meant to scale back tax evasion in addition to fraud. Whereas the federal government sources declined to disclose any names, they did say that a number of well-known private and non-private banks are already utilizing this know-how to boost buyer safety. This verification step is just not necessary. It’s meant for use in conditions the place the financial institution might not produce other identification playing cards such because the PAN card.

Considerations over person privateness

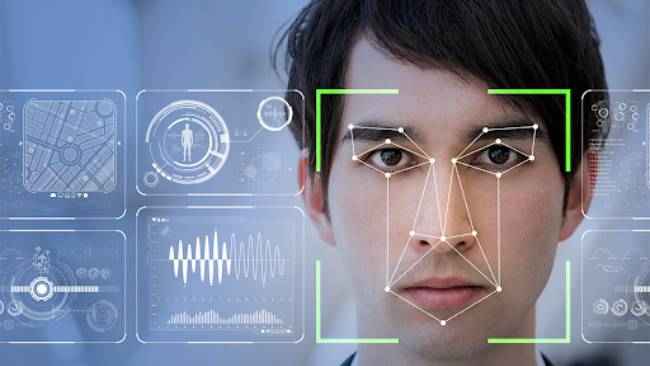

In fact, with any know-how that depends on human information to operate, there are a number of issues over buyer privateness already. “This raises substantial privateness issues particularly when India lacks a devoted legislation on privateness, cybersecurity and facial recognition,” mentioned Pavan Duggal, an advocate and cyber legislation skilled.

Who has to undergo these safety measures?

People who make withdrawals and deposits exceeding Rs. 2 million in a monetary yr and have solely shared their Aadhar playing cards with the financial institution might be required to undergo the safety procedures on the request of the financial institution.

A Distinctive Identification Authority of India (UIDAI) spokesperson elaborated that this can solely occur with the client’s consent. He additionally mentioned, “UIDAI often advises all authentication and verification entities to make use of face or iris authentications to cater to residents whose fingerprint authentication fails.”

For extra

know-how information,

product critiques, sci-tech options and updates, maintain studying

Digit.in or head to our

Google Information web page.

![[UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review [UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review](https://www.psu.com/wp/wp-content/uploads/2025/01/Horizon.jpeg)