Fast Take

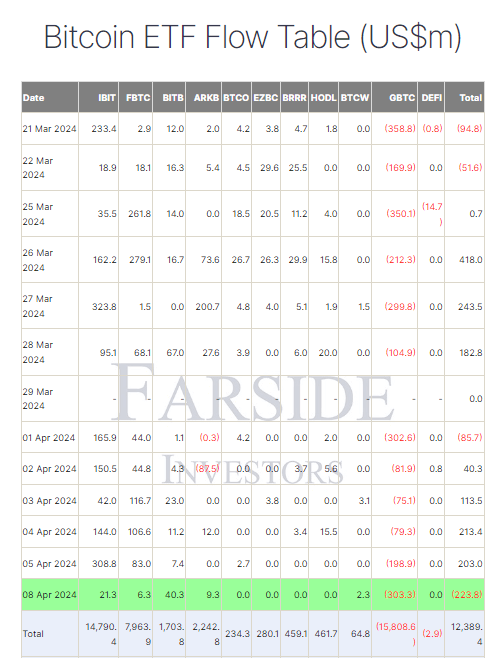

Farside information studies that the Bitcoin ETF market skilled a notable shift on Apr. 8, with the general sector recording its first internet outflow day since Apr. 1, totaling $223.8 million. The first driver of this transformation was a big $303.3 million outflow from the Grayscale Bitcoin Belief (GBTC), its largest outflow since March 25, which has now seen a complete of $15,808.6 billion in outflows.

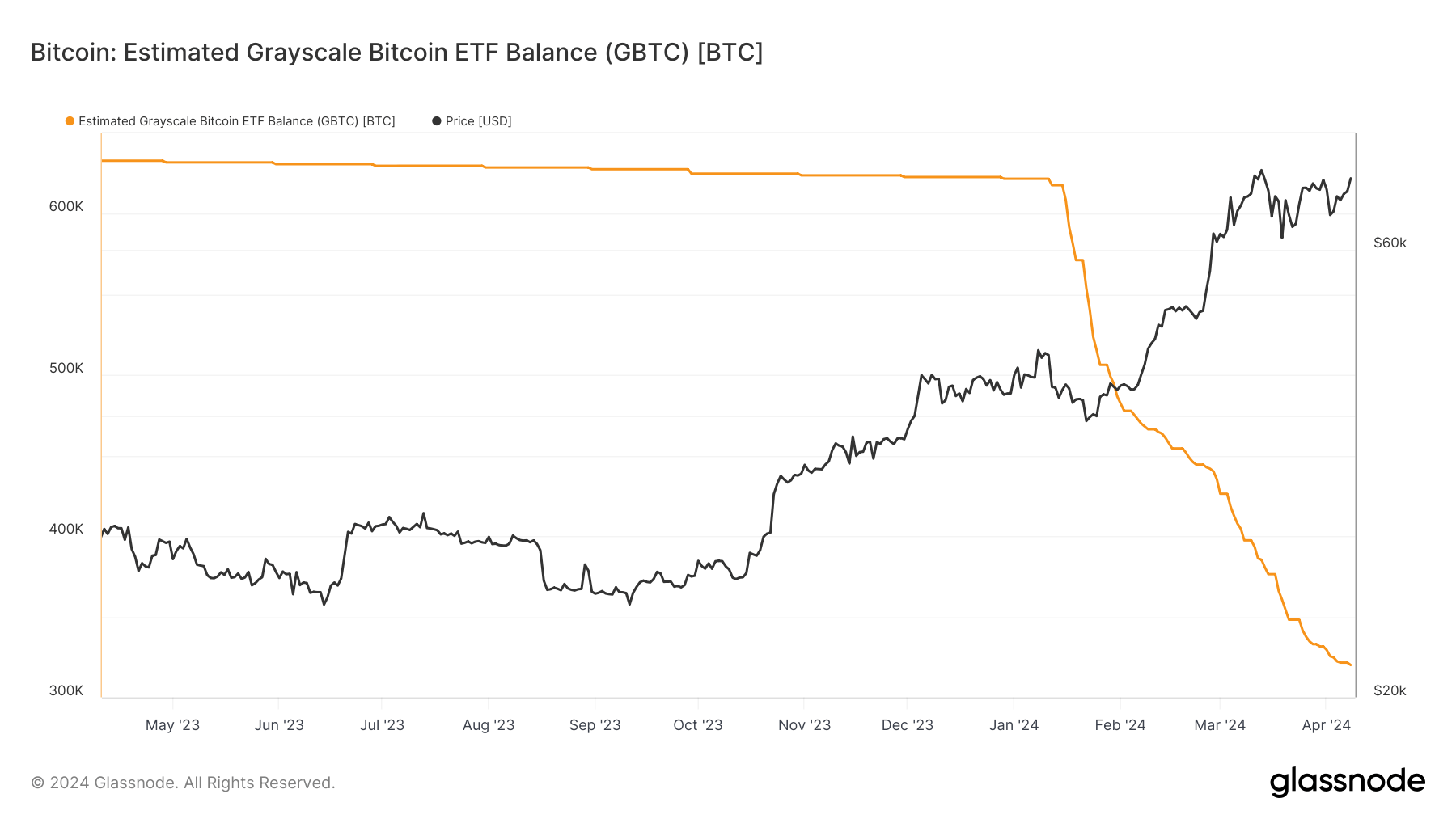

This outflow has resulted in GBTC’s Bitcoin holdings dropping from 621,000 to only 320,000 over the previous three months, a lower of 300,000 BTC, based on Glassnode.

In distinction, different spot Bitcoin ETFs noticed comparatively muted inflows, with Bitwise BITB main the pack at $40.3 million, bringing their whole influx to $1,703.8 billion. BlackRock IBIT noticed a $21.3 million influx, bringing their whole influx to $14,790.4 billion, whereas Constancy FBTC noticed a $6.3 million influx, bringing their whole to $7,963.9 billion, based on Farside.

Farside information reveals that regardless of this minor decline, the whole internet influx to the spot ETF market stays at a wholesome $12,389.4 billion.

The put up Grayscale Bitcoin belief sheds roughly 300,000 BTC since ETF launch appeared first on CryptoSlate.