Let’s focus on what a buying and selling journal is, the way to create one, the way to use it, and why it is advisable to have one.

Buying and selling journals can play a significant position in funding methods, no matter a consumer’s market experience. They’re helpful instruments to plan future trades, monitor one’s buying and selling efficiency, and optimize earnings. It additionally turns into simpler to study from previous errors when merchants bookmark shedding trades of their buying and selling journals.

A buying and selling journal is vital for merchants to investigate their commerce historical past. In any other case, it might be tough to trace buying and selling positions-both profitable and shedding. Let’s focus on what a buying and selling journal is, the way to create one, the way to use it, and why it is advisable to have one.

A buying and selling journal is a file containing all of the related particulars of the trades a consumer makes and the explanation behind these trades. The doc comprises every little thing a dealer does, from technique improvement and danger administration to psychology and logic. Severe merchants use buying and selling journals to establish patterns of their buying and selling journey and enhance their market efficiency to keep away from repeating poor market decisions.

Apart from commerce evaluation, a dealer might file the components that led to the ultimate funding determination. This manner, the data turns into accessible for analyzing why a commerce went flawed or proper and how one can enhance.

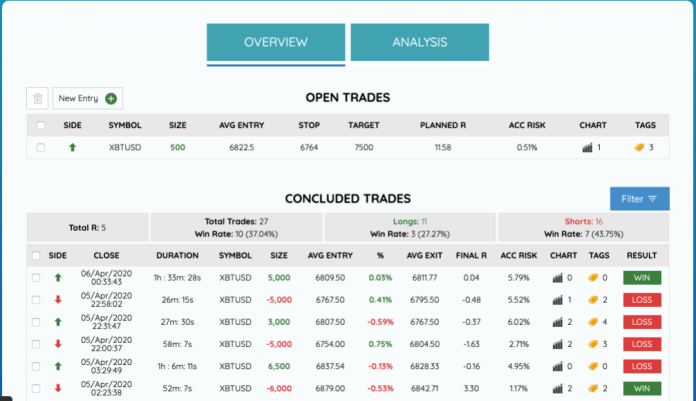

Making a crypto buying and selling journal doesn’t require any technical expertise. Anybody can discover buying and selling journal templates on the web. Some examples embrace Coin Market Supervisor, TraderSync, TraderVue, Edgewonk, and Journalytix. Whereas there are free templates, it’s essential to construct a buying and selling journal custom-made to your particular buying and selling wants and magnificence.

To make a custom-made journal, first draft a spreadsheet or doc to file your buying and selling actions, plans, and selections. Afterwards, you’ll have to experiment and discover a construction that can have probably the most influence in your buying and selling journey. Which means that your spreadsheet or doc ought to comprise columns associated to each commerce made. Some attainable information columns embrace:

You can even embrace elective columns for screenshots of trades or setup and time frames. The target is to incorporate all of the related info that may enhance your development as a dealer or investor. It additionally helps to have an additional tab or part to summarize your concepts and ideas about each commerce, so you’ll be able to analyze your individual buying and selling efficiency.

Making a crypto buying and selling journal is the straightforward half; understanding the way to implement it is a little more tough. Writing prolonged buying and selling journals repeatedly helps one develop into accustomed to them and the way they function. Your buying and selling expertise and methods will typically enhance by sustaining a journal and evaluating your buying and selling patterns.

Contemplate this: you want a superb cause to enter a commerce, and also you get concepts, ideas, or emotions each time you have a look at the market. Writing them down may also help you see one thing that might probably enhance or damage your buying and selling efficiency, like previous trades, potential trades, common market habits, and present trades. Moreover, you’ll be able to jot down the arguments over particular commerce concepts, which you’ll later consider.

It’s essential that the spreadsheet be well-organized and up-to-date. Correct data allow you to consider the profitability of your concepts. Moreover, recording trades instantly after you execute them will prevent time sooner or later. Taking a look at your commerce portfolio daily offers you insights into your publicity degree and new angles to enter trades.

Usually, completely different trades want completely different approaches, so having a number of buying and selling methods based mostly on market circumstances is essential. Write them in your buying and selling journal for future reference, and to successfully observe your progress. It could additionally forestall you from over-trading, particularly when you could have a number of positions opened concurrently. Understanding the variety of trades and positions you could have that day makes it simpler to keep away from over-trading.

Holding observe of all of the trades you make, even with small investments, is unattainable with no buying and selling journal. A buying and selling journal may also help you assess your buying and selling account and historical past, in addition to who you might be as a dealer. The knowledge garnered from profitable trades lets you establish the components that made the trades excel, particularly if the market was risky.

Moreover, info like entry value, place dimension, exit value, and buying and selling charges positions you forward of different market contributors.

Having a grasp on each buying and selling exercise means that you can improve your crypto buying and selling expertise and enhance your decision-making talents.

Buying and selling journals assist customers file every bit of knowledge associated to the trades they make, from concepts and emotions to commerce execution and final result. Measuring and analyzing this info permits merchants to make extra knowledgeable selections sooner or later and improve their market efficiency.