In Australia, the federal elections are set to happen on Could 21. There are only a few days left to know whether or not Scott Morrison will proceed because the Prime Minister or Anthony Albanese will take up the seat. As historical past tells us, pre-election and post-election instances are extremely risky for the share markets.

How do elections have an effect on markets?

Like different home and world elements, elections affect the inventory market. For example, if the present authorities wins, likelihood is greater for the market to go up as consistency in authorities reveals political stability.

Secondly, the manifesto framed by events has a big affect on the inventory market. If the events discuss financial progress and slashing taxes, the market might rise. Moreover, the federal government’s ideology performs an important function in market volatility. For example, if a celebration that helps in depth financial progress wins in exit polls (the mock polls performed earlier than elections), the inventory market rises immediately.

Within the debates and the manifestos, whichever industries the events discuss must increase. For example, if one social gathering says they wish to scale back taxation and supply incentives for the tourism trade, journey shares would rise.

The market tends to get extra risky earlier than, throughout, and put up the elections. Subsequently, traders should be additional cautious to minimise threat and optimise stability and revenue.

GOOD SECTION: Which insurance policies are unveiled by the Australian opposition forward of elections?

Supply: © 2022 Kalkine Media®

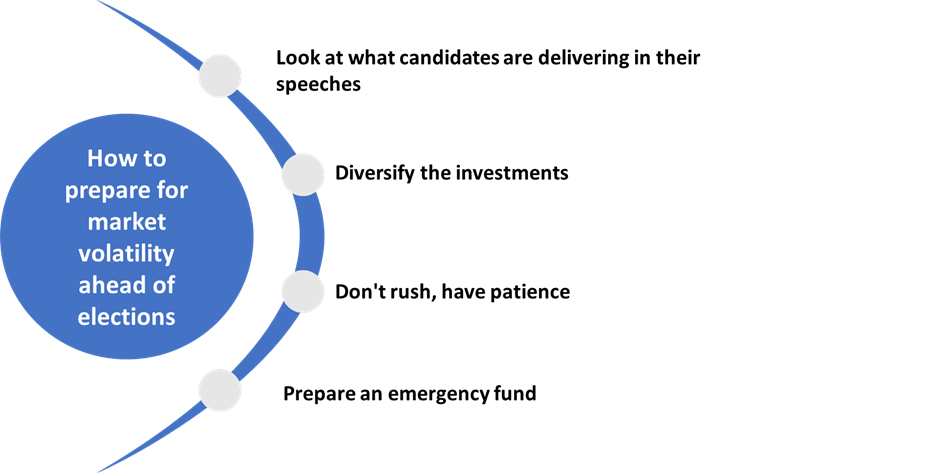

How one can put together for market volatility forward of elections?

- Have a look at what candidates are delivering of their speeches: That is the time when Aussies ought to have a look at what Morrison and Albanese are speaking about. For example, through the second spherical of their debates, they particularly talked about a couple of industries their respective events would assist extra. Thus, traders ought to pay extra heed to such enterprises to make sure good points.

- Diversify investments: The golden means of defending oneself towards excessive market volatility is to diversify the portfolio. It helps if a specific trade falls immensely, the investor stays protected as a result of they did not make investments a lumpsum quantity in just one sector, slightly selected to diversify.

INTERESTING READ: Australia Federal Elections 2022: Will Covid wave see Aussies solid their vote by way of telephone?

- Do not rush, have endurance: Amid market volatility, many individuals make the error of pulling all their cash out, and there are excessive possibilities of making losses in such instances. Thus, one ought to research the market accurately and never feed the beast considerably once they have invested for the long run.

- Put together an emergency fund: In instances of uncertainty, the one golden rule of investing is to arrange an emergency fund. The emergency fund will hold traders afloat even when the portfolio doesn’t yield a lot earnings.

All in all, the inventory market is prone to oscillate for some extra time until the mud settles down. As these sinusoidal developments proceed, traders can suppose long-term and preserve a powerful temperament with out letting worry or greed affect their funding selections.