Up to date on October 18, 2022

Amongst different devices like Foreign exchange and Crypto, there may be one that’s often most popular by extra skilled buyers. Novice merchants are inclined to overlook it because it might sound extra difficult than the extra simple and acquainted choices. This instrument is known as an ETF — exchange-traded fund.

What are ETFs?

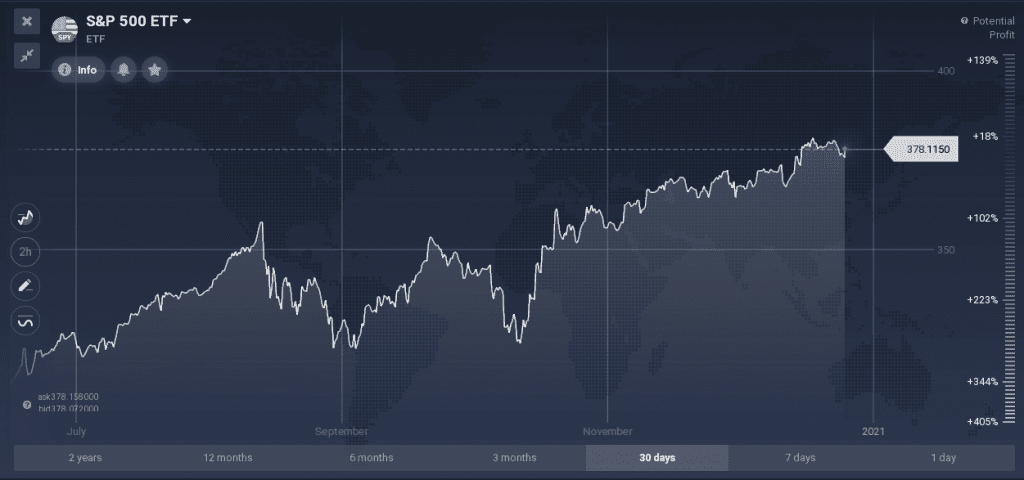

An exchange-traded fund is a kind of buying and selling instrument that combines a set of securities, (shares, commodities, currencies and so on.), and it typically tracks an underlying index. For instance, a well known index S&P 500 is tracked by S&P 500 ETF (SPY).

ETFs may be purchased and offered identical to common shares, which makes it a versatile and handy instrument. Since it’s primarily a basket, it combines each dangerous and fewer dangerous belongings, permitting for extra diversification.

If you want to study extra about ETFs, check out this video explaining the particular traits of those belongings.

Tips on how to commerce ETFs on IQ Choice?

On the IQ Choice platform, it’s attainable to commerce CFDs on ETF belongings. It implies that in the intervening time of opening the deal, a dealer makes a prediction concerning the value change of the ETF.

Merchants could speculate whether or not the value will develop or fall, with out having to really personal the asset. Here’s a step-by-step on the right way to commerce S&P 500 ETF and different ETFs on IQ Choice.

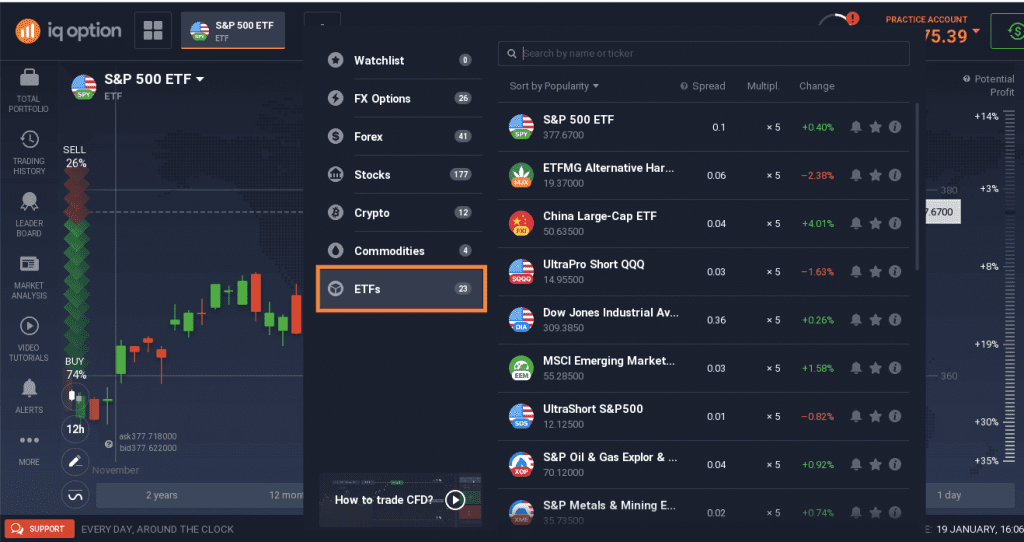

- Firstly, it’s possible you’ll select the asset that you just desire from the checklist of accessible ETFs. The checklist contains many alternative choices for each form of dealer.

The above-mentioned S&P 500 ETF (SPY) is likely to be appropriate, for instance, for these in search of know-how and financial institution shares. Dow Jones Industrial Common ETF (DIA), as an example, could curiosity these looking for for a fund that features industrial firms whereas Power SPDR (XLE) is an exchange-traded fund that follows the efficiency of the Power Choose Sector Index, and it could be appropriate for merchants within the vitality subject.

Every ETF has an outline within the “Data” part, so don’t hesitate to learn and study all belongings earlier than making a selection.

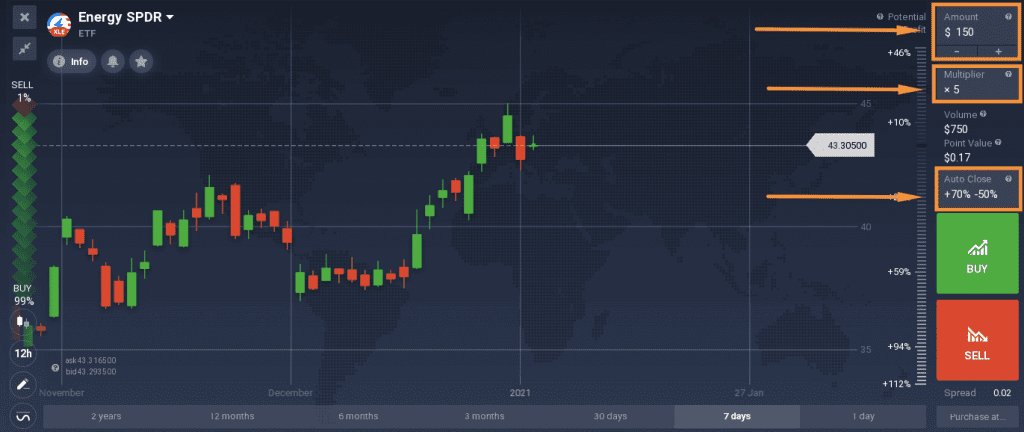

- Secondly, if you’re trying to open a deal on the chosen asset, it’s possible you’ll choose the funding quantity, in addition to a multiplier and cease loss and take revenue ranges. You will need to observe {that a} multiplier could maximize the constructive final result, however it will probably additionally maximize losses in case of an incorrect prediction. These steps coordinate with buying and selling on different CFD belongings, like Foreign exchange or Shares.

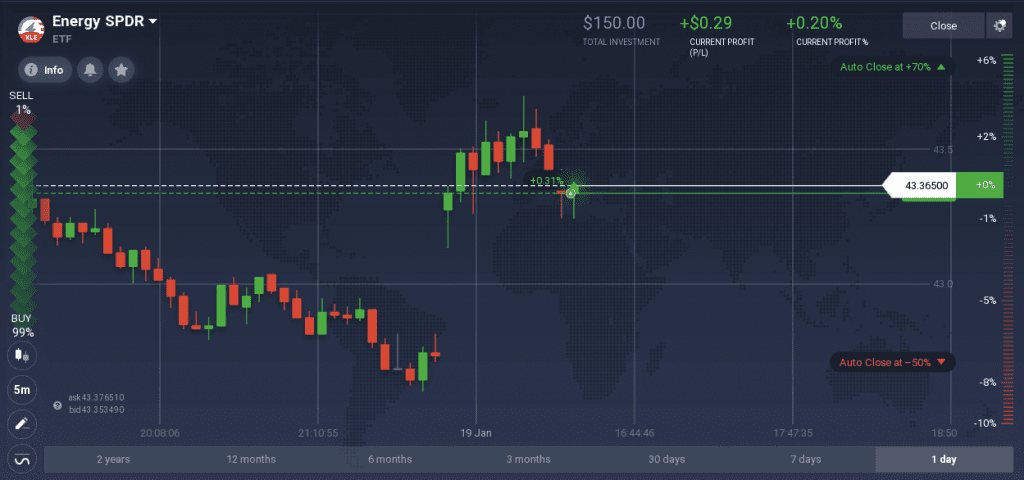

- As soon as the commerce particulars are set, it’s possible you’ll click on on “Purchase” or “Promote” relying in your expectation of the ETF’s value efficiency. When you click on the button, the deal is open.

- It’s attainable to maintain the commerce open for so long as you want, however thoughts your cease loss and take revenue ranges, in addition to the in a single day charges. All the chance administration strategies must also be utilized, as although ETF belongings indicate diversification, they don’t assure constructive outcomes. As soon as you might be glad with the end result, it’s attainable to shut the deal by clicking on the “Shut” button.

As with all instrument, it’s possible you’ll make the most of technical and elementary evaluation with a view to consider the ETF’s efficiency. Intently following the sphere that the ETF covers may additionally be a very good determination.

Conclusion

ETF belongings could also be an answer for merchants who want to diversify their portfolio with out buying quite a few shares and spending a big capital. With ETFs, it’s attainable to decide on the sphere you want to put money into and discover the fund that fits your technique greatest. As ETFs are traded like shares, they are often purchased and offered at any second, relying on the dealer’s choice.

Now that you already know all of the fundamentals, you might be able to check out CFD-type buying and selling on ETFs on the observe stability. Please tell us what you suppose within the feedback!