Article Gist: Clarify the origin of cash, and why Bitcoin has such potential as a forex

Earlier than I soar into cryptocurrencies, let me take you to the medium of trade historical past.

∞ BC — 1100 BCE: Again in BC life, when the human inhabitants remains to be very small, our ancestors might survive by simply benefiting from the accessible pure merchandise (eg. looking, fishing, planting). Because the inhabitants grows, the pure sources are getting scarce, and our ancestors are compelled to do a barter or trade any items to outlive. This compelled was the forerunner of transactions that occurred till as we speak.

1100 BC — 1000 BCE: Metallic cash have been invented by Shang Dynasty right now and used as a forex in historical Chinese language civilization. These steel cash have been constituted of copper, silver, gold, and metals. They have been designed with sq. holes within the center so that they could possibly be carried simply.

700 BCE: Gold and silver have been used within the subsequent transactions, Turkey and Yunani began this invention, they imagine that gold is the most effective medium of trade ever created due to its restricted provide and to keep away from inflation.

Even today, many nonetheless imagine that gold is the most effective storage worth.

You possibly can examine this ->web site to see Prime Property sorted by market cap.

618–907: Retailers in Tang Dynasty swapped the steel cash by utilizing paper cash as a medium of trade as a result of it’s simpler to deliver paper cash.

Remember that each paper cash printed is backed by the gold they’ve or obtained.

960–1279: Paper cash grew to become a pattern, and so in 1265 Music Dynasty introduced that paper cash is their official nation forex. Fourteen years later, Mongolians overthrew Music Dynasty and hijacked their monetary system by printing giant quantities of paper cash with out counting on the worth of gold.

Nevertheless, this technique has a flaw, as a result of those that have the authority to print cash had cheated inflicting inflation. This type of paper cash is the forex we now have now, we used to name it a fiat forex.

1450: Hyperinflation occurred, Mongolians had induced a monetary disaster in China, so that they imagine it’s best to make use of gold or silver once more.

1700: The flaw within the paper cash system was used once more out of the country, in that point Financial institution of England promised rates of interest can be given to those that saves their gold within the financial institution. The greed of these bankers started to emerge slowly, they thought there can be many individuals who would maintain their gold for a very long time and people individuals wouldn’t withdraw giant quantities on the identical time. Because of this, they printed paper cash past their gold inventory.

1944: Because the years go by, as a rustic that dominated WW1 and WW2, America managed to gather gold in a big quantity as much as two over three of the world’s gold reserves. So, America was in a position to make an settlement referred to as the Breton Woods system in 1944–1947.

The Breton Woods system regulated how the greenback forex relies on the gold reserves owned by America, then the currencies of different nations are primarily based on the greenback as if the greenback is gold.

1971: Through the period of President Nixon, America was frightened as a result of they didn’t management the remainder of the world’s gold provide (round one over three), then America introduced that their greenback would not be backed by gold, and that is the monetary system we use till at the present time.

Since this technique was applied, there have been 5 main monetary crises: (1) The Worldwide Debt Disaster in 1982, (2) The Latin American Debt Disaster in 1995, (3) The East Asian Financial Disaster in 1997, (4) The Russian Disaster in 1998, and (5) The World Financial Recession (2007), during which the bankers and the worldwide elite took a big position within the incidence of this world crises.

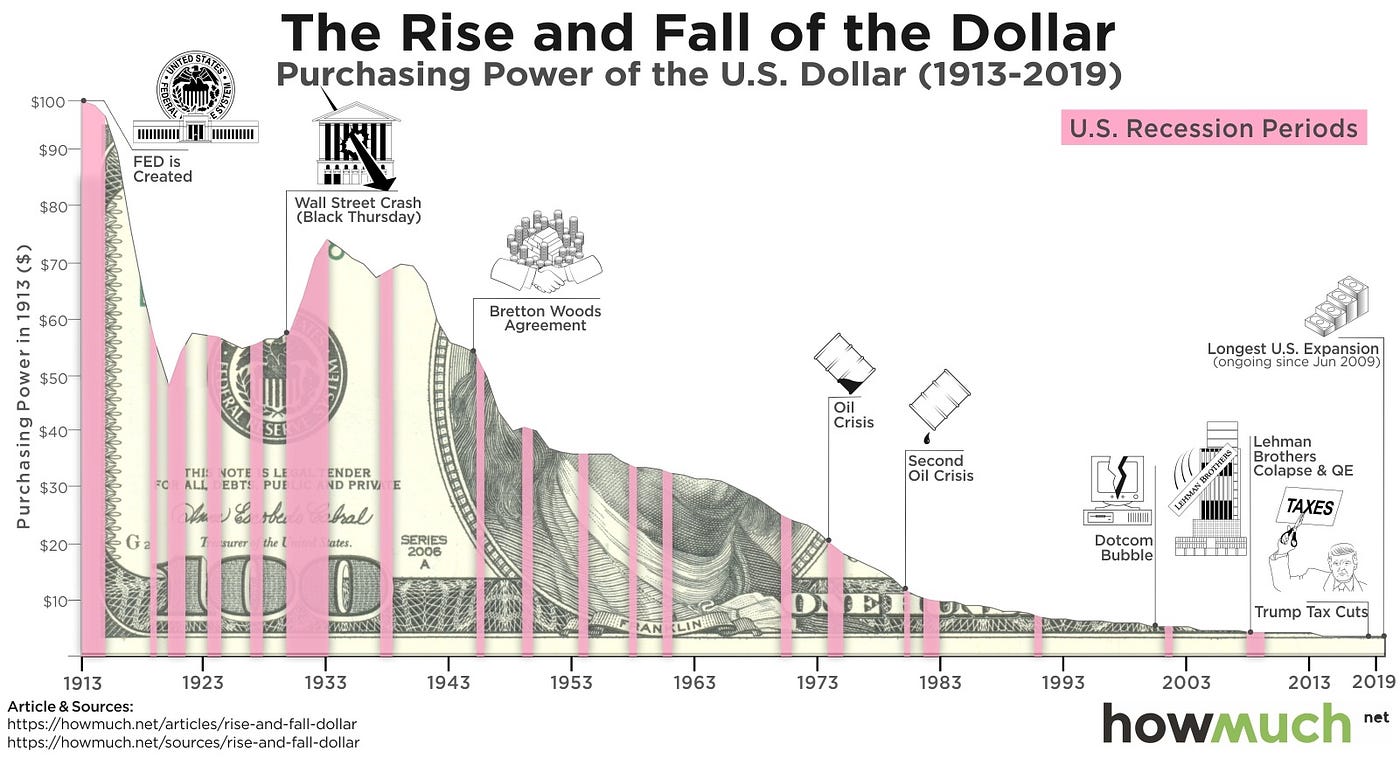

There are a number of conspiracies and speculations, that fiat currencies have been managed by the worldwide elite. If we take a look at the details, the buying energy of the greenback can also be reducing. This can be a image of the inflation impact.

A yr after the worldwide financial recession began, an individual or a gaggle with an preliminary Satoshi Nakamoto printed a whitepaper entitled “Bitcoin a Peer to Peer Digital Money System.” Quoted from the whitepaper, Satoshi intends to make an internet fee system that enables one social gathering to ship money to a different social gathering with out going by a monetary establishment.

This digital trade device has a “proof of labor” system, the place individuals can get bitcoin by mining it. The mining could possibly be accomplished by fixing tough math questions, the query has its personal algorithm and requires laptop energy and electrical energy. The presence of bitcoin is anticipated to exchange a extra steady forex than its predecessor, which has violated the supposed transaction instruments.

Bitcoin is designed in order that customers might do a transaction with out third events anonymously, this type of cash is saved in digital wallets. Transaction charges (in massive quantities) for cross-country transactions are additionally decrease than utilizing intermediaries from worldwide monetary establishments. Each transaction can also be clear, it’s all written in a ledger, this ledger is called the blockchain.

There are a number of common blockchains:

blockchain.com

btc.com

etherscan.io

bscscan.com

solscan.io

As a result of its decentralization, the worth of bitcoin may be very risky, as a result of it can’t be managed by any social gathering, solely the availability and demand can change its worth. However since its delivery, bitcoin is ready to pump the identify of cryptocurrency right into a beneficial forex and is liked by many individuals.

Bitcoin has been legalized as a authorized tender in El Salvador.

On the finish of the day, a medium of trade is only a medium of trade, all of it will depend on the settlement of every individual to simply accept it or not, I don’t know whether or not this cryptocurrency might be used as a medium of trade sooner or later, but when I take a look at the worth that retains going up, we will see an rising demand that continues yearly.

Hopefully, the brand new medium of trade might be extra steady, extra clear, and have new benefits over its predecessor.