The next is a visitor submit from Shane Neagle, Editor In Chief from The Tokenist.

Half a yr after Bitcoin ETFs launched, it’s protected to say that they’ve been probably the most profitable ETF launch in historical past, having generated a $309.53 billion quantity. Simply inside the first day of buying and selling, spot-traded Bitcoin ETFs pulled in $4 billion, crushing the earlier file holder, Gold ETF (GLD), which took 3 days to prime $1 billion in inflows.

That is all of the extra spectacular as Bitcoin is a novel asset in comparison with historical gold. The pattern clearly factors to Bitcoin being fitter for objective within the digital age. However what’s that objective?

BlackRock’s Head of Thematic & Energetic ETFs, Jay Jacobs, lately famous that Bitcoin is a “potential hedge towards geopolitical and financial dangers”. By now, most individuals are conscious that central banks’ potential to tamper with the cash provide brings many ethical hazards, from record-breaking budgetary deficits to inflation as an additional layer of taxation to cowl these wild spending sprees.

Gold is much less suited to counter that potential as a result of it’s bodily, confiscatable, and never actually restricted. As a result of Bitcoin is one-tenth the scale of the gold market, its worth is extra risky, however additionally it is a extra engaging good points machine.

Now that Bitcoin ETFs have simplified and institutionalized entry to extra thrilling digital gold, which steps are wanted to make sure that pattern continues?

Making certain Community Reliability

Owing to its proof-of-work (PoW) consensus mechanism, Bitcoin is dual-natured. It’s a digital asset anchored into the bodily actuality of vitality and {hardware}. This underlying basis provides Bitcoin its worth as a decentralized counter to central banking.

In flip, the elements of that basis, the Bitcoin community, must scale as much as proceed the institutional consumption. Presently, the Bitcoin community handles round 412k transactions per day, practically double from two years in the past. Though the median transaction payment oscillates relying on community load, it hardly ever exceeds $5 per transaction.

In parallel, their networks must scale to make sure the Bitcoin community handles orders of magnitude better load coming from establishments. To extend their stability and robustness, they must deal with a number of community elements, from software program and servers to {hardware} and web connection.

Scalable Blockchain Options

Simply as IBM made vital contributions to creating present massive language fashions (LLM), the legacy pc firm additionally made a robust case for blockchain scaling with IBM Blockchain. This immutable ledger is predicated on an open-source Hyperledger Cloth framework with a whole set of instruments for constructing blockchain platforms.

Such a framework may interface with the Bitcoin ecosystem through atomic swaps, equivalent to digital vaults with timed good contracts. Equally, Visa proposed an experimental Common Cost Channel (UPC) framework as a hub for blockchain community interoperability. Worldwide banking community SWIFT had already accomplished the second check part for atomic settlement functionality.

Zooming out, an image emerges of enterprise-grade blockchain options for establishments, interlinking with worldwide hubs and intermediating with establishments that deal with publicity to Bitcoin, equivalent to Coinbase.

Reliable Servers

Powering scalable blockchain options comes within the type of {hardware}. These can both be inner servers, through custom-made options supplied by Broadcom, or offloaded to exterior choices just like the Canton Community.

As a decentralized infrastructure, the Canton Community is a community of networks, constructing on Daml good contract language and micro-services structure. The latter permits for every service plugged in to to have its personal server, expandable with extra CPUs and storage.

Utilizing atomic settlements, the Canton Community makes real-time settlement potential throughout completely different blockchain apps. By outsourcing companies to such networks, companies and establishments can give attention to core options fairly than IT infrastructure administration, together with the upkeep of CPUs, devoted GPU internet hosting to diversify into AI assist, and different important {hardware}.

Web Connectivity

Nodes in any blockchain community have to speak constantly to validate transactions and execute settlements by including them as the following block on the blockchain ledger. In different phrases, web connectivity essentially includes redundancy and failover methods.

For instance, when Solana skilled community downtime issues, co-founder Anatoly Yakovenko employed Soar Crypto to develop Firedancer as a secondary community validator consumer to fortify community throughput and stability.

With broader options just like the Canton Community, having fun with assist from the Massive Tech and Massive Financial institution, redundancies, multi-channels, backup methods, and cargo balancing are already baked into the DLT cake.

Enhancing Community Efficiency

It’s inherent in all forms of pc networks to endure from some degree of packet loss and jitter. Packet losses can occur as a result of overwhelming demand, inflicting congestion, community interference, defective software program or {hardware}, and knowledge corruption on laborious drives.

Transmission Management Protocols (TCP) take care of packet losses by retransmitting knowledge, which causes delays, or by Ahead Error Correction (FEC), which provides redundant knowledge to packets, eradicating the necessity for retransmission. The Bitcoin Relay Community makes use of FEC to this impact, as does the Blockstream Satellite tv for pc community, instead avenue to obtain Bitcoin blockchain knowledge.

As for jitter, sure knowledge packets can arrive at completely different intervals. When this jitter occurs, packets land in numerous orders, disrupting knowledge stream. The jitter drawback is often dealt with with buffers that briefly retailer streamed packets to make sure their right order arrival.

One other option to deal with jitter is to introduce high quality of service (QoS) community configurations that prioritize vital visitors. This can be utilized to scale back packet loss. Community design itself is a giant consider decreasing jitter by ensuring the community has as few hops as potential.

The Bitcoin community advantages from its decentralized design as a result of every transaction requires a number of confirmations. If jitter happens, later confirmations offset the delays. Most significantly, the Bitcoin mainnet has an auto-adjusting issue mechanism that maintains the typical block time at 10 minutes.

In apply, the administration of the community’s knowledge packet loss and jitter lands on on-site vs. ISP options.

On-site vs. ISP Options

On-site options require organizations to deal with their IT infrastructure. Whereas this offers establishments whole management, together with regulatory knowledge compliance and sooner personnel response, the upfront prices for {hardware} and storage are considerably greater.

Then again, ISP-hosted options are simpler to scale as specialised firms are prone to be well-oiled machines, dealing with each upkeep and community uptime. On the shoppers’ finish, this requires a dependable web connection and the collection of one of the best packet loss and jitter metrics.

Living proof, Amazon Net Companies (AWS) provides shoppers a International Accelerator instrument to boost and stability community efficiency. Alongside Amazon Managed Blockchain and Quantum Ledger Database (QLDB), such companies propelled AWS to change into one of many infrastructure pillars of the blockchain house.

As for ISPs themselves, they’re sometimes much less forthcoming on their jitter/packet loss metrics, as they depend on a number of elements. To that finish, there are various instruments to trace community latency, packet loss and jitter, equivalent to PingPlotter.

Jack Dorsey’s Block (former Sq.) opted to construct its personal Bitcoin mining community, using its 3 nm chip design, seemingly constructed by TSMC foundries. With an in-house, open-source mining hashboard, which is suitable with Raspberry Pi controllers, Block is heading to arrange new requirements for the Bitcoin ecosystem.

The opposite piece of the Bitcoin scalability puzzle revolves round vitality.

Sustainable Vitality Options

It’s usually stated that Bitcoin is digital vitality, or higher but, tokenized vitality. Finally, Bitcoin’s proof-of-work units it aside from 1000’s of copypasta cryptocurrencies, making it just about unassailable from a community safety standpoint. And that consensus algorithm exerts vitality, as anticipated from any work.

However how a lot and how much vitality? Bitcoin’s vitality expenditure is usually in comparison with a nation’s footprint, such because the Netherlands or Argentina. It’s sufficiently excessive for Greenpeace to name for a marketing campaign to vary Bitcoin from proof-of-work to proof-of-stake.

BRÆKING: @greenpeaceusa continues its SEXIST anti-#Bitcoin marketing campaign, releasing new video about “Bitcoin BROS.”

NEWSFLASH to Greenpeace misogynists: there are WOMEN in Bitcoin, & Bitcoiners is not going to stand by when you ERASE them.

Please retweet in case you suppose Greenpeace is sexist. pic.twitter.com/qX3emR8TaL

— Walker

(@WalkerAmerica) June 22, 2024

But Greenpeace itself may launch such a shift, provided that Bitcoin’s open-source code is accessible to all. The issue is that and not using a community and market curiosity, such a tweak could be meaningless.

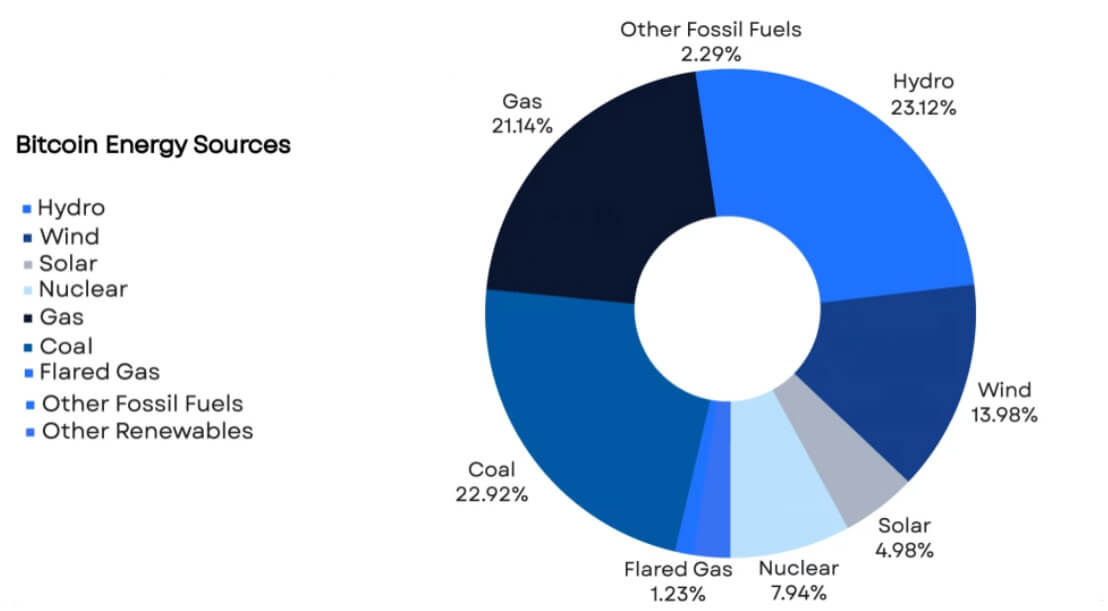

Within the meantime, over 50% of the Bitcoin community attracts energy from renewable sources. In accordance with Daniel Batten’s analysis through Batcoinz, most of it comes from hydro, wind, photo voltaic, and nuclear.

Not solely did Bitcoin step onto the majority-green territory, however it has been acknowledged as a key ingredient in balancing energy networks. Particularly, the Electrical Reliability Council of Texas (ERCOT) pays massive Bitcoin mining firms, equivalent to Bitdeer and Riot Platforms, to stabilize the grid throughout anomalous situations equivalent to warmth waves.

As lately as June thirteenth, ERCOT really helpful that Bitcoin mining be instantly built-in as a Controllable Load Useful resource (CLR) to spice up energy grid balancing. Moreover, there’s an rising pattern for Bitcoin miners to make use of flared gasoline from oil drilling operations. In any other case wasted and burned off, this byproduct might be captured to energy Bitcoin mining rigs.

Now that BlackRock, the principle driver of the ESG framework, is pushing Bitcoin, it is a clear sign to institutional buyers that the “soiled Bitcoin” narrative is a bygone concern.

Block has but to disclose its 100% solar-powered mining facility in West Texas. Nevertheless, a number of Bitcoin mining firms, equivalent to Bitfarms, Iris Vitality, TeraWulf, and CleanSpark, have already transitioned to near-zero carbon footprints.

With nuclear energy on the horizon as a result of AI knowledge middle calls for, buyers ought to count on even better greening of Bitcoin operations. And within the chance of Donald Trump’s victory within the subsequent presidential elections, Bitcoin sustainability issues will additional fade away.

Conclusion

In 2022, Messari famous that gold mining produces 3 times as many carbon emissions as Bitcoin. Since then, Bitcoin has outperformed gold ETF capital inflows by a fair better magnitude.

It seems that there’s nice worth to be present in an asset that can not be tampered with on a sensible degree and isn’t managed by anybody. Quite, Bitcoin is enforced by ingenious cryptography, tethering code to {hardware} belongings and vitality.

With capital rattling damaged, and entry to Bitcoin publicity placed on the identical degree as another inventory, it’s a race to new highs and new lows to purchase the dip. Constructing from the expertise of different blockchain networks and mining firms, the tech is available to faucet into this rising ecosystem.