Why you’ll have to rethink your consumer progress technique

Downturns basically rewrite the business’s technique (and expectations) for consumer progress. In a bull market, the main focus is on prime line progress. You typically need 2-3x YoY for a a brand new product in its first few years, and even sooner when its proper out the gate. Excessive progress and excessive burn are fantastic. As a result of if you should spend some huge cash to get there, whether or not via paid advertising or partnerships, you do it… in spite of everything, you possibly can simply elevate extra money, proper?

However in a bear market, the reply adjustments: No. It seems, you gained’t be capable to simply elevate extra money to maintain going. No, you possibly can’t simply count on to rent dozens of engineers, no matter progress — notably when hiring freezes are coming into impact. For startups, the bar for elevating the subsequent spherical simply went manner up, as many traders are ready out the turbulent market. This implies the technique for consumer progress simply went from “as a lot as doable” to “environment friendly, worthwhile, productive” in just some quarters.

What are some methods try to be rethinking your progress technique? Right here’s some issues each group must be eager about:

- Embrace the brand new regular

- Lower your advertising spend

- Laser focus in your engaged, excessive LTV customers

- Dwell to battle one other day

I’ll unpack a few of these as we go.

The brand new regular

Environment friendly progress is now the important thing focus for product groups. Throughout a bull market, the first metric that individuals discuss is simply top-line progress — what’s your year-over-year progress fee. A number of the actually eye-popping progress charges may exceed 10x YoY, typically backed with investor cash — as has been within the case with on-demand companies.

Nevertheless, the brand new regular is concentrated on environment friendly progress. Though there’s a ground for how briskly a product has to develop to be attention-grabbing — in all probability one thing like 2.5x — there’s a a lot greater emphasis on effectivity. What’s one of the best ways to measure this? One metric that’s been lately popularized by David Sacks is the “Burn A number of” — he defines it beneath:

Burn A number of = Internet Burn / Internet New ARR

This places the main focus squarely on burn by evaluating it as a a number of of income progress. In different phrases, how a lot is the startup burning with a view to generate every incremental greenback of ARR?

In different phrases, should you spend $10M and achieve $5M extra in annual recurring income, that’s a 2x burn a number of — which he grades as “Suspect.” The Burn A number of metric is straightforward, however it’s exactly helpful as a result of it’s so easy. Plenty of instances, unit economics are hand-waved by product groups as a result of some prices are excluded from the contribution margin or web income calculations that possibly shouldn’t be — like headquarters prices, actual property, and so forth.

Burn a number of cuts via all that, because it’s simply mixture money versus income, and it’s arduous to cover something with a metric so easy. And with this straightforward metric, it permits you additionally evaluate totally different corporations, and probably totally different eventualities for a given firm, to determine the right way to greatest scale back it.

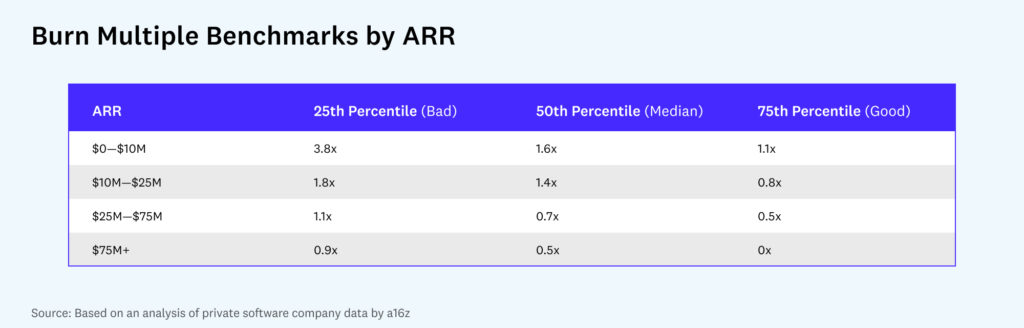

To supply some benchmarks, my colleagues at a16z, Justin Kahl and David George, lately wrote an article on navigating the downturn the place they collected some empirical information:

As you possibly can see, the bar for what constitutes a superb burn a number of goes up as income goes up. Naturally, you burn extra upfront throughout the product growth section, after which get extra environment friendly because the enterprise will get scale.

From a product progress lens, the shift from topline progress to environment friendly progress signifies that try to be eager about how a lot burn, what number of engineers, and the way a lot advertising is required to hit the milestones you wish to attain. And the primary inquiries to ask are sometimes round advertising.

Lower your advertising spend

The primary and easiest factor to do is to chop your advertising spend. And in a selected order:

- Hold the excessive ROI channels, lower the low ROI ones, even when they supply quantity

- Give attention to accountable spend, and scale back ones have a protracted/fluffy payback?

- Rethink model advertising spend — do you really want it?

On the primary level, each advertising/progress effort is constructed from layers of channels constructed on prime of one another. The very best ROI tends to be channels like search engine marketing, phrase of mouth, and different natural efforts. The subsequent could be paid channels like newsletters, that are arduous to scale however extremely productive. Then there’s extremely focused paid advertising. Often the bottom ROI tends to be broad concentrating on — notably show adverts — on giant promoting networks.

Often these layers are constructed over time, one after the other, by progress advertising people who preserve investing and arbitraging 10:1 LTV/CAC ratios down to three:1, then 1.5:1, earlier than they decelerate. There may also be ongoing advertising experiments to attempt new short-format video or in any other case. It’s time to unwind that. Often every incremental channel may add extra quantity, however isn’t as environment friendly because the previous efforts. There’s a diminishing returns — Regulation of Shitty Clickthroughs strikes once more — as every layer is constructed. As an alternative, return to the core.

The opposite vector to consider that is direct response versus model advertising. Model efforts are a good way to spend cash with out understanding its precise effectiveness to impression metrics, and it’s time to dial these down. Whether or not it’s giant scale occasions, model advertising, PR/comms, splashy movies, or in any other case — except you possibly can justify the prices, it’s time to scale back.

Both manner, it’s time to retrench and give attention to excessive intent, low CAC channels.

Laser focus in your engaged, excessive LTV customers

In a sizzling market, there’s typically a land seize to accumulate as many customers as doable. If there’s a purpose to develop 10% in a time interval, the stress is usually to develop 10% by buying a mass of recent customers — most of which can burn off from decrease utilization — when the higher possibility could be to develop 10% by incentivizing greater engagement from current, core customers. At Uber, it was typically famous that it was a lot sooner to get drivers to spend 10% extra time on the platform, in order that there’d be extra “provide hours” to react to demand — than to accumulate 10% extra drivers in a market. The latter would require an enormous advertising push, and may take weeks for the drivers to ramp as much as the identical stage of engagement.

The explanation why this dynamic exists — the place the core customers outperform new ones — is that there’s typically a central section of the place the product is de facto working, after which an “Adjoining Person” the place it solely form of works. For instance, early Instagram was working properly with high-tech, city customers however not properly in any respect inside older demographics. Later, it wasn’t working properly for Android customers in rising markets. However there’s typically stress to develop by capturing new segments of customers, reasonably than bettering on the core, which signifies that the customers that are available in via advertising channels are worse high quality, decrease intent, and fewer engaged than the core.

This may develop into a tradeoff between Advertising versus Product-Led Development, the place the previous drives CAC, whereas the latter is constructed on product growth prices. The benefit of progress pushed throughout the product — whether or not that’s higher consumer onboarding, excessive impression options, or in any other case — is that they impression a large swath of customers throughout the product. You possibly can make investments as soon as and get advantages over a protracted time frame, and amortize prices throughout a big section of customers. I’d lean in the direction of product, when doable, when the roadmap is evident on what to do. Clearly advertising spend and engineering time isn’t interchangeable, however lowering advertising budgets whereas sustaining/rising product groups seems like a superb commerce.

Dwell to battle one other day

The milestones required to unlock extra funding/headcount has nearly actually gone up, and particularly for startups, the bar wanted to lift extra enterprise capital cash has gone up as properly. Understanding these milestones will permit groups to battle one other day, and arising with a sensible plan is a key step.

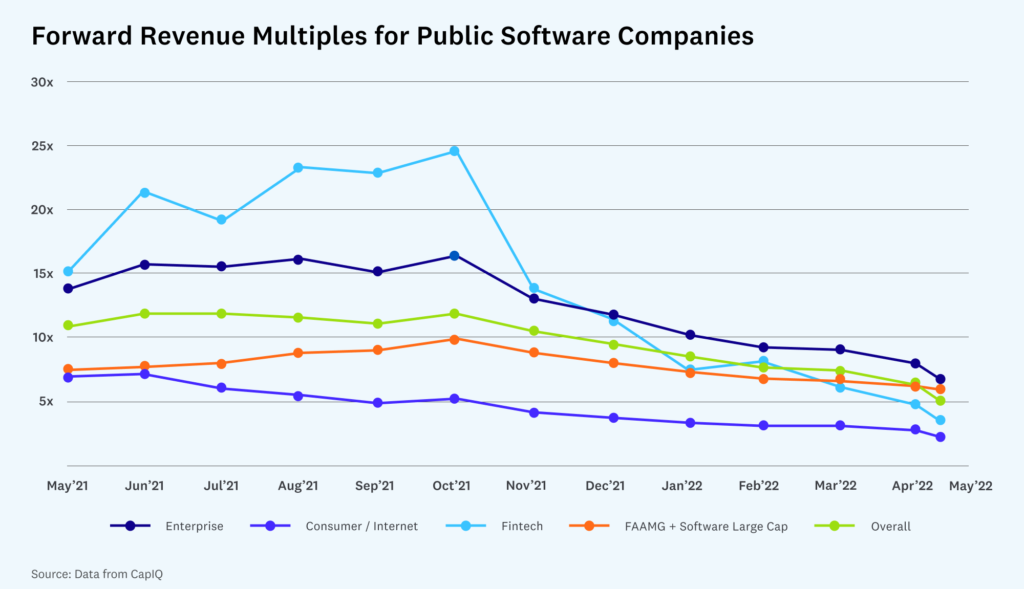

The easiest way to know how the bar has moved is will be proven by a chart within the aforementioned article shared by my a16z colleagues David and Justin, displaying how the ahead income a number of for public corporations are down considerably. That means, you want way more income to justify the identical valuation — what was once a 15x a number of is now 7x, that means valuations are down half even given the identical income numbers.

Or stated one other manner, when the valuation of public software program corporations will get halved, then the quantity of income wanted to justify the a valuation goes up double. (For early merchandise that suppose extra about Lively Customers or DAUs or in any other case, you possibly can recreate these graphs primarily based on $/DAU or in any other case — and sure, these are manner down)

That is inflicting a domino impact within the business. Once you see a $2B public firm lower all the way down to $1B, then a $500M privately held startup is lower all the way down to $250M, and so forth. The difficult half is that for a public firm, after all you’ve gotten a real-time inventory quote to see these valuation adjustments. For a tech startup, you elevate new funding rounds yearly or two. Which means for a lot of the business, the subsequent spherical of a startup simply turned a lot, a lot more durable, however we probably gained’t know for a yr+ how a lot the bar has moved. Both manner, this implies fewer assets to hit the identical arduous progress targets.

The simplest strategy to flex to hit these elevated targets is to take extra time, with greater effectivity. Groups have to purchase extra runway, specializing in higher ROI and never a “excessive progress, excessive burn” mindset to hit the expansion metrics. For startups who’ve lately raised, they’ll have to “catch up” on their most up-to-date valuation, and moreover progress to justify the customary 2-3x bounce in valuation between rounds. That’s the brand new bar.

Conclusion

The subsequent few years are going to see a whole lot of change within the tech panorama, notably for the way groups consider rising their merchandise. A lot of the final decade has been targeted on progress by any means — and investor subsidies, chasing quantity through excessive CACs, have all performed a key function. However within the subsequent section, effectivity signifies that we’ll have to retrench throughout the business and discuss high quality and effectivity.

There’s a myriad of advanced developments intersecting on the identical time: The brand new Apple privateness adjustments to advert networks, the possibly stingy enterprise capital panorama, the hiring freezes which are occurring, how web3 performs out over the subsequent few years, and so forth. Simply as product leaders needed to reinvent their considering to make the most of the cell increase, we’ll see them do the identical within the coming years for the brand new surroundings that’s quickly taking form. Within the meantime, it’s important for groups to take a pause, determine a brand new strategy, and construct in the direction of the subsequent increase.

PS. Get new updates/evaluation on tech and startups

I write a high-quality, weekly e-newsletter masking what’s occurring in Silicon Valley, targeted on startups, advertising, and cell.

Views expressed in “content material” (together with posts, podcasts, movies) linked on this web site or posted in social media and different platforms (collectively, “content material distribution retailers”) are my very own and will not be the views of AH Capital Administration, L.L.C. (“a16z”) or its respective associates. AH Capital Administration is an funding adviser registered with the Securities and Change Fee. Registration as an funding adviser doesn’t suggest any particular talent or coaching. The posts will not be directed to any traders or potential traders, and don’t represent a proposal to promote — or a solicitation of a proposal to purchase — any securities, and will not be used or relied upon in evaluating the deserves of any funding.

The content material shouldn’t be construed as or relied upon in any method as funding, authorized, tax, or different recommendation. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others. Any charts supplied listed here are for informational functions solely, and shouldn’t be relied upon when making any funding resolution. Sure info contained in right here has been obtained from third-party sources. Whereas taken from sources believed to be dependable, I’ve not independently verified such info and makes no representations concerning the enduring accuracy of the knowledge or its appropriateness for a given state of affairs. The content material speaks solely as of the date indicated.

Not at all ought to any posts or different info supplied on this web site — or on related content material distribution retailers — be construed as a proposal soliciting the acquisition or sale of any safety or curiosity in any pooled funding car sponsored, mentioned, or talked about by a16z personnel. Nor ought to it’s construed as a proposal to supply funding advisory companies; a proposal to spend money on an a16z-managed pooled funding car will probably be made individually and solely by the use of the confidential providing paperwork of the precise pooled funding autos — which must be learn of their entirety, and solely to those that, amongst different necessities, meet sure {qualifications} below federal securities legal guidelines. Such traders, outlined as accredited traders and certified purchasers, are typically deemed able to evaluating the deserves and dangers of potential investments and monetary issues. There will be no assurances that a16z’s funding aims will probably be achieved or funding methods will probably be profitable. Any funding in a car managed by a16z entails a excessive diploma of danger together with the chance that the complete quantity invested is misplaced. Any investments or portfolio corporations talked about, referred to, or described will not be consultant of all investments in autos managed by a16z and there will be no assurance that the investments will probably be worthwhile or that different investments made sooner or later may have comparable traits or outcomes. An inventory of investments made by funds managed by a16z is obtainable at https://a16z.com/investments/.

Excluded from this listing are investments for which the issuer has not supplied permission for a16z to reveal publicly in addition to unannounced investments in publicly traded digital belongings. Previous outcomes of Andreessen Horowitz’s investments, pooled funding autos, or funding methods will not be essentially indicative of future outcomes. Please see https://a16z.com/disclosures for extra necessary info.