When individuals banking in the USA lose cash as a result of their cost card received skimmed at an ATM, fuel pump or grocery retailer checkout terminal, they might face hassles or delays in recovering any misplaced funds, however they’re virtually all the time made complete by their monetary establishment. But, one class of Individuals — these receiving meals help advantages by way of state-issued pay as you go debit playing cards — are significantly uncovered to losses from skimming scams, and often have little recourse to do something about it.

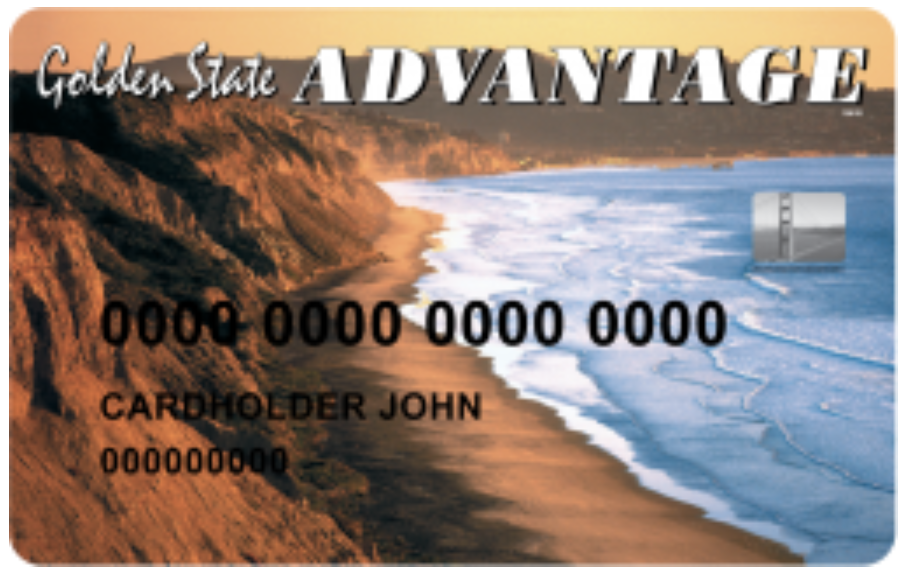

California’s EBT card doesn’t at present embrace a chip. That silver sq. is a hologram.

Over the previous a number of months, authorities in a number of U.S. states have reported fast will increase in skimming losses tied to individuals who obtain help by way of Digital Advantages Switch (EBT), which permits a Supplemental Vitamin Help Program (SNAP) participant to pay for meals utilizing SNAP advantages.

When a participant makes use of a SNAP cost card at a licensed retail retailer, their SNAP EBT account is debited to reimburse the shop for meals that was bought. EBT is utilized in all 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, and Guam.

EBT playing cards work similar to common debit playing cards, in that they can be utilized together with a private identification quantity (PIN) to pay for items at taking part shops, and to withdraw money from an ATM.

Nevertheless, EBT playing cards differ from debit playing cards issued to most Individuals in two necessary methods. First, most states don’t equip EBT playing cards with good chip expertise, which might make cost playing cards rather more tough and costly for skimming thieves to clone.

Alas, it’s no accident that all the states reporting latest spikes in fraud tied to EBT accounts — together with California, Connecticut, Maryland, Pennsylvania, Tennessee, and Virginia seem to at present difficulty chip-less playing cards to their EBT recipients.

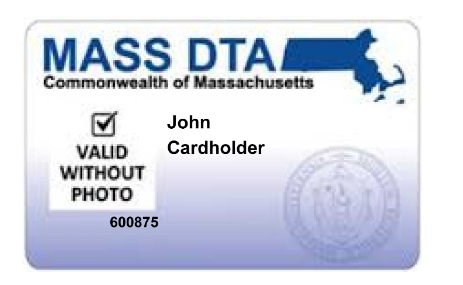

The Massachusetts SNAP advantages card appears to be like extra like a library card than a cost card. Oddly sufficient, each are reliant on the identical basically insecure expertise: The magnetic stripe, which shops cardholder knowledge in plain textual content that may be simply copied.

In September, authorities in California arrested three males considered a part of a skimming crew that particularly focused EBT playing cards and balances. The lads allegedly put in deep insert skimmers, and stole PINs utilizing tiny hidden cameras.

“The arrests had been the results of a joint investigation by the Sheriff’s Workplace and Financial institution of America company safety,” reads a September 2022 story from The Sacramento Bee. “The investigation targeted on unlawful skimming, significantly the high-volume cash-out sequence at ATMs close to the beginning of every month when Digital Advantages Switch accounts are funded by California.”

Armed with a sufferer’s PIN together with stolen card knowledge, thieves can clone the cardboard onto something with a magnetic stripe and use it at ATMs to withdraw money, or as a cost instrument at any institution that accepts EBT playing cards.

Skimming gear seized from three suspects arrested by Sacramento authorities in September. Picture: Sacramento County Sheriff’s Workplace.

Though it could be surprising that California — one in all America’s wealthiest states — nonetheless treats EBT recipients as second-class residents by issuing them chip-less debit playing cards, California behaves like most different states on this regard.

Extra essential, nevertheless, is the second manner SNAP playing cards differ from common debit playing cards: Recipients of SNAP advantages have little to no hope of recovering their funds when their EBT playing cards are copied by card-skimming gadgets and used for fraud.

That’s as a result of within the SNAP program, federal legislation bars the states from changing SNAP advantages utilizing federal funds. And whereas a few of these EBT playing cards have Visa or MasterCard logos on them, it isn’t as much as these corporations to switch funds within the occasion of fraud.

Victims are inspired to report the theft to each their state company and the native police, however many victims say they not often obtain updates on their circumstances from police, and, in the event that they hear from the state, it’s often the company telling them it discovered no proof of fraud.

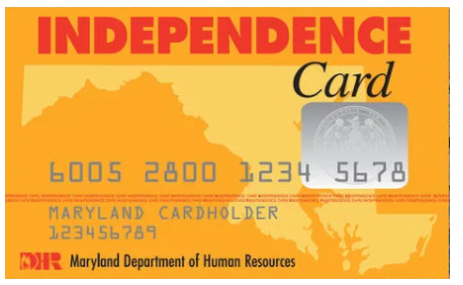

Maryland’s EBT card.

That’s in accordance with Brenna Smith, a reporter at The Baltimore Banner who lately wrote in regards to the case of a Maryland mom of three who misplaced practically $3,000 in SNAP advantages because of a skimmer put in at an area 7-Eleven. Maryland [Department of Human Services] spokesperson Katherine Morris informed the Banner there was proof of “a nationwide EBT card cloning scheme.”

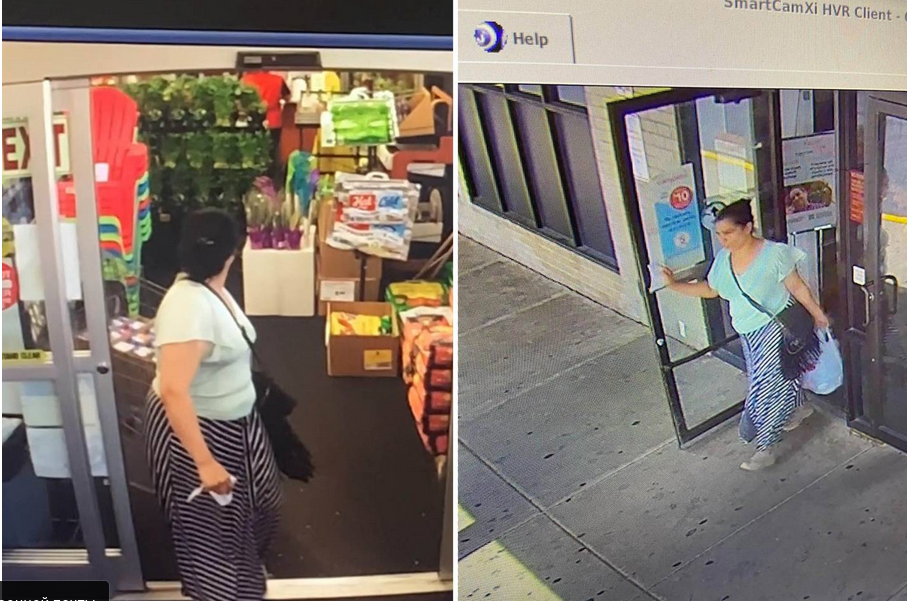

The lady profiled in Smith’s story contacted all the retailers the place her EBT card was used to purchase 1000’s of {dollars} value of child formulation. Two of these retailers agreed to share video surveillance footage of the individuals making the purchases on the actual timestamps laid out in her EBT account historical past: The movies clearly confirmed it was the identical fraudster making each purchases with a cloned copy of her EBT card.

Even after the police officer assigned to the sufferer’s case confirmed they discovered a skimmer put in on the 7-Eleven retailer she frequented, her declare — which was denied — remains to be languishing in appeals months later.

(Left) A video nonetheless exhibiting a pair buying virtually $1,200 in child formulation utilizing SNAP advantages. (Proper) A video nonetheless of a girl leaving from the CVS in Seat Nice. Picture: The Baltimore Banner.

The Heart for Regulation and Social Coverage (CLASP) lately printed 5 Methods State Businesses Can Help EBT Customers at Threat of Skimming. CLASP says whereas it’s true states can’t use federal funds to switch advantages until the loss was because of a “system error,” states might use their very own funds.

“Doing so will guarantee households don’t need to go with out meals, fuel cash, or their lease for the month,” CLASP wrote.

That might assist handle the signs of card skimming, however not a root trigger. Hardly anybody is suggesting the plain, which is to equip EBT playing cards with the identical safety expertise afforded to virtually everybody else taking part within the U.S. banking system.

There are a number of causes most state-issued EBT playing cards don’t embrace chips. For starters, no person says they need to. Additionally, it’s a good bit costlier to supply chip playing cards versus plain outdated magnetic stripe playing cards, and lots of state help packages are chronically under-funded. Lastly, there is no such thing as a vocal (or at the least well-heeled) constituency advocating for change.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23925969/acastro_STK045_04.jpg)