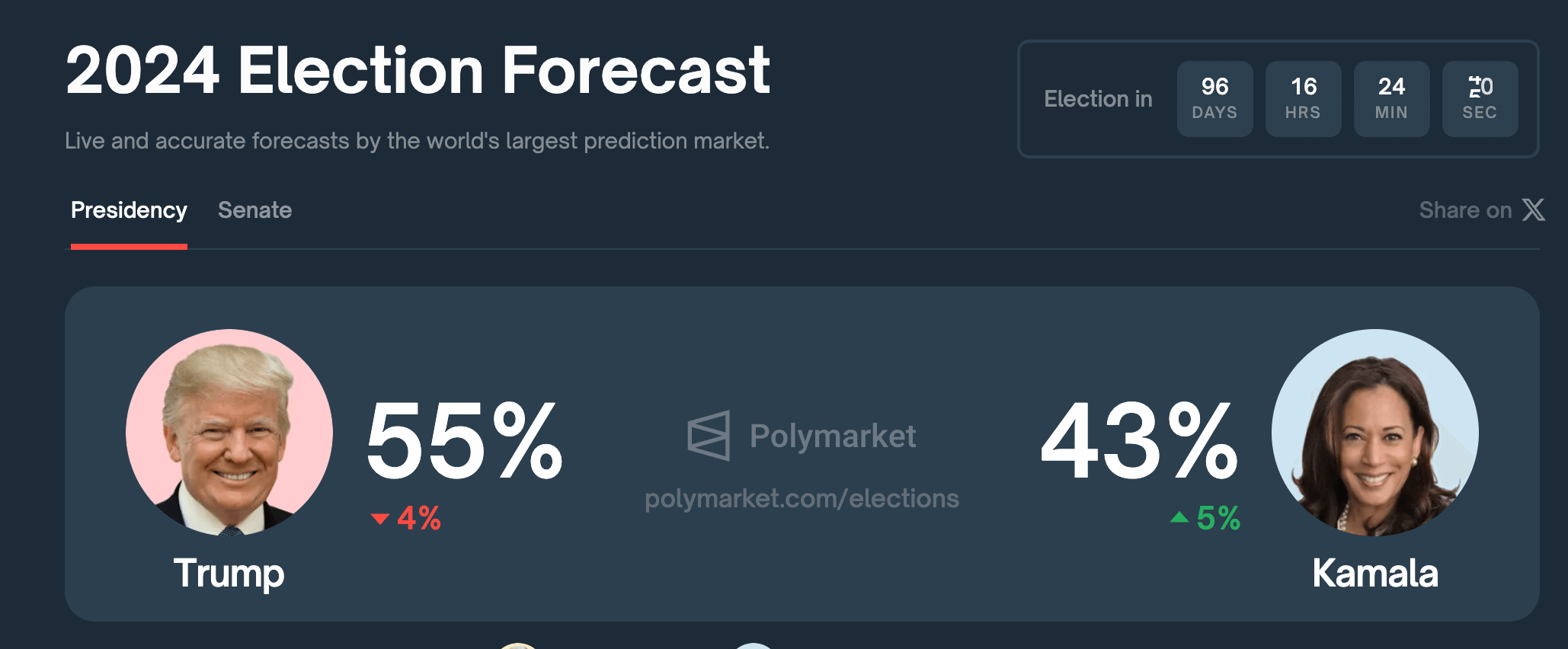

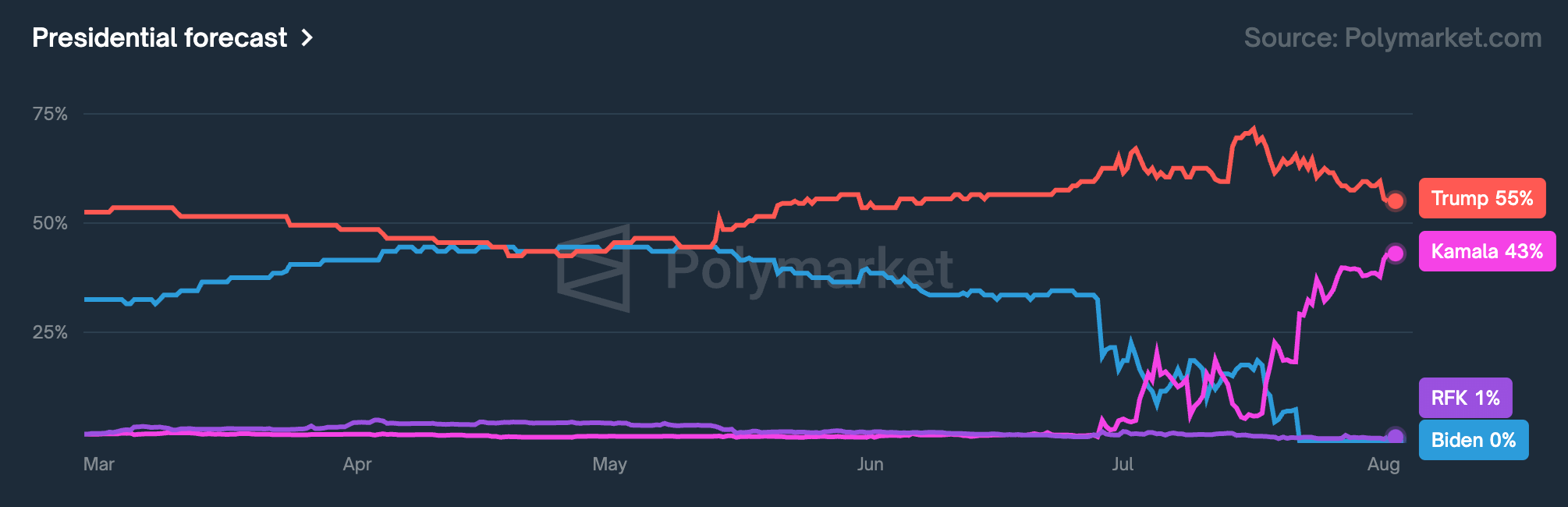

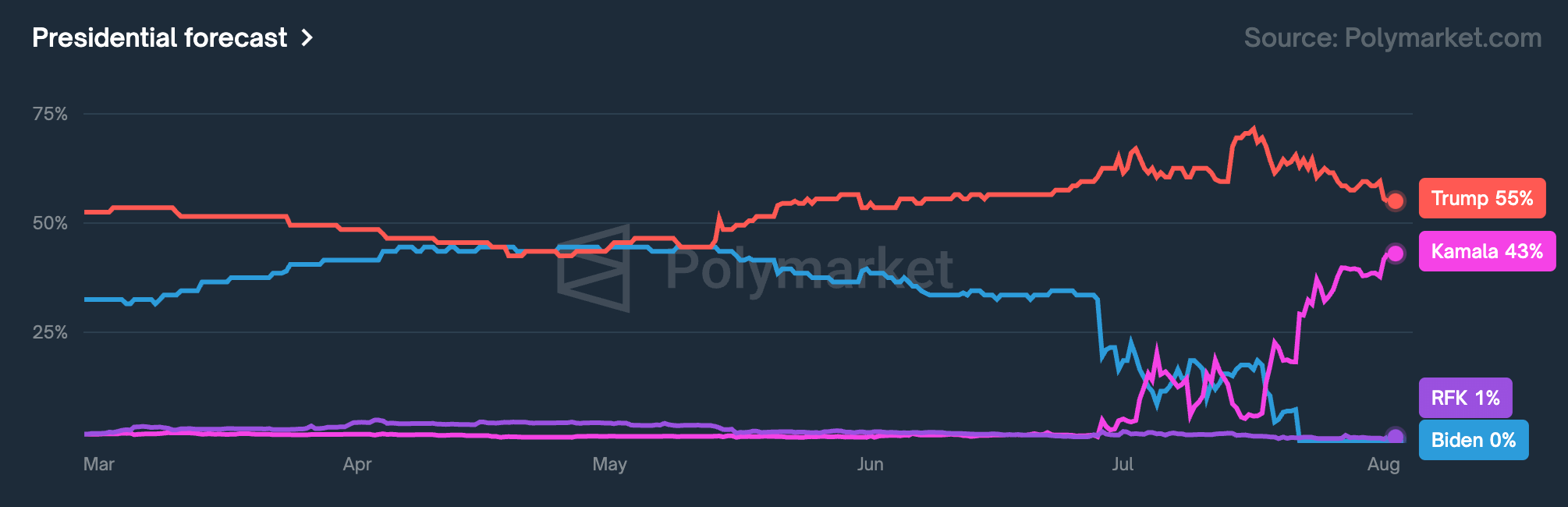

Kamala Harris’s odds surged to 45% on Polymarket following Donald Trump’s look on the Nationwide Affiliation of Black Journalists (NABJ) panel. Polymarket, the distinguished crypto betting platform, has seen a major inflow of wagers as a result of turbulent US presidential election, prompting the platform to improve its infrastructure. Based on Bloomberg, the platform added MoonPay to deal with the elevated quantity of bets and open on-ramps into crypto.

Polymarket’s US elections guess quantity has hit $467 million, up from $364 million final week, reflecting heightened curiosity within the Trump vs. Harris race. The platform permits customers to guess on varied outcomes, together with the US presidential election, and has attracted important consideration just lately on account of Harris’s doubtless Democratic nomination and an assassination try on Trump. Regardless of Harris’s latest beneficial properties, large-scale bettors on Polymarket nonetheless overwhelmingly favor Trump, who retains a major lead with a 55% likelihood of profitable the election.

Nonetheless, Trump’s lead has been lower massively from 60% over the previous 24 hours and a excessive of 72% on July 16. Equally, Harris’ likelihood opened at simply 37% on July 31 earlier than rising to 43% as of press time, her highest likelihood since becoming a member of the race. The final time the Democrats had such a excessive worth per share on Polymarket was Might 16, when Trump accepted the controversy with Joe Biden, resulting in a surge in bets in Trump’s favor.

Outdoors of crypto prediction markets, Harris’s marketing campaign has additionally been bolstered by latest polls exhibiting her making beneficial properties on Trump in essential swing states. A Bloomberg/Morning Seek the advice of ballot discovered Harris main Trump 53%-42% in Michigan, whereas different polls present her both main or tied with Trump in states like Wisconsin, Arizona, and Nevada. This polling information might have contributed to the surge in Harris’s betting odds on platforms like Polymarket, the place the dynamic and closely contested election season is mirrored within the platform’s interactive maps and trending market evaluation.

Nonetheless, whereas polling might have been an element, the timing appears to align extra carefully with Trump’s efficiency in entrance of a crowd of black journalists, the place he questioned Harris’ heritage and claimed to have been invited underneath “false pretenses” after being challenged on his rhetoric towards the black group.

Founding father of SkyBridge Capital and former Trump press secretary Anthony Scaramucci felt Trump’s efficiency would result in a drop in his ballot numbers, commenting,

“Not over but. Trump might go away the race. Simply watch his ballot numbers plummet and see what occurs.”

Common Accomplice at Van Buren Capital, Scott Johnsson, commented on the correlated drop in Bitcoin’s worth to $63,700, saying,

“The irony of the Trump speech is now the whole crypto trade is totally correlated to this one crypto occasion contract.”

Bitcoin has recovered to $64,300 as of press time following yesterday’s FOMC assembly and the decline in Trump’s odds. Trump is seen because the extra Bitcoin-friendly candidate, and his odds of profitable the presidency appear to align with the worth of Bitcoin at current.