Ouch! Crypto trade FTX suffered an virtually full implosion falling 85 p.c in the present day and a full 90 p.c since final week’s excessive of $25.78. The collapse follows allegations that Binance was backing out of a merger deal and the opening of an FTC investigation into FTX mishandling withdrawal requests. The token is now price lower than $3.

Cryptocurrencies continued to tumble on Wednesday because the FTX trade implodes. Crypto billionaire Sam Bankman-Fried’s buying and selling platform skilled what is usually known as a “financial institution run” after the US Federal Commerce Fee introduced it had opened an investigation into whether or not FTX Buying and selling illegally dealt with buyer withdrawals earlier within the week.

A financial institution run is when numerous depositors go to take their cash out of a financial institution. It often occurs when folks suppose the establishment is about to go bancrupt. Since most of a financial institution’s cash solely exists on paper and isn’t sitting within the native vault, most depositors seeking to withdraw funds stroll away empty-handed, additional feeding the panic.

In Bankman-Fried’s case, the FTC alleges he loaned out buyers’ FT tokens (FTT) to different crypto lenders like BlockFi and Voyager Digital. He moreover struck a number of promoting offers with sports activities groups and athletes to advertise FTX.

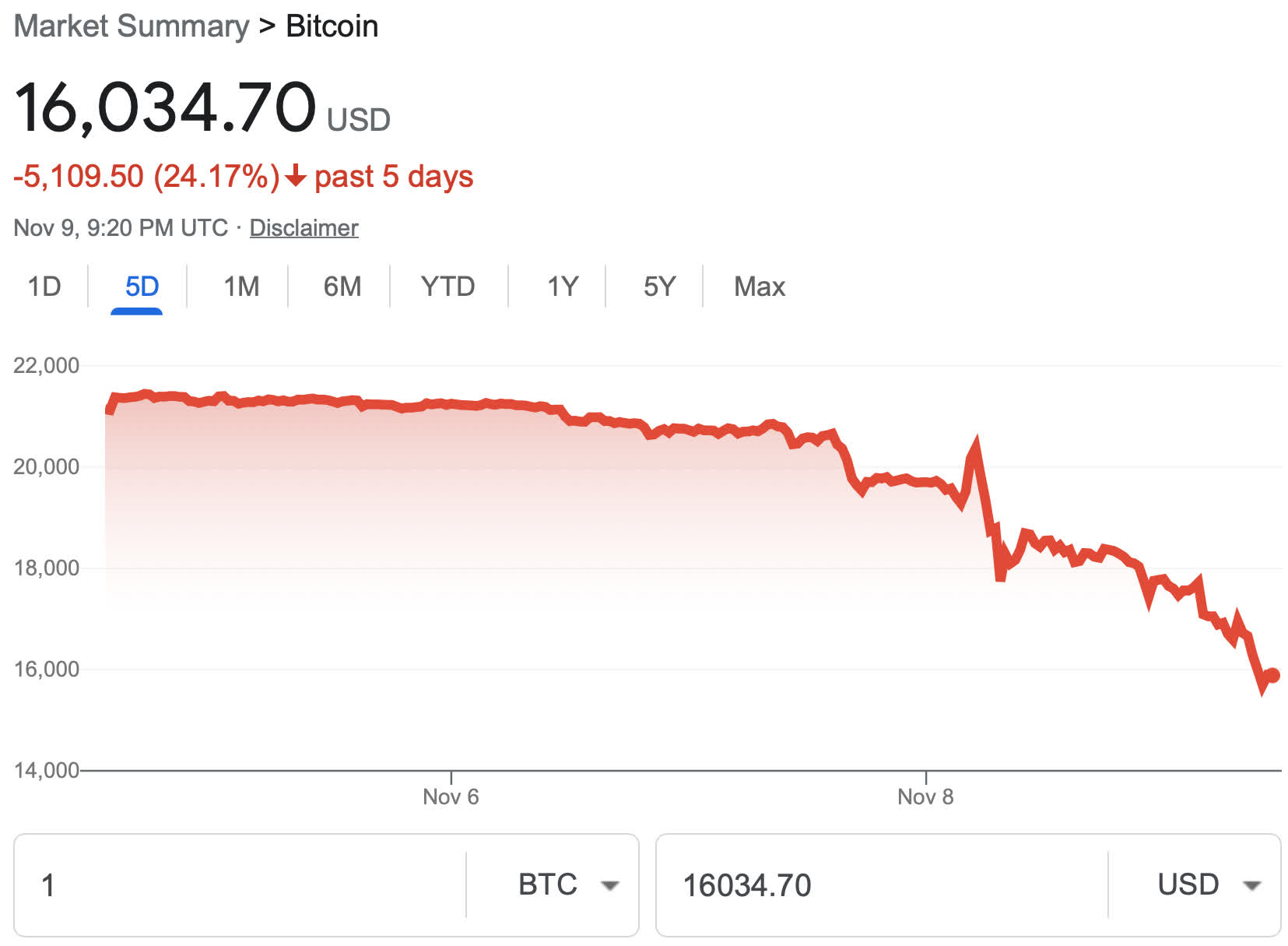

Forbes notes the shakeup brought on a ripple impact that noticed Bitcoin worth fall 10 p.c on Tuesday and one other seven p.c Wednesday to $17,056 — a two-year low. Bitcoin has continued its fall since this morning’s low and sits at $16,034.70 as of this writing, greater than $5,000 decrease than it was buying and selling every week in the past.

Earlier than the scare, rival trade Binance was reportedly in talks to merge with FTX however backed out of the deal. In response, Binance CEO Changpeng Zhao sometimes called simply CZ, issued a tweet containing a memo he despatched to all Binance workers.

In accordance with CZ, Binance had nothing to do with FTX’s disaster. He emphasizes that this was not some “grasp plan” to again out of the deal. Due diligence continues to be underway, indicating that the settlement shouldn’t be canceled, regardless of what CoinDesk’s “nameless sources” say.

“DO NOT commerce FT tokens. If in case you have a bag, you’ve gotten a bag. DO NOT purchase or promote,” CK suggested.

Most likely a smart resolution contemplating the coin has nowhere to go however up or out. Bankman-Fried’s FTT dropped seven p.c, on Wednesday. Tokens have been holding comparatively regular final week, hovering at round $25. As of publication, the tokens are valued at $2.50, a 90-percent freefall. Promoting right now would nearly be a complete loss except you invested method again in September 2019 when it was buying and selling for beneath $2.

The repercussions have been additionally felt all through the remainder of the sector. Ethereum slid 9 p.c on Wednesday and is 30 p.c decrease than every week in the past. Inventory in Coinbase dumped 18 p.c of its valuation within the final two days nearing an all-time low.

“Bernstein analysts known as the dip a results of a ‘seismic shift’ within the business,” Forbes famous.