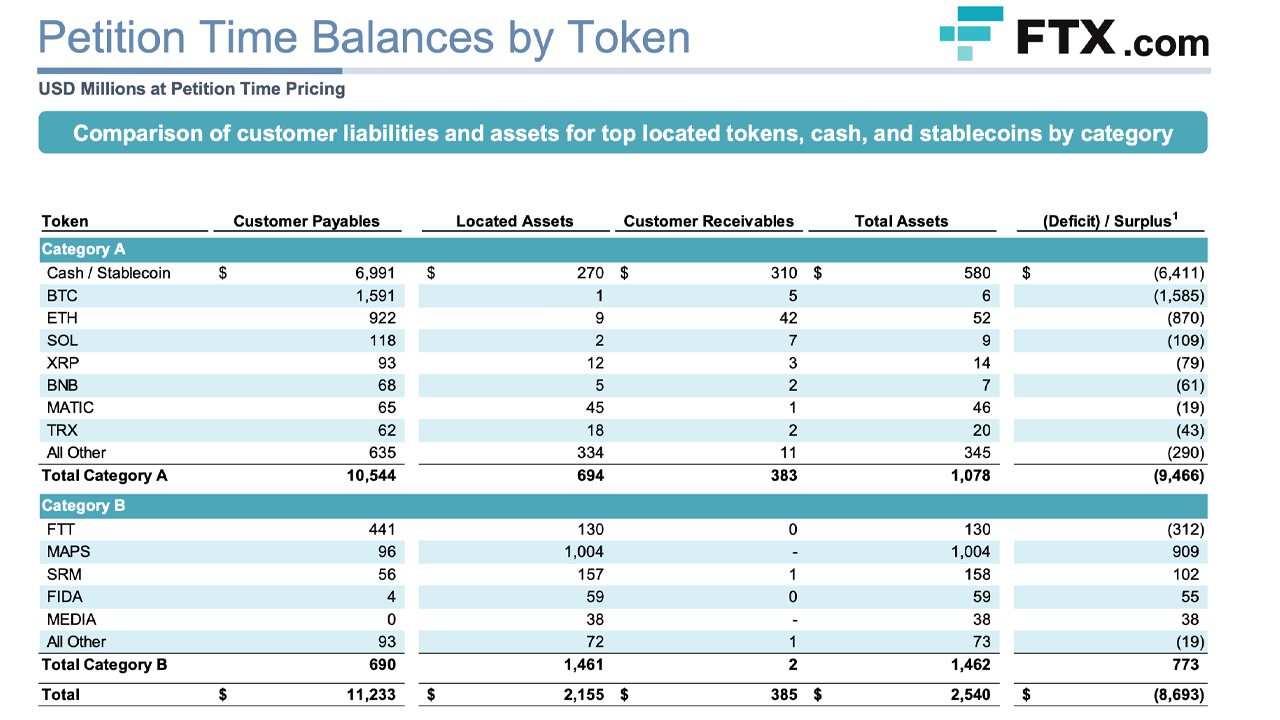

On March 2, 2023, FTX debtors launched their second stakeholder presentation, which incorporates a preliminary evaluation of the now-defunct cryptocurrency alternate’s shortfalls. The newest presentation reveals a major shortfall, as roughly $2.2 billion of the corporate’s complete belongings have been present in FTX-related addresses, however solely $694 million is taken into account “Class A Property,” or liquid cryptocurrencies equivalent to bitcoin, tether, or ethereum. As well as, John J. Ray III, FTX’s present CEO, said that the debtor’s effort had been vital, and he added that the alternate’s belongings have been “extremely commingled.”

A Preliminary Abstract of What Contributed to FTX’s $8.9 Billion Shortfall

FTX debtors and CEO John J. Ray III have launched a complete presentation documenting FTX’s shortfalls. The preliminary report mentions the cyber assault that occurred the day after FTX filed for Chapter 11 chapter safety on November 11, 2022. In a now-deleted Telegram chat channel, FTX US common counsel Ryne Miller described the alternate being hacked and that the platform was unsafe. The preliminary shortfall evaluation refers to this particular cyber assault all through.

The report additionally mentions that each FTX and FTX US sometimes held digital belongings in sweep wallets that weren’t segregated for particular person prospects. The debtors famous that as a result of cyber assault, the corporate’s computing surroundings was secured and “stays topic to sure restrictions,” limiting entry to essential information. The report categorizes FTX’s holdings into two teams: “Class A Property,” which have bigger market caps and buying and selling volumes, and “Class B Property,” which don’t meet the liquidity necessities of Class A Property.

Nonetheless, regardless of figuring out all of the belongings, an $8.9 billion shortfall stays. “There’s a substantial shortfall on the FTX.com alternate on the time of the petition, outlined because the distinction between digital asset claims on the FTX.com ledger and digital belongings accessible to fulfill these claims,” the report states. “The shortfall is especially vital for Class A Property. Solely a small amount of money, stablecoin, [bitcoin], [ethereum], and different Class A Property stay in wallets preliminarily related to the FTX.com alternate.”

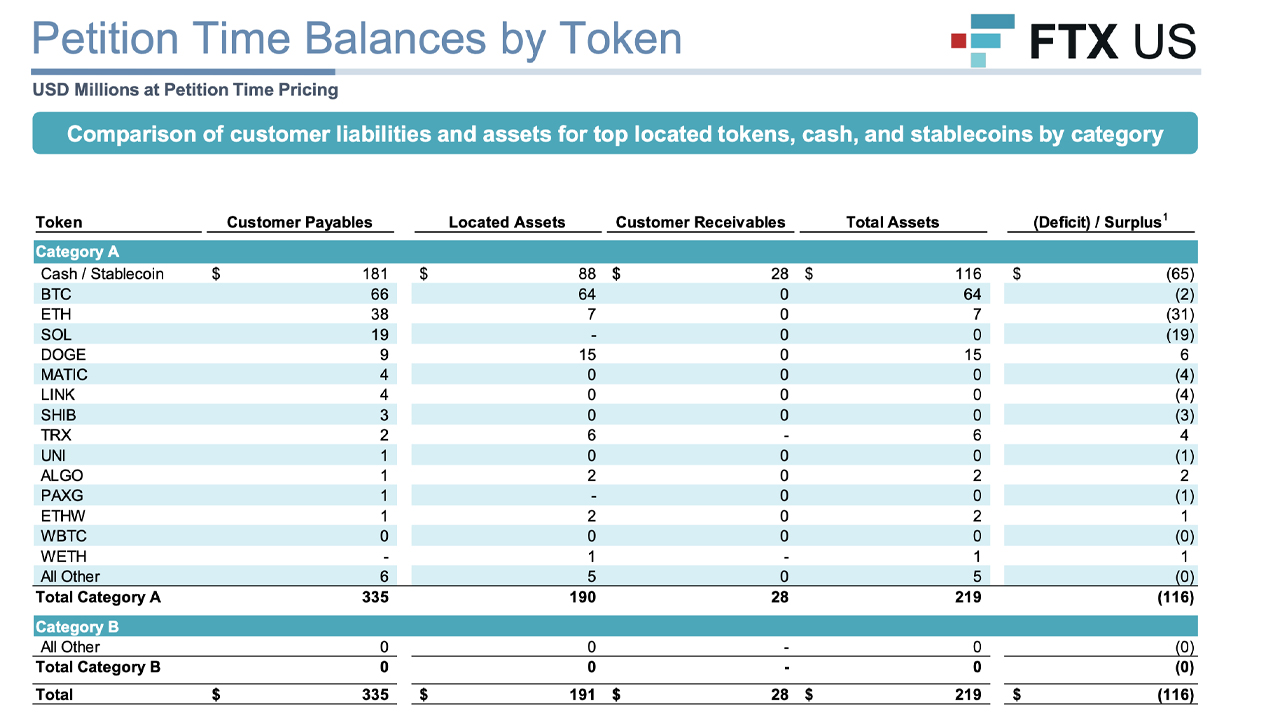

The report additionally notes that whereas the shortfall at FTX US was substantial, it was smaller than that of the worldwide alternate. In a press launch, CEO Ray shared his ideas on the presentation and talked about that funds have been commingled and record-keeping was insufficient.

“That is the second in what the FTX Debtors anticipate can be a collection of displays as we proceed to uncover the details of this case,” Ray mentioned in an announcement. “It has taken an enormous effort to get this far. The exchanges’ belongings have been extremely commingled, and their books and data are incomplete and, in lots of instances, completely absent.” He pressured that the data supplied by the debtors was preliminary and topic to alter.

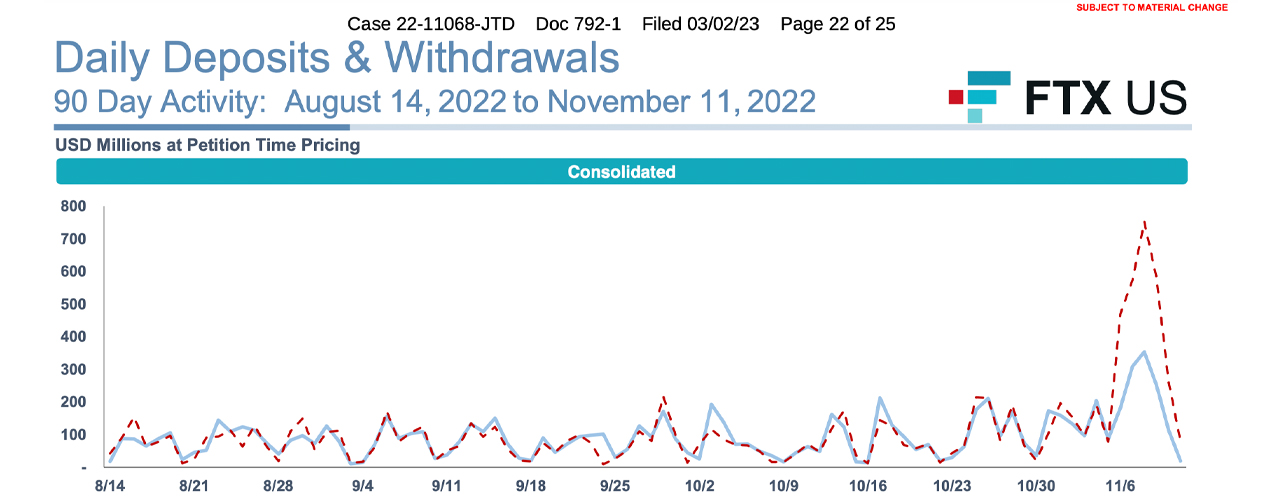

One attention-grabbing facet of the newest debtors’ presentation is that ftx token (FTT), the corporate’s alternate coin, is classed as a Class B Asset. Whereas BTC and ETH are Class A Property, SOL, MATIC, UNI, SHIB, PAXG, WBTC, and WETH are additionally thought of A-class belongings. The report additionally highlights the each day deposits and withdrawals made 90 days previous to the chapter petition date.

Moreover, the alternate’s shortfall doesn’t embrace Alameda Analysis belongings, which encompass $956 million price of solana (SOL) and aptos (APT), $820 million held at third-party exchanges, $185 million in stablecoin belongings held in chilly storage, and $169 million in bitcoin (BTC) held in chilly storage.

What do you assume the fallout of FTX’s vital shortfall can be for stakeholders? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Sergei Elagin

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.