Through the growth of cryptocurrencies, occasions like BTC halving, LTC halving, and DASH’s emission discount have gained a lot highlight out there. Mining rewards per block have dropped in these halvings or reductions, probably squeezing miners’ pockets. Conversely, market merchants see these halving occasions as indicators of recent market traits.

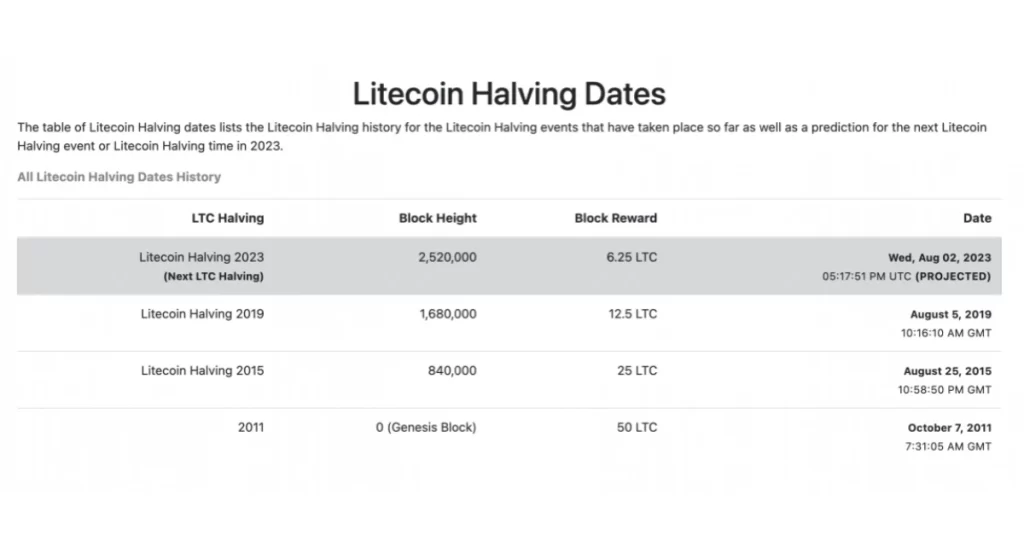

Primarily based on information from LITECOIN HALVING, as of July 25, 2023, Litecoin’s block reward is about to halve from 12.5 LTC to six.25 LTC on August 23, 2023. There are nonetheless 4,845 blocks remaining till the following LTC halving occasion.

With the LTC halving approaching, LTC has gained appreciable market consideration. Each miners and merchants are intently following this occasion as it might current new funding alternatives through the halving interval.

Much like BTC, LTC has its block rewards halved each 4 years. Within the historical past of cryptocurrency growth, LTC has already skilled two halvings: the primary one occurred on August 25, 2015, lowering the miner’s block reward from 50 LTC to 25 LTC, and the second occurred on August 5, 2019, reducing the reward to 12.5 LTC. The upcoming LTC halving this August will additional scale back the reward to six.25 LTC. Primarily based on related information, LTC halving will proceed till roughly 2142 when the block reward reaches 0.

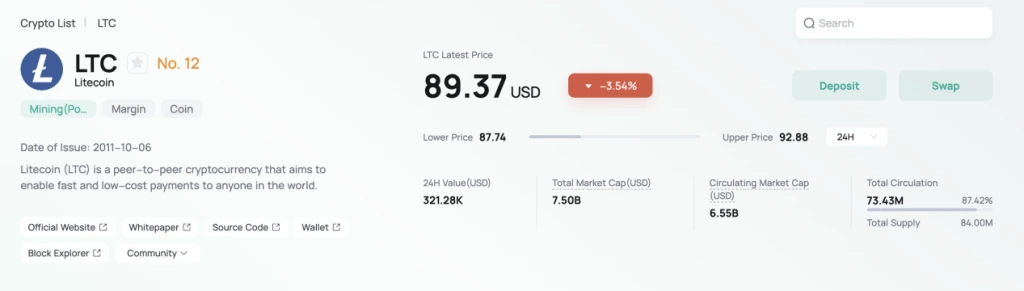

Following the LTC halving in August 2023, the provision of LTC will lower, leading to short-term worth fluctuations out there. For merchants, this will likely current an funding alternative as they’ll revenue from the worth fluctuations of LTC. As of July 25, 2023, market information from CoinEx reveals that LTC is at present priced at $89.37 with a complete market cap of $7.50 billion. Over the previous month, the worth has decreased by 0.41%, to $113.47 on July 3 earlier than fluctuating downwards.

Because the LTC halving occasion attracts close to, LTC witnessed a notable worth enhance in early July, however it did not maintain the upward momentum and started fluctuating downwards. Given the discount in miner rewards and its influence on the safety of the LTC community, investing in LTC demonstrates buyers’ belief in community safety.

Regardless of the challenges it poses for miners, the LTC halving additionally contributes to stabilizing the coin’s worth and preserving its shortage. This might make LTC admire in worth and supply extra interesting returns to miners. Contemplating the previous BTC halving occasions, which garnered market recognition and stimulated long-term progress, the LTC halving remains to be a chance for buyers, whatever the present market efficiency. Nevertheless, it’s important to notice the dangers concerned in investments. Merchants ought to analyze market information objectively, handle buying and selling dangers, and keep away from blindly following market sentiments or going all-in on LTC.

CoinEx’s Market Knowledge characteristic gathers real-time information on numerous cryptocurrencies on the trade, integrating coin rankings, order distribution, worth change distribution, and historic market worth to fulfill customers’ various wants for info. With this characteristic, customers can entry priceless market information, observe real-time worth adjustments and buying and selling volumes of various cryptocurrencies on CoinEx, and keep up to date with market traits. Furthermore, by analyzing market information, everybody could make extra knowledgeable buying and selling choices and mitigate buying and selling dangers. Through the LTC halving interval, customers can monitor LTC’s worth fluctuations and buying and selling standing in real-time on CoinEx as a reference for his or her investments.