Since April, the cryptocurrency market has been in a extreme downturn.

Bitcoin is down by 70% from all-time highs, whereas Ethereum is down 80%. Entire ecosystems, like Luna, have been obliterated, and dozens of altcoins and GameFi tokens have misplaced almost all their worth.

Buyers can obtain passive returns in a bull market by merely investing in beta to comply with the final pattern. However in bear markets, it doesn’t work. Amid these situations, we have to use alpha investing to search out funding alternatives.

Learn how to spend money on DeFi in a bear market

Use macro information to search out market developments

DeFi copies nearly all conventional finance fashions, from lending to monetary derivatives. The primary distinction between DeFi and conventional finance initiatives is the usage of sensible contracts, extra clear info on the chain and the minting of its token as an incentive.

Due to this fact DeFi has lots of the traits of conventional finance, but it surely lacks sturdy regulation resulting in excessive value fluctuations. DeFi doesn’t have extra real-world use circumstances exterior of constructing more cash on crypto, and most of the people discover it troublesome to onboard. Due to this fact, person development has stalled after an preliminary growth in curiosity.

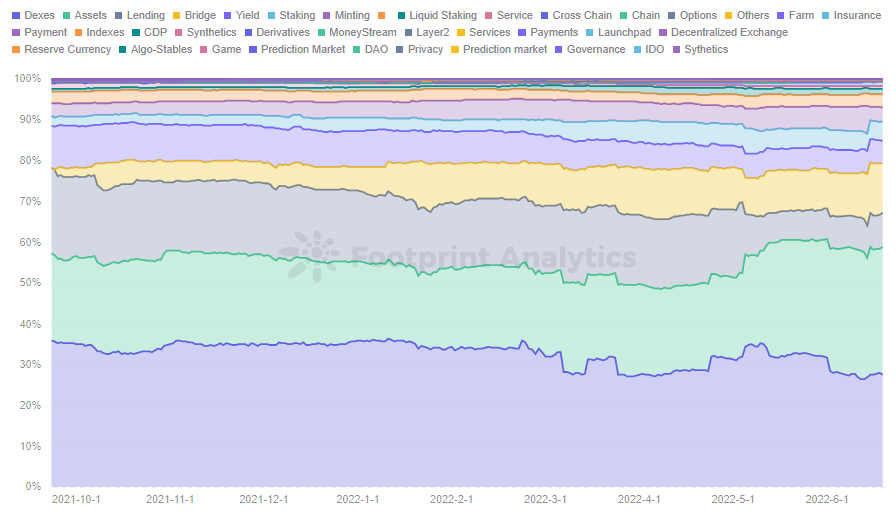

Based on information from Footprint Analytics, DEXs don’t stay the highest class inside DeFi by TVL, and its market share declined 40percentto 27%. Lending initiatives have been obliterated, dropping from second place at 20% to eight%]. Belongings and Bridge initiatives now occupy 31% and 12% of the market.

1.Use a Greenback Value Common technique

Greenback-cost averaging refers to allocating an equal amount of cash and investing it often. It contrasts with attempting to time the market, promoting at highs, and shopping for at lows.

We can’t inform when a token will hit backside within the present macro surroundings. So, it is sensible to place greenback value common into initiatives you imagine will survive long-term. Whereas steadily investing common sums of money is much less worthwhile than making excellent swing trades, it’s safer.

2.Stablecoin investing

FOMO feelings as a result of excessive cryptocurrency volatility make it troublesome to make good selections, particularly in bear markets, so utilizing stablecoins is a comparatively low-risk funding possibility. There isn’t a scarcity of investments in stablecoins on each Lending and DEX platforms, and a LP shaped with a stablecoin additionally protects in opposition to impermanent loss. Whereas stablecoins have extra use circumstances and fewer volatility, you will need to keep in mind that in addition they have threat.

Nonetheless, the safety of algorithmic stablecoins is a priority after the UST crash. The opaque info of centralized stablecoins additionally presents sure safety points, and the liquidation threat of overcollateralized stablecoins can also be regarding.

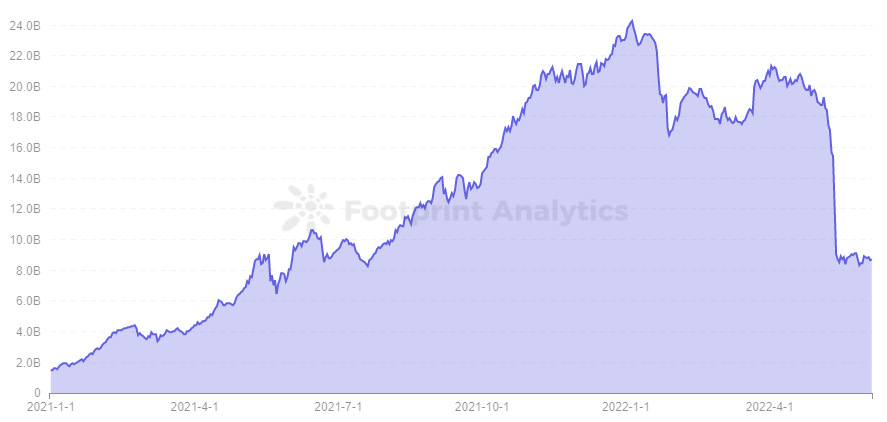

Based on Footprint Analytics, the plunge has induced a precipitous drop in TVL for Curve, DeFi’s largest stablecoin DEX platform. This exhibits that stablecoins aren’t so secure in spite of everything, so make investments cautiously.

Learn how to spend money on GameFi in a bear market

Use macro information to search out market developments

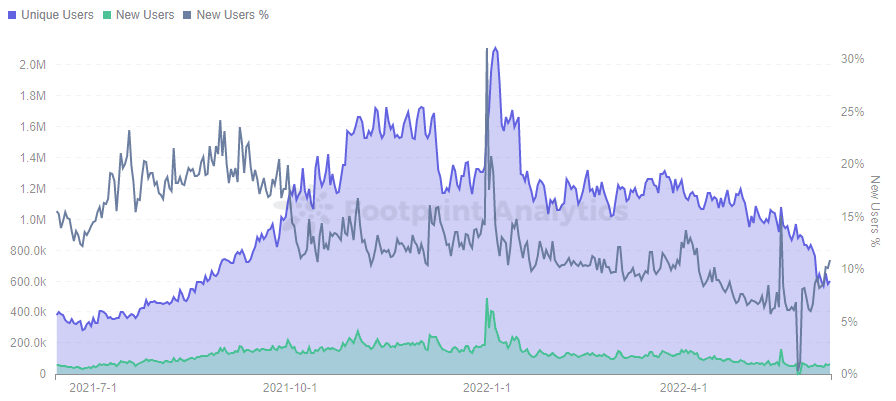

Information from Footprint Analytics exhibits that GameFi’s distinctive customers grew to a crescendo in late 2021, peaked once more in January, after which oscillated downward. A extra vital drop occurred in late Might, with a gradual decline in new customers. On June 8, there have been 65,000 new customers and 606,000 distinctive customers, solely 30% of the height.

GameFi 1.0 is quickly creating, and the most typical feeling amongst gamers is boredom. The present video games are much less playable, and many of the initiatives solely use tokens as a reward mechanism to draw many mining and promoting gamers. The challenge interval is principally just a few months.

Selecting a challenge to spend money on amongst many GameFi initiatives is troublesome. It’s a wonderful strategy to consider the challenge by way of challenge reputation, new participant development, retention of previous customers, and token issuing.

Enter on the early stage will likely be extra more likely to return the capital, and on the identical time, ought to pay extra consideration to the challenge’s dynamics, in keeping with the challenge’s dynamics in a well timed method to make selections and should seize the chance on the eve of token value fluctuations.

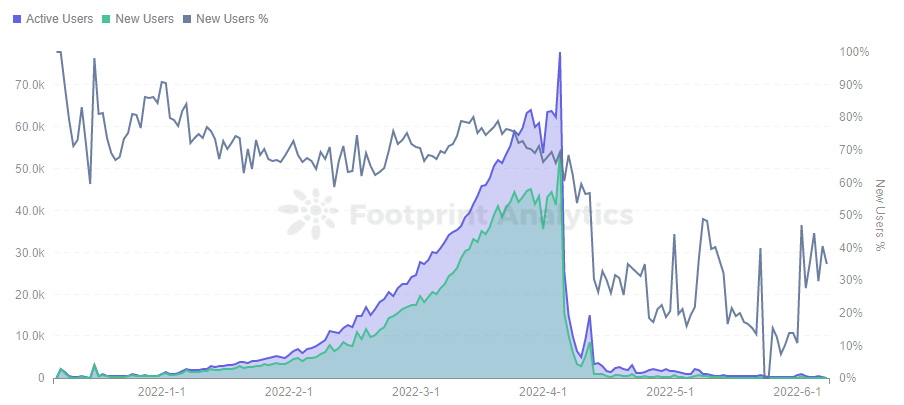

For instance, many customers appreciated StarSharks early mannequin, and numerous customers joined the challenge.

Nonetheless, the speedy inflow of customers induced the token to be overminted, and token inflation led to a value drop. When the challenge proprietor realized the issue and eliminated the rental market, person information additionally fell off a cliff, not in a position to entice new customers, and the token value fell right into a demise spiral.

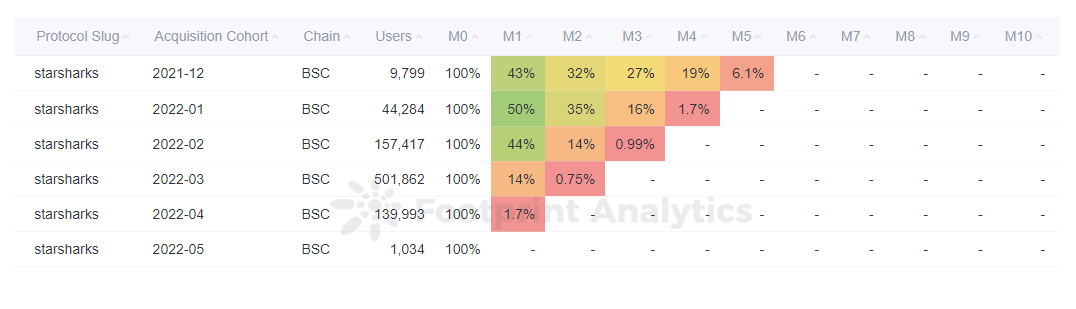

The drop in StarSharks can also be evident within the retention charge, with only one.7% of customers who entered the sport in April staying on. The previous customers within the earlier interval have been misplaced, and solely those that entered in December final 12 months nonetheless have 6.1% retention, presumably as a result of these customers have NFT at a decrease value and now have principally returned sufficient capital, and the output after that’s pure revenue. Due to this fact, it’s crucial to decide on the precise time to enter.

Along with taking note of the macro scenario of the general market, macro-control by the challenge can also be vital. Though that is opposite to decentralization, efficient management at an early stage can forestall token costs from surging and plummeting, permitting the challenge to develop extra completely. Due to this fact, it’s essential for customers to pay shut consideration to the challenge’s dynamics, such because the challenge’s comms or organized actions in the neighborhood, to have the ability to perceive the long run course and make the precise actions earlier than modifications happen.

As GameFi bottlenecks, some conventional builders are transferring into the world of blockchain, and VCs have been engaged on 3A video games for a very long time, with Illuvium, essentially the most well-known of them, gaining a number of consideration and a token value of $1,800 at its peak.

Though the event value of 3A video games is excessive and the interval is lengthy, the video games’ lovely graphics and wealthy playability will entice extra gamers who worth the intrinsic worth. Whether or not they can break the spell of the demise spiral can look ahead to the video games’ efficiency on-line this 12 months.

Funding in a bear market mustn’t solely be pinned on hypothesis but in addition on discovering such useful video games. There isn’t a doubt in regards to the improvement capacity of conventional recreation builders, however whether or not they can adapt to blockchain and make video games appropriate for cryptocurrency customers additionally wants to concentrate to their financial fashions.

- Take note of new methods to earn, cautiously

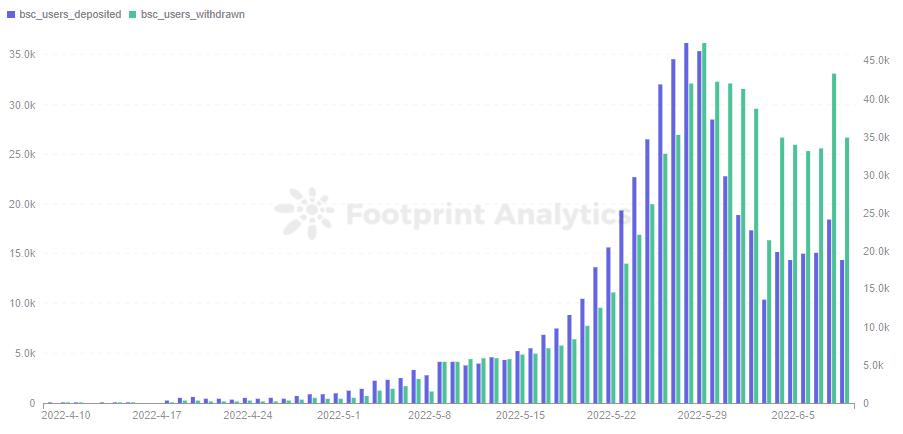

StepN introduced the X-to-earn mannequin to the forefront and was even as soon as considered the best way out of the demise spiral. Nonetheless, with a collection of detrimental information, it grew to become obvious from June that StepN’s withdrawals exceeded deposits on the BSC chain, and the token dropped all the best way.

Whether or not or not StepN’s try is profitable, the X-to-earn mannequin will likely be an space of consideration within the brief time period. It’s vital to see extra and select fastidiously, analyze the challenge’s personal worth benefits, and enter on the low level of the early stage of the challenge to attenuate the danger of being trapped.

Abstract

Conventional finance buyers use insider info to outperform retail. Whereas this nonetheless occurs in crypto, blockchain information is open and clear, which permits those that examine the information to slender the hole.

After understanding the macro pattern, you need to take part in group occasions to maintain up with info, examine on-chain information, then be cautious in making judgments however act shortly when doing sufficient analysis.

Date & Writer: June 24, 2022, Simon

Information Supply: Footprint Analytics – Investing in Bear Market Dashboard

This piece is contributed by the Footprint Analytics group.

The Footprint Neighborhood is a spot the place information and crypto fans worldwide assist one another perceive and acquire insights about Web3, the metaverse, DeFi, GameFi, or every other space of the fledgling world of blockchain. Right here you’ll discover energetic, numerous voices supporting one another and driving the group ahead.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualise blockchain information and uncover insights. It cleans and integrates on-chain information so customers of any expertise stage can shortly begin researching tokens, initiatives, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain information and make investments smarter with Footprint.