Final week, Bitcoin’s value dropped from $29,400 to a low of $25,000. Whereas this decline may seem modest given Bitcoin’s historic volatility, it signifies a notable departure from the tight buying and selling vary noticed over the previous two months.

But, even amidst this volatility, the arrogance of long-term holders stays unshaken, a sentiment that’s essential to observe because it typically serves as a barometer for the market’s underlying well being.

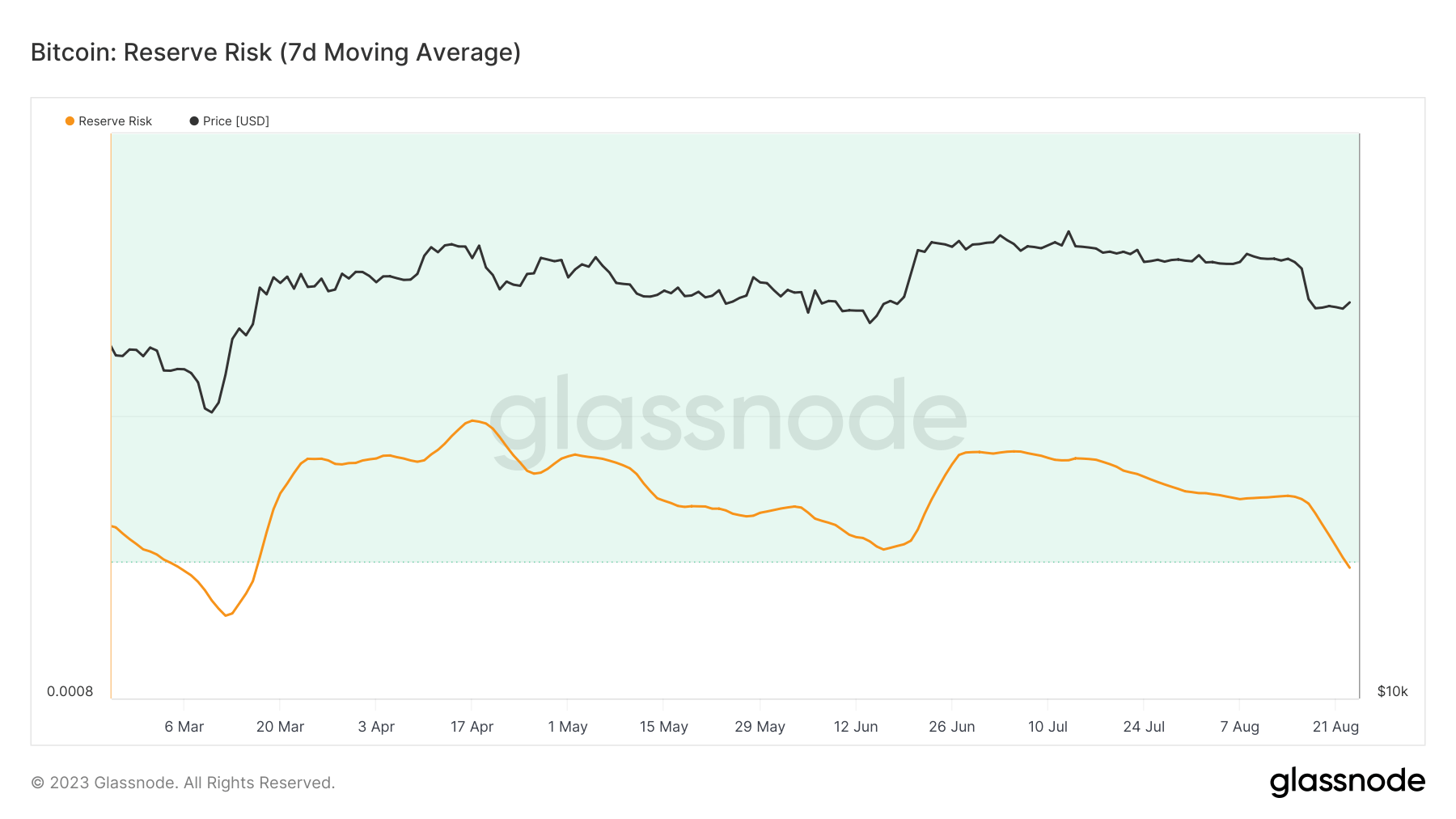

This unwavering confidence is seen in Bitcoin’s reserve danger, an typically underutilized on-chain metric.

Reserve danger is a metric used to judge the danger/reward ratio of investing in Bitcoin at any given time limit. It’s calculated by dividing the worth of Bitcoin by the HODL Financial institution. The HODL financial institution represents the worth of all cash when it comes to their age (i.e., how lengthy they’ve been held with out being spent). The extra cash are being held for longer intervals, the upper the HODL Financial institution.

The metric basically gauges the arrogance of long-term holders in relation to the coin’s present value. A low Reserve Threat signifies that long-term holders are assured within the asset, and the present value is seen as enticing for funding. Conversely, a excessive Reserve Threat means that long-term holders is perhaps much less assured, and the worth is perhaps thought of excessive relative to that confidence.

From Aug. 14 to Aug. 23, Bitcoin’s reserve danger plummeted from 0.0011 to 0.00098. Bitcoin’s value additionally decreased throughout this identical interval, transferring from $29,400 to $26,400. To place this in perspective, the final occasion when Bitcoin’s reserve danger touched these ranges was on March 15, with the worth at $25,050.

The drop in each Bitcoin’s value and reserve danger implies that whilst the worth dipped, the arrogance of long-term holders surged. This may be interpreted as long-term holders perceiving the worth drop as a profitable shopping for window, reinforcing their perception in Bitcoin’s long-term worth.

Different on-chain knowledge additional helps this, most notably the availability of Bitcoin held by long-term holders.

Regardless of the worth hunch, the variety of Bitcoins held by long-term holders has elevated, rising from 14.62 million to 14.64 prior to now week. It’s necessary to notice that this uptick continues an upward pattern that started in July 2022.

The diminished reserve danger and the elevated long-term provide point out a prevailing sentiment that the present value presents a positive danger/reward steadiness for funding.

Whereas market fluctuations are inherent to the risky nature of cryptocurrencies, metrics like reserve danger provide a deeper dive into the underlying sentiments. The latest knowledge underscores a bullish outlook for Bitcoin, exhibiting that its long-term holders stay steadfast of their perception in its long-term worth, even throughout short-term value declines.

The submit How Bitcoin’s falling reserve danger counters its value decline appeared first on CryptoSlate.

![Yellow Claw Talk Staying Fresh, Los Angeles Tour Dates, €URO TRA$H and more [Interview] Yellow Claw Talk Staying Fresh, Los Angeles Tour Dates, €URO TRA$H and more [Interview]](https://www.youredm.com/wp-content/uploads/2023/08/press-pic-yellow-claw-1.jpg)