American multinational monetary providers company Mastercard has seized the limelight, and never for an excellent motive. The Australian Competitors and Client Fee (ACCC) has sued Mastercard over retailer offers.

Encouraging competitors and inspecting allegations of anti-competitive conduct within the monetary providers sector, with emphasis on fee programs, is a prime significance for the ACCC.

Anti-competitive conduct in offers with massive retailers

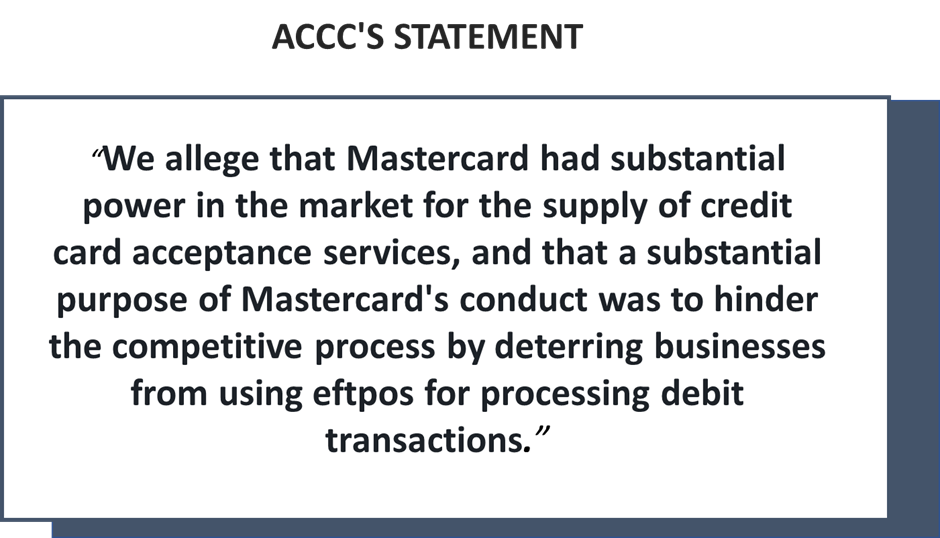

Australia’s shopper watchdog, ACCC, has sued Mastercard for allegedly conducting anti-competitive agreements with massive retailers. The primary accusation that ACCC has put is that Mastercard considerably tried to reduce the competitors in debit card acceptance providers.

Supply: © Vicdemid | Megapixl.com

Glancing on the context of allegations

Based on the ACCC, the stated exercise started in 2017 throughout RBA’s least price routing initiative. The primary goal behind the RBA’s initiative was to extend the competitors throughout the monetary providers sector and cut back fee prices for companies. So, corporations would have the autonomy to decide on amongst Visa, Mastercard or eftpos, whichever is the most cost effective.

ALSO READ: QBE, SUN, IAG: How are these ASX monetary shares faring?

Nevertheless, following RBA’s determination, Mastercard allegedly tried to take a shorter route by getting into into agreements with round 20 large retail companies, together with supermarkets, quick meals chains and clothes retailers.

What did the settlement entail?

Below the settlement, the companies have been obliged to course of all their Mastercard-eftpos debit card transactions by Mastercard as an alternative of the eftpos community. In return, the businesses would get discounted charges for Mastercard bank card transactions.

© 2022 Kalkine Media®

As per ACCC Chair Gina Cass-Gottlieb, Mastercard’s alleged conduct meant that companies didn’t obtain the complete good thing about the elevated competitors that was supposed to move from the least price routing initiative. Lowering prices for companies permits them to supply their prospects higher costs. Making certain the foremost card schemes, Mastercard, Visa and eftpos, compete strongly is critical for each these companies in addition to their prospects.

Repercussions of the settlement for friends

Due to the alleged settlement between Mastercard and enterprise retailers, companies wouldn’t obtain the optimum profit from the elevated competitors entailed by RBA’s initiative. And, in the end, it’s a loss for the direct buyer additionally. As a result of blocking the diminished prices for companies means they would not have the ability to provide higher costs to prospects. Thus, making certain powerful competitors among the many monetary providers suppliers was important to creating the initiative work.

Notably, this case demonstrates ACCC’s heightened curiosity in addressing aggressive hurt attributable to unique preparations engaged in by corporations with market energy.