Este artículo también está disponible en español.

Ethereum, the second largest crypto by market cap, is buying and selling at $2,420 after a current worth rally. Ethereum has been up by 3.4% and 6.3% prior to now 24 hours and 7 days, respectively, which has raised hopes for an prolonged bullish run. As the worth efficiency continues to unfold, some main developments are taking root, which might pave the best way for Ethereum’s worth to rally again above the $4,000 mark.

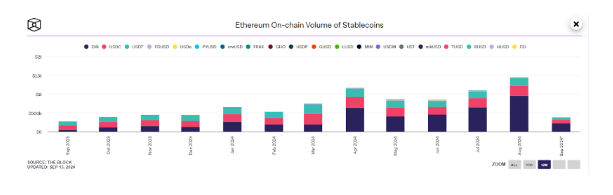

Stablecoin Transaction Quantity Hits New Excessive

Regardless of the bearish sentiment which has lingered in a 30-day timeframe, on-chain knowledge exhibits that the Ethereum blockchain continues to witness huge exercise, particularly within the stablecoin area of interest. The stablecoin buying and selling quantity on the blockchain soared massively in August to interrupt its earlier all-time excessive. Significantly, the stablecoin buying and selling quantity reached $1.46 trillion.

This surge in stablecoin exercise additional solidifies Ethereum’s place because the go-to blockchain platform on the earth of DeFi. As stablecoin adoption continues to rise, this might drive up Ethereum income as a consequence of demand for ETH tokens used to pay transaction charges. This elevated utility might, in flip, contribute to its worth reaching $4,000 or past.

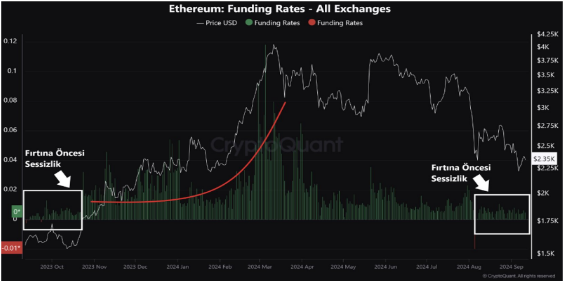

Watch Out For The 0.015 Level In Funding Charges

One other key issue to observe now for Ethereum is the funding charge. The funding charge is a metric that tracks the price of holding an extended or brief place within the perpetual futures market. Funding charges replicate market sentiment, as constructive funding charges point out that longs are paying brief positions, suggesting a bullish outlook, whereas adverse charges present a bearish pattern.

In response to on-chain knowledge from CryptoQuant, the Ethereum funding charge is approaching the 0.015 level. As an analyst at CryptoQuant identified, the Ethereum funding charge is presently hovering between 0.002 and 0.005. This motion is harking back to a sample in September 2023, when the funding charge was equally low.

Though these figures may seem modest for a typical bull market, a CryptoQuant analyst has famous that this could possibly be the calm earlier than a serious upward motion. It’s because the funding charges ultimately crossed 0.015 in 2023, permitting Ethereum to “surge from the $1,500s to $4,000s.” An identical prevalence might see Ethereum surging massively to $4,000 within the subsequent few months.

Ethereum: Community Progress

In response to Santiment, the Ethereum community has witnessed huge progress prior to now week, just lately reaching a four-month excessive. Other than its L2 options like Optimism and Arbitrum, the platform stays the muse for decentralized finance (DeFi) and non-fungible tokens (NFTs). This community progress was accompanied by a rise within the creation of pockets addresses and energetic addresses.

On the time of writing, Ethereum is buying and selling at $2,421. If these components above align in favor of Ethereum, we might see ETH proceed to strategy the $4,000 mark.

Featured picture from StormGain, chart from TradingView