Claims about crypto alternate Huobi’s monetary well being and its executives’ authorized entanglements have fueled market hypothesis over the weekend.

Huobi has been witnessing continued outflows from its whole locked-up worth (TVL), dropping to $2.4 billion from a stage of $3 billion in July. As reported by FX168 Monetary Information, there have now been rumors that a number of Huobi alternate executives had been taken into custody by the Chinese language police.

Nonetheless, these claims have been categorically denied by Justin Solar, a worldwide advisor to the corporate, who took to social media to debunk the rumors. Regardless of these assurances, the market sentiment remained skeptical because the outflow continued.

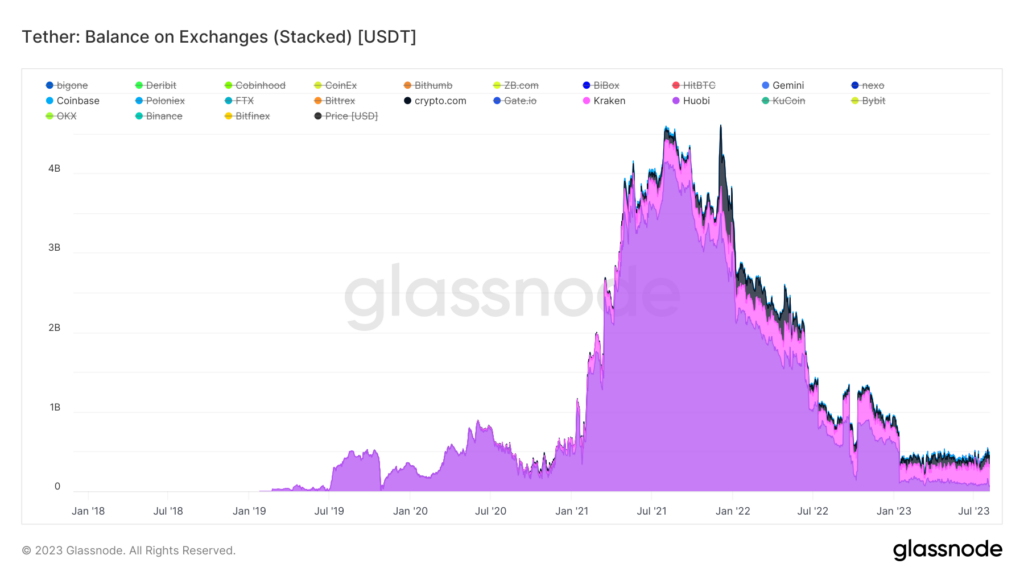

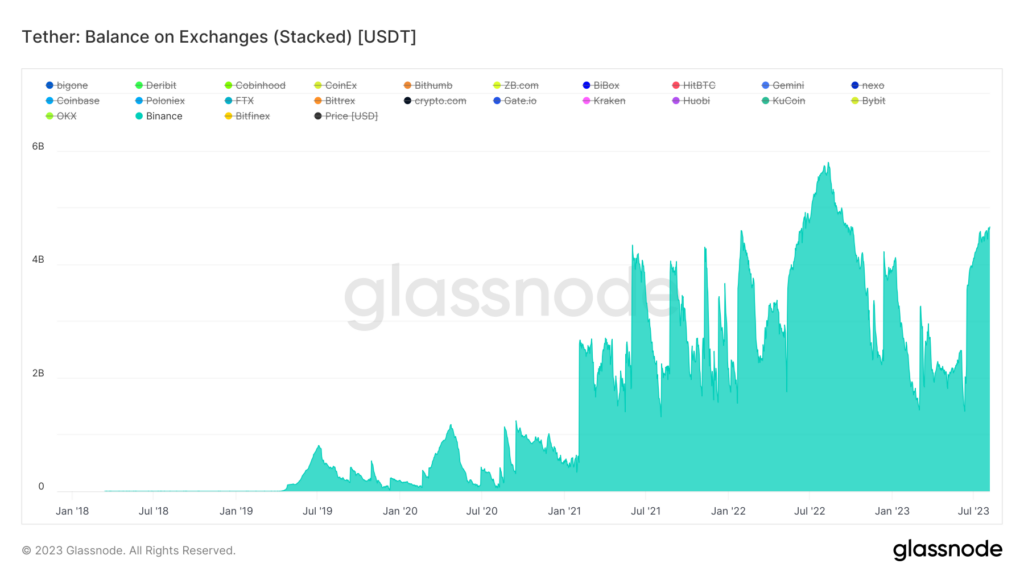

USDT reserves throughout exchanges

A more in-depth examination reveals that Huobi’s state of affairs will not be remoted. In response to knowledge from Glassnode, USDT reserves, on all chains, throughout most prime exchanges, together with Huobi, have depleted at the same fee. This implies that the issues round Huobi may be a part of a broader market pattern reasonably than a problem particular to Huobi.

Apparently, Binance stands as an outlier on this state of affairs. Whereas different exchanges have seen a lower of their USDT reserves, Binance has recorded a rise, in keeping with Glassnode. This divergence highlights that Binance’s position and techniques within the present market surroundings are markedly totally different from different exchanges.

Considerations about Huobi’s solvency.

Adam Cochran, a associate at Cinneamhain Ventures, raised concerns over Huobi’s monetary well being in a publish thread on X on Aug. 5.

Cochran’s allegations focus on distributing and controlling USDT and USDC tokens inside the Huobi platform. In response to Cochran’s tweets on Aug. 5, Tron’s blockchain knowledge means that 98% of the token is held instantly by Solar or Huobi.

He additional claims that when customers’ stake’ their USDT into stUSDT, it will get swept right into a Huobi deposit tackle, indicating a scarcity of transparency. Cochran alleges that Huobi holds solely $90 million of belongings throughout USDT and USDC, considerably smaller than the $630 million reported in Huobi’s ‘Merkle Tree Audit.’

Knowledge from Glassnode confirms that Huobi holds $58 million in USDT as of press time.

Whereas customers imagine they maintain balances of $631 million in Huobi, Cochran posits that the precise quantity is considerably much less, with the shortfall being utilized by Justin Solar to bolster his different decentralized finance (DeFi) functions.

Along with the alleged USDT discrepancy, Cochran suggests a parallel state of affairs regarding Ethereum (ETH), the place customers’ holdings have been transformed into stETH with out their information or consent.

As Cochran reported, “However it’s not simply that. All of the person ETH can also be lacking; Solar has turned it into stETH. All of it. Customers suppose they maintain 141,000 ETH on Huobi, and as an alternative, Solar holds about half that whole steadiness, and it’s all in stETH.”

This collection of revelations has ignited controversy and hypothesis, resulting in counter-claims from Huobi representatives.

A Huobi group supervisor, @33Huobi, retorted on Aug. 6, insisting that the police have been investigating neither Huobi nor Tron and that every one operations had been regular. Regardless of this, Cochran doubled down on his preliminary allegations, citing a senior government from the Tron staff as his supply.

Amid this conflicting data, Cochran continued his evaluation, reporting on Aug. 7 that Huobi’s whole steadiness stood at $2.5 billion. He maintained that even the full liquid belongings on the alternate have been lower than one-third of the reported quantity of USDT obligations, additional fueling insolvency rumors.

Cochran’s ultimate tweet on Aug. 7 learn, “Huobi denied the rumors” Yeah… did you anticipate Justin to be like, “Oh yeah, we’re bancrupt?” Folks lie. Blockchains don’t. 🤷♂️”

Whereas the reality behind Cochran’s allegations requires extra data and affirmation of sure accounts’ possession, this case serves as an important reminder of the significance of transparency and accountability inside the crypto trade.

Regardless of these issues, Huobi continues to reassure its customers and the broader group of its operational stability. Xie Jiayin, Huobi PR, has reiterated that the platform’s operations are operating as traditional and requested the group to chorus from spreading or believing in rumors, in keeping with FX168. Huobi’s spokesperson additionally urged additional investigation into the knowledge supply to keep away from FUD.

As of press time, Huobi had not responded to CryptoSlate’s requests for remark.